Chapter 01 : Adjustments for accruals and prepayments

| Introduction In this chapter, you will learn the concept of adjustments and adjustments for accruals and prepayments. The competencies developed in this chapter will enable you to prepare a complete set of financial statements by considering adjustments for accruals and prepayment. |

The concept of adjustments

The concept of adjustments in accounting requires an enterprise to carry out important adjustments on its financial record, in order to prepare financial statements that portray a true and fair view. This is because, some of the expenses incurred by the enterprise in one accounting period may be paid for in the next accounting period. Similarly, cash for some of the revenues earned in one accounting period may be received in the next period. Also, enterprises will find themselves in a situation where they have to pay for expenses that are not yet incurred and cash received for goods they have not yet sold or for service they have not yet rendered. In these cases, adjustments in the accounting records are important in dealing with such incidences. By doing so, the matching concept of accounting and the accrual concept of accounting are all met.

Accrual, and cash basis of accounting and the matching concept

In accounting, the accrual basis of accounting is a practice whereby revenue is recognized when earned, not when cash is received; and expenses are recognized when incurred not when paid for. On the other hand, the cash basis of accounting is the practice of recognizing revenue when cash has been received, and expenses when cash has been paid. Thus, the difference between accrual and cash basis of accounting lies in the timing when revenue and expenses are recognized in the books of accounts. Matching concept in book-keeping is a practice wherebyenterprise recognize revenue and their related expenses in the same accounting period. The enterprise should prepare income statements along with the expenses that were exactly incurred to generate the reported income.

The main purpose of the matching concept is to avoid misstating earnings for an accounting period. Professionally, every enterprise is required to maintain its accounting records using the accrual basis of accounting. This has been put forward by the International Accounting Standard Board (IASB), which is the board responsible forregulating the accounting practice internationally. The International Accounting Standards (IAS) which are recommended to you are IAS 1 (Presentation of Financial Statements), IAS 7 (Statement of Cash Flows) and IAS 16 (Property, Plant and Equipment).

IAS 1 which was issued by the IASB requires every enterprise to prepare its books of accounting under the accrual basis of accounting. However the board responsible for public sector accounting standards is the International Public Sector Accounting Standards Board (IPSASB).

The concept of adjustments in relation to the accrual and matching concepts

Adjustments of accounting records enable enterprises to prepare their financial statements by meeting the accrual and matching concept of accounting. These accounting concepts are related to the concept of adjustment in the sense that the accrual concept of accounting requires the enterprise to recognize revenues when earned not when cash is received and expenses when incurred, not when paid for. On the other hand, matching concept of accounting requires business enterprises to match revenues earned against expenses incurred in the process of generating that revenue in the same accounting period when ascertaining its performance and its financial position.

Adjustments of accounting entries enable the enterprise to determine its actual revenue and expenses that must be reported in the same accounting period when preparing its financial position at the year end. Without carrying out adjustments on accounting records, it would be difficult to determine the actual revenue earned and the expenses incurred in the accounting period, hence failing to adhere to accrual and matching concepts. Accounting adjustments refers to the action of passing adjusting entries in the books of accounts so as to make financial statements reflect more accurately the earned income and the incurred expenses under the accrual basis. Normally, adjustments are made at the end of the accounting period which can be at the end of the month or year. There are six common types of adjusting entries which include deferred revenue (unearned revenue), prepaid expenses, accrued revenue, accrued expenses, depreciation expenses and adjustments for bad and doubtful debts. These adjustments will be covered later in this book.

Accruals and prepayments

Accrual basis of accounting requires an accountant to recognise revenue whenit is earned, not when it is received; and expenses when incurred, not when they are paid for. In accounting, there is a difference between earning and receiving revenue. Earning revenue occurs when services or goods have been consumed by a customer while receiving revenue occurs when we receive payments related to services or goods provided to customers. Moreover, there is a difference between incurring and paying an expense. An expense is incurred when we consume or use a service such as water or electricity services irrespective of whether we have paid for or not while an expense is paid for when actual payment is made.

Prepayment and accruals are concepts related to the accrual basis of accounting. Prepaid revenue refers to revenue received in advance (before it is earned). A prepaid expenses refer to expenses paid in advance (before they are incurred) for goods or services to be received in the future. Hence, there are two types of prepayments which are prepaid revenue and prepaid expenses. On the other hand, accruals refer to revenues not yet received (after being earned) and expenses not yet paid (after being incurred). Hence, there are two types of accruals which are accrued revenue and accrued expenses. These concepts are further elaborated below:

Accrued income

This occurs in situation where the company has provided the service has been provided but have not yet received the income from the customer. When preparing financial statements such amounts receivable from customers are treated as accrued income.

A good example of this situation is: suppose, rent receivable per year is TZS 120,000 and the actual cash received for rent from tenants is TZS 50,000 for the year. At the end of the year, TZS 70,000 is accrued rent.

- Accrued income is a current asset (which is recorded in the statement of financial position)

- The amount of revenue earned for the period, that is, TZS120,000 (and not TZS50,000) should be transferred to the income statement.

Prepaid revenue or income

This is a revenue or income received in advance before it is earned. This happens when cash has been received for a particular service before rendering the service and thus, the revenue has not yet been earned.

A good example of this situation is where, rent receivable per year is TZS 120,000 and the actual cash received for rent from tenants is TZS 150,000 for the year. At the end of the year, TZS 30,000 is a prepaid rent.

- Prepaid income is a current liability (it is recorded in the statement of financial position).

- The amount of revenue earned for the period should be transferred to the income statement.

Accrued expenses

These are expenses not yet paid but have been incurred. It occurs when cash has not been paid for a particular expense however, it is already incurred. Accrued expenses occur where an entity has already incurred expense such as salaries, wages but the payment for such expenses has not yet been made. The amounts remain outstanding at the end of the accounting period.

Example, rent payable per year is TZS 120,000 and the business has paid rent of TZS 100,000 only. Then TZS 20,000 is accrued rent expense

- Accrued expense is a current liability (it is recorded in the statement of financial position)

- The amount incurred for the period should be transferred to the income statement under expenses section.

Prepaid expenses

These are expenses paid for but not yet incurred. These occur when cash has been for paid a particular service before such service has been rendered to the business. Prepaid expenses occur in situations where payments for different expense items are made before the business has actually incurred. It is common to have such prepayments in expenses such as rent, electricity or mobile communication charges.

A good example of this situation is where, rent payable per year is TZS 120,000 and the business has paid cash for rent of TZS 200,000 for the year. Then, at the end of the year, TZS 80,000 is prepaid rent expense.

- Prepaid expense is a current asset (it is recorded in the statement of financial position)

- The amount of expense incurred for the period should be transferred to the income statement under expenses section

Recording accruals and prepayments

There are two approaches to recording accruals and prepayments

Approach I

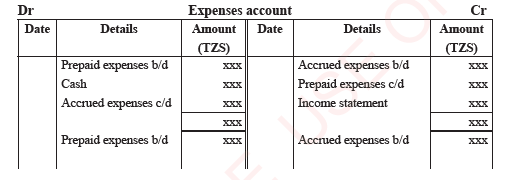

The rule of recording accruals and prepayments

| Balance of Account | Where to record |

| 1. Prepaid/advance brought down 2. Accrued/outstanding/owing brought down 3. Prepaid/advance carried down 4. Accrued/outstanding/owing carried down | Debit side for expenses, Credit side for revenue Opposite side (Credit side for expenses, debit side for revenue) Credit side for expenses, debit side for revenue Opposite side (debit side for expenses, Credit side for revenue) |

|

|

|

|

Note: The balance of an account can be either prepaid or accrued balance. Prepaid or accrued balance brought down. This is a balance brought down at the beginning of the period. Prepaid or accrued carried down. This is a balance carried down at the end of the period.

Approach II

There is an alternative approach of recording prepayments and accruals in the books of accounts.

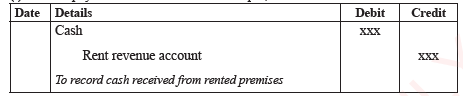

(a) For prepaid revenue

(i). When payments are received for example, rent is received

|

|

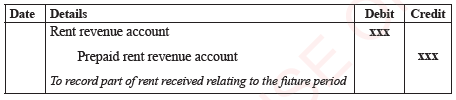

(ii). When there is a prepaid revenue (for example, prepaid rent revenue)

|

|

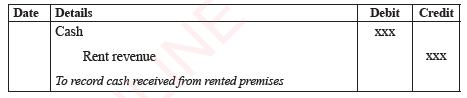

(b) For accrued revenue

(i) When payments are received for example, is rent received:

|

|

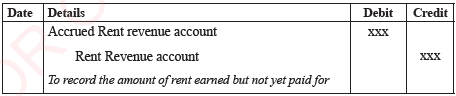

(ii) When there is an accrued revenue (for example accrued rent revenue)

|

|

Example 1.1

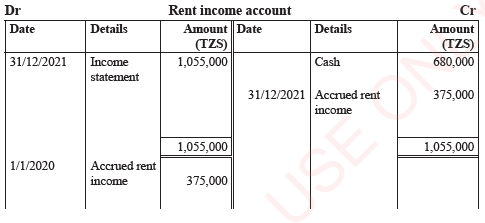

Accrued Income

The rent received during the year amounted to TZS 680,000 and the accrued rent receivable amounted to TZS 375,000 as at 31st December 2021. Show the necessary accounting entries in the books of Chumbe Enterprise.

Approach I (using two accounts to record rent)

|

|

|

|

Approach II (Mixed accounts approach)

|

|

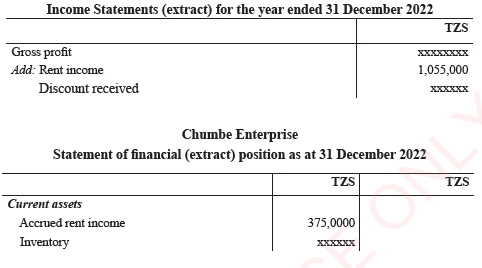

Financial statements (for both Approaches I and II)

Chumbe Enterprise

|

|

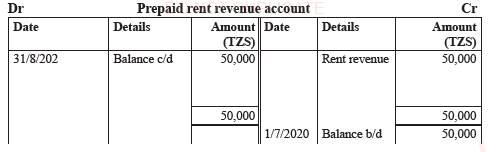

Example 1.2

(a) Prepaid revenue

The rent received during the year ending 31st August 2020 is TZS 200,000. At the end of the year, the prepaid rent revenue amounted to TZS 50,000. Account for the above entries in the books.

|

|

|

|

The balance of prepaid rent revenue account is transferred to the statement of financial position

(b) For prepaid expenses

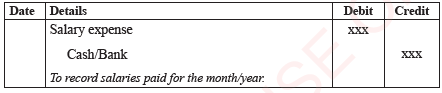

(i) When payments are made for example, Salary expense

|

|

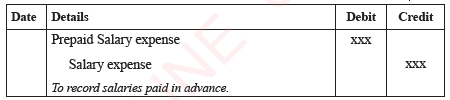

(ii) When there is prepaid Expense (for example, prepaid salary expense)

|

|

(c) For accrued expenses

(i) When payments are made for, example: Salary expense

|

|

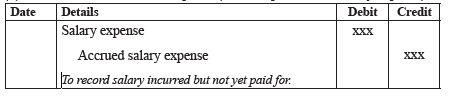

(ii) When there is an accrued expense (for example Accrued salary expense)

|

|

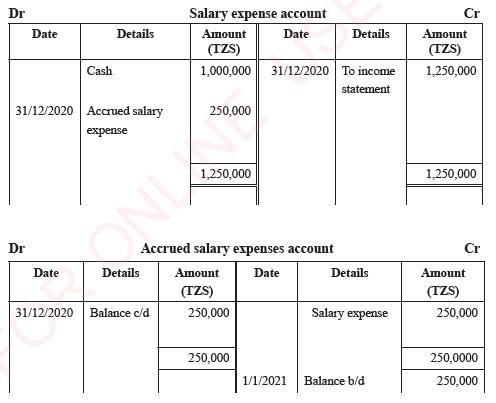

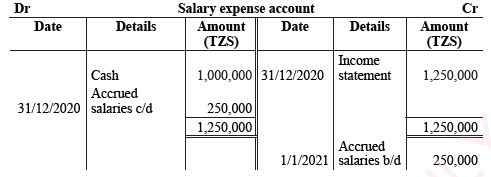

Example 1.3

Accrued expense

Salary expense paid by Chumbe Enterprise during the year ending 31st December 2020 is TZS 1,000,000. At the end of the year, the accrued salary expense amounted to TZS 250,000. Account for the above entries in the books.

Approach I

|

|

Approach II (mixed)

|

|

The accrued salary expense is transferred to the statement of financial position as a current liability and in the income statement as an expense.

Financial statements (for both Approaches I and II)

|

|

Exercise 1.1

The following expenses were paid out in the cash book:

Rent TZS 2,700,000

Wages expenses TZS 50,000

Water bills TZS 300,000

On investigation, the following additional information was received:

(i) Rent accrued was TZS 100,000 on 1st January 2020. Also, prepaid rent was TZS 25,000 on 31st December 2020

(ii) Water bills accrued on 1st January 2020 was TZS 40,000 and by 31st

December there was an advance of TZS 85,000

(iii) Wages expenses unpaid by 31st December was TZS 60,000

Required: Prepare relevant ledger accounts.

Deferred revenue (unearned revenue)

Deferred revenue is a liability (alternatively known as unearned revenue) on the statement of financial position of an enterprise. It is the amount that the enterprise receives as advance payment on its future revenue. Normally, this is in the form of customer owned goods and

services, which have not been delivered yet. The payment is treated as a liability to the enteprise because there is still a possibility that the goods or services may not be delivered, or sometimes the buyer may cancel the order.

In the case of cancelled order, the enterprise will have to repay the customer, unless other payment terms were clearly stated in a signed contract. Deferred revenue is normally reported as a current liability on the statement of financial position. Examples of deferred revenue include rent payments received in advance and payment received on newspaper subscriptions.

Prepaid expenses

Prepaid expenses are treated as a type of asset (current asset) on the statement of financial position that results from a business making advanced payments for

goods or services expected to be received in the future. In the books of accounts, prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Typical examples of expenses that are usually paid in advance include telephone, internet, rent, salaries, taxes, equipment paid for before use, interest expenses and utility bills (electricity, water and sewage).

| Activity 2 1. A small business owner has approached you claiming that there is no need of adjusting accounting records before financial statements are prepared. Using good examples, explain to this owner, why it is important to adjust accounting records before financial statements are prepared. 2. Using the internet or library which is nearby, explore more the meaning and importance of deferred revenue and prepaid expenses. Then write a short note which you will share with your fellow students |

www.learninghubtz.co.tz

Revision exercise 1

1. The following expenses were paid out in the cash book:

Electricity TZS 1,300,000

Van expenses TZS 90,000

Rent TZS 100,000

On investigation, the following additional information was received:

(i) Electricity prepaid by TZS 70,000 on 1.1.2017 and unpaid was TZS 20,000 on 31st December 2017.

(ii) Rent accrued on 1.1.2017 was TZS 34,000 and by 31st December there was an advance of TZS 45,000.

(iii) Van expenses unpaid by 31st December was TZS 35,000.

Required:

Prepare ledger accounts for electricity, rent and van and the extracts of statement financial position and income statement.

2. The following trial balance was extracted from the books of Mzalendo at the close of business on 28th February 2019.

| Dr(TZS) | Cr(TZS) | |

| Purchases and sales | 9,280,000 | 15,716,500 |

| Cash at bank | 410,000 | |

| Cash in hand | 32,400 | |

| Capital account 1 March 2018 | 1,140,000 | |

| Drawings | 1,710,000 | |

| Office furniture | 290,000 | |

| Rent | 340,000 | |

| Wages and salaries | 3,140,000 | |

| Discounts | 82,000 | 16,000 |

| Accounts receivable and accounts payable | 1,231,600 | 524,500 |

| Inventory 1 March 2018 | 412,000 | |

| Allowance for doubtful debts 1 March 2018 | 40,500 | |

| Delivery van | 375,000 | |

| Van running costs | 61,500 | |

| Bad debts written off | 73,000 | |

| 17,437,500 | 17,437,500 |

Additional information:

(a) Inventory 28th February 2019 was TZS 240,000

(b) Wages and salaries accrued at 28th February 2019 TZS 34,000

(c) Rent prepaid at 28th February 2019 was TZS 23,000

(d) Van running costs owing at 28th February was TZS 7,200

(e) Increase the allowance for doubtful debts by TZS 8,190

(f) Provide for depreciation as follows:

(i) Office furniture TZS 38,000

(ii) Delivery van TZS 125,000

Required:

Draw up the income statement for the year ending 28th February 2019 together with a statement of financial position as at 28th February 2019.

3. On 31st December 2019, containers in hand amounted to TZS 3,700,000. During the year to 31st December 2020, we paid TZS 54,960,000 for containers. There was no inventory of containers on 31st December 2020. On 31st December 2020, we still owed TZS 5,500,000 for containers already received and used. Show containers account.

4. From the following given details prepare rent and rates account for the year ended on 31st December 2020. Rent is payable at TZS 600,000 per annum. The rates of TZS 400,000 per annum are payable by instalments. At 1st January 2020 rent of TZS 100,000 had been prepaid in 2019. On 1st January 2020, rates (local charges) of TZS 400,000 were owed. During 2020, rates of TZS 450,000 were paid. During 2020 rates (council charges) TZS 500,000 was paid. On 31st December 2020, the rent of TZS 50,000 was owing, on 31st December 2020, the rates of TZS 60,000 had been prepaid.

5. The financial year of Mtamba ended 31st December 2019. Show ledger accounts for the following items including the balance transferred to the necessary part of the financial statements:

(i) Rent expenses of TZS 93,400 was paid in 2019, owing at 31st December 2020 was TZS 17,300.

(ii) Insurance expenses of TZS 81,500 was paid in 2019 while prepaid amount as at 31st December 2020 was TZS 13,400

(iii) Advertising expenses was TZS 73,150; prepaid amount as at 31st December 2018 was TZS 21,500; owing as at 31st December 2019 was TZS 17,800.

(iv) Electricity expenses of TZS 68,450 was paid 2019, prepaid amount as at 31st December 2018 was TZS 14,310; prepaid amount as at 31st December 2019 was TSH 12,140

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

WHATSAPP US NOW FOR ANY QUERY

App Ya Learning Hub Tanzania