THE PRESIDENT’S OFFICE MINISTRY OF EDUCATION, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

COMPETENCY BASED SECONDARY EXAMINATION SERIES

BOOK KEEPING

FORM TWO- SEPT 2022

INSTRUCTIONS

- This paper consist of section A, B and C

- Answer all questions

- All writings should be in blue or black ink pen except drawings which must be in pencils

- Cellphone and calculators are not allowed in the examination room

SECTION A

Answer all question in this section.

- For each of the following items (i) to (x) choose the most correct answer and write its letter beside the item number in space provided.

- Which of the following is nominal account?

- Bank account

- Furniture account

- Motor running expenses

- Bank overdraft

- What would you consider to be the main source of government revenue

- Royalties

- Fees

- Penalties

- Taxes

- Net profit is calculated in the …………

- Statement of financial position

- Income statement

- Trial balance

- Columnar cash book

- An officers who control public money is known as

- Paymaster General

- Accounting Officer

- Authorized Officer

- Receiver of revenue

- A cheque which is not accepted for payment by the bank due to insufficient fund in the drawer’s bank account is known as

- Uncredited cheque

- Unrecorded cheque

- Open cheque

- Dishonoured cheque

- Which among the following is the correct record for the goods taken from business for personal use?

- Debit Pill’s A/C and credit purchases A/C

- Debit drawings A/C and credit cash A/C

- Debit Drawings A/C and credit cash A/C

- Debit purchases A/C and credit pill’s A/C

- The double entry for a credit sales transaction for Tshs.700 is

- Debits Debtor’s A/C and credit sales A/C

- Debit Cash A/C and credit sales A/C

- Debit Sales A/C and credit cash A/C

- Debit receivable A/C and credit cash A/C

- Assume that you are the manager of NMB, then you write a cheque and sent it to Mussa, then Musa is a

- Payee

- Drawer

- Receiver

- Drawee

- Suppose a petty cashier was given Tsh 1000/= as a cash float of the month. At the end of the period Tshs 850/= was spent. Now a petty cashier is to be reimbursed with

- Tshs 1000

- Tshs 150

- Tshs 850

- Tshs 1850

- Sometimes a transaction may appears on both credit and debit side of two column cash book, before that transaction is known as

- A discount entry

- A credit entry

- Simple entry

- Contra entry

- For each of the items(i) – (v) match the descriptions of accounting concepts terms in Column A with their corresponding terms in Column B by writing the letter of the correct response beside the item number in the answer booklet provided.

| COLUMN A | COLUMN B |

|

|

SECTION B (40 MARKS)

Answer all questions in this section.

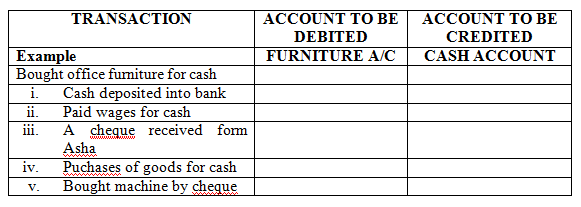

- (a)Complete the following table and show which accounts are to be debited and which accounts are to be credited.

(b)Source documents are detailed documents from which information to be entered in the Subsidiary book are extracted and because of these documents a business owner is able to track all daily transactions to be recorded in the books of prime entry Outline five (5) source documents used in book-keeping.

- (a)Sometimes accounting errors occur but not affect the agreement of a trial balance, mention four (four (4) errors which do not affect the agreement of a trial balance.

(b)Accounting records reports provide information to various interested parties (Users) and serve very useful purposes in the business. Identify six (6) users of accounting information.

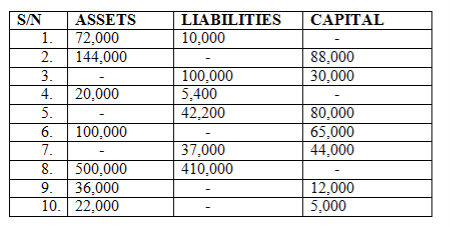

- By using ACCOUNTING QUATION, complete the following table

- Kulwa is a Star secondary school accounting expert who assist a school bursary office to perform bank reconciliation on 30th March 2022, he was issued with a cash book and a bank statement showing a closing balance of Tshs. 6,578,300/= and Tshs. 7,557,300/= respectively. In five (5) points mention the reasons of this difference to arise.

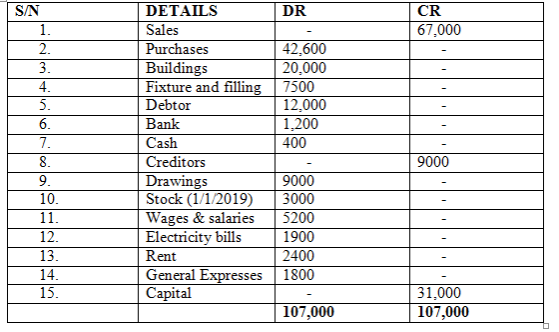

- From the following trial balance of Katundu, a sole trader extracted after one years of operations, prepare income statement for the year ended 30th June 2020 and statement of financial position as at 30th June 2020.

KATUNDU

TRIAL BALANCE AS AT 3OTH JUNE 2020

ADDITION INFORMATION

Closing stock (30/6/2020) was Tshs 5500/=

- ABC Co. ltd cash book showed the following balances on 31st March 2019

Cash column Tshs 28,000 (DR)

Bank Column Tshs 435,000 (CR)

The following transactions took place for the month of April.

April 2: received a cheque from Bongo in full settlement of his bill in Tshs. 450,000 less 3% cash discount.

April3: cash sales Tshs. 180,000/=

April 6: Received cash from Ndegu less 5% cash discount in settlement of his debt of Tshs. 650,000/=

April 6: Banked in the evening Tshs 730,000/=

April 14: Paid brazas Tshs. 712,000 by cheque in full settlement of his bill of Tshs 750,000/= as discount

April 16: Paid office cleaners half month salary in cash Tshs. 45,000

April 22: Cash sales amounted to Tshs. 112,000/=

April 25: made personal drawing by cheque Tshs 30,000/=

April 28: Draw a cheque for Tshs 40,000 for office use

Required: Prepare a three column cash book.

- While extracting a trial balance of MbatiCo.ltd as at 31st December 2008, it was observed that the total debit side exceeded the total credit ride by 23,800/= investigation through the year revealed the following

- TShs. 2200/= received from the debtor had been debited to his account ………….

- A payment of Chacha Tshs. 15,000/= had not been entered in his account ……….

- Sales had been over casted by Tshs 1500/= …………..

- A cash purchase of Tshs. 232/= had been recorded in the purchases account only but yet recorded in the cash Account. ……………..

- Returns outward account had not been credited with an amount of Tshs 6132/=

REQUIRED: Prepare the Journal entries to correct the above errors as well as the Suspense Account.

FORM TWO BKEEPING EXAM SERIES 120

FORM TWO BKEEPING EXAM SERIES 120

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256