OFFICE OF THE PRESIDENT, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

SECONDARY EXAMINATION SERIES

MID TERM EXAMINATION-MARCH-APRIL-2025

BOOK-KEEPING FORM FOUR

INSTRUCTIONS

1. This paper consists of section A, B and C with a total of seven {7} questions

2. Answer all questions in both sections

3. Time allowed is 2:30 hrs

SECTION A (15 Marks)

1. For each of the following items (i-x) choose the best correct answer from the given alternatives and write its letter on then answer sheet.

i. Business enterprise will not be closed down shortly is known as: A. On going concern concept B. Historical concern concept C. Money measurement concept D. Dual concept E. Matching concept

ii. Government expenditure on items from which the government attains no value are called; A. Development expenditure B. Recurrent expenditure C. Capital expenditure D. Nugatory expenditure E. Revenue expenditure

iii. If a non-trading organization operates a bar of profit purpose which of the following would determine if that activity made a profit or loss. A. Income statement B. Receipt and payment C. Income and expenditure D. Subscription account E. None of the above

iv. The existing provision for bad debts in the books of Anna is Tsh. 5,600 on 31st December, the sundry debtors stood at 98,000; it is the policy of the company to create a provision of bad debts of 12% per annum. What would be the amount to be transferred to income statement? A. 2,450 B. 1,350 C. 4,250 D. 6,160 E. 3,150

v. If total of two trial balance do not agree, the difference must be entered in: A. Real account B. The capital account C. Trading account D. A suspense account E. Debtors account

vi. In triple column cashbook, cash withdraw from bank for office use will appear on:

A. Debit side of the cash book only B. Both side of the cash book C. Credit side of the cash book only D. Discount column E. Discount receiver account

vii. A firm bought a motor car for TZS 70,000; it was expected to be used for 5 years the sold for TZS 45,000. What is the annual amount of depreciation if the straight line method is used. A. TZS 5,000 B. 7,000 C. 7,500 D. 6,750 E. 16,000

viii. If stock at the end of the year is undervalued, gross profit will be: A. Understated B. Overstated C. Only affected next year D. Not affected E. Overvalued

ix. The balances in the purchases ledger usually: A. Contras B. Debit balances C. Normal account balances D. Real account balances E. Credit balances

x. The document issued by a bank to inform its customers of their state affairs is referred to as: A. Cash book B. Cheque book C. Bank statement D. Cheque sheet E. Unpresented cheque

2. Match the explanations of the bank reconciliation concepts in column A with the corresponding phase in column B by writing the letter of the correct response beside the item number in your answer sheet.

SECTION B: (40 Marks)

3. Briefly explain the following terms a. Book keeping b. Double entry system c. Business entity concept d. Trial balance e. Discount allowed

4. (a) The following information was extracted from the final accounts of John Mpatu’s business on 31st July, 2012.

Transactions during the year Shs.

Sales 300,000/=

Purchases 130,000/=

Stock (1/8/2011) 36,000/=

Fixed assets 200,000/=

Current assets 90,000/=

Current liabilities 74,000/=

Total expenses 20,000/=

Stock ( 31/7/2012) 25,000/=

Calculate the following financial ratios:

(i) Markup (Net profit)

(ii) Margin (Gross profit)

(iii) Return on capital

(iv) Working capital ratio

(v) Rate of stock turnover

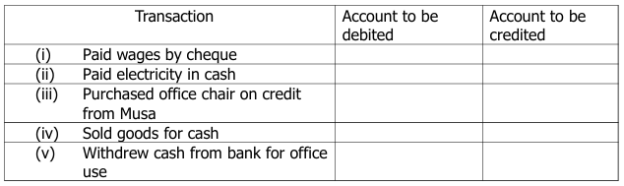

(b) Indicate the accounts to be ‘’Debited”and ‘Credited”from the following transactions.

5. (a) In 2010 Mr. Chipepeto bought a motor car for the cost value of sh. 8,000,000/= with the aim of assisting him in business. But three years later he decided to dispose it for a book value of sh. 6,700,000/=.

i. What is the term used to mean the difference between cost value and book value

ii. Outline four reasons that could be the causes for him to dispose the car for less than the cost value.

(b) The financial year of Duka la Ujamaa ends 31st December each year. At 1st January 2016 Duka la Ujamaa had in use Furniture with atotal accumulated cost of TShs. 135,620 which had been depreciated by a total of Tshs. 81,374. During the year ended 31st December 2016 Duka la Ujamaa purchased new furniture costing Tshs. 47,800 and sold off furniture which had originally cost Tshs. 36,000 and which depreciated by Tshs. 28,224 for Tshs. 5,700. No further purchases or sale of furniture are planned to December.

The policy of the company is to depreciate furniture at 40% using the diminishing balance method. All full year’s deprecation is provided for all furniture in use by the company at the end of each year. Required Prepare the following accounts:

(a) Furniture account

(b) Provision for depreciation account

(c) Furniture disposal account

SECTION C: (45 Marks)

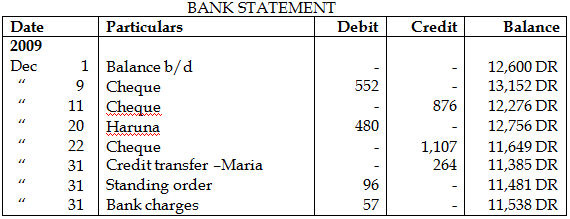

6. The information that follows was extracted from the books of the Nchimba manufactures Ltd as at 31st December 2014.

Additional information

(a) Stock balance as at 31st December 2014 were made up of the following; -

Raw materials TZS 26,000 –

Finished goods TZS 38,000 –

Work in progress TZS 18,000

(b) Lighting, rent and insurance are to apportioned factory 2/3, administration 1/3.

(c) Depreciation on productive and accounting machinery is 10% on cost.

Use the above information to prepare the following;

(i) Statement of manufacturing cost

(ii) Income statement for the year ended 31st December, 2012. 7. On 5th JUNE 2019, M. Halima of Mwanza consigned 1,000 units of goods to J.Manyanya of Arusha, the cost price was Tshs. 800,000.00 M. Halima paid the following expenses;

-Carriage Tshs. 200,000

–Marine insurance Tshs. 80,000

Freight Tshs. 90,000

On 30th June, 2019 J. Manyanya sent an account sale to M.Halima, showing that 600 units were sold for shs. 1,200,000.00 and she incurred the following expenses.

-Carriage Tshs. 150,000

-Import duty Tshs 45,000

-Storage Tshs 50,000

-Commission Tshs 80,000

-Sales expenses Tshs 5,000 Record the above transactions in the books of the consignor, showing the calculation of unsold inventory.

FORM FOUR BKEEPING EXAM SERIES 213

FORM FOUR BKEEPING EXAM SERIES 213

PRESIDENT OFFICE REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

SECONDARY EXAMINATION SERIES

FORM FOUR MID TERM TEST MARCH 2023

062 BOOK KEEPING

TIME: 3:00 HOURS.

INSTRUCTIONS.

1. This paper consists of section A, B and C with a total of nine (09) questions.

2. Answer all questions in section A and B and two (02) questions from section C.

3. Non programmable calculators may be used.

4. Cellular phones and any unauthorized materials are not allowed in the examination room.

5. Write your Examination Number on every page of your answer sheet(s).

SECTION A (20 Marks)

Answer all questions in this section.

1. For each of the items (i) – (xv), choose the correct answer among the given alternatives and write its letter beside the item number.

(i) If petty cashier had the balance of TZS 12,000 on 1st January, then on 2nd January received TZS 32,000 to restore the imprest. How much was the desired cash float?

- TZS 20,000

- TZS 24,000

- TZS 44,000

- TZS 32,000

- TZS 12,000

(ii) Making the second entry of double entry system is known as

- Posting

- Recording

- Transaction

- Narrating

- Journalizing

(iii) If the opening capital was TZS 35,000, closing capital TZS 29,700 and drawings were TZS 8,600,

- The loss for the year was TZS 3,300

- The profit for the year was TZS 3,300

- The loss for the year was TZS 5,300

- The profit for the year was TZS 21,100

- The profit for the year was TZS 26,400

(iv) Which one of the following would not be taken into account when calculating working capital?

- Cash

- Debtors

- Loan from bank

- Motor vehicles

- Creditors

(v) A separate fund which is controlled by accounting officer is known as.

- Warrant of fund

- Vote

- Consolidated fund

- Special fund

- Virement

(vi) Which of the following best describes the meaning of trial balance?

- It is a list of balances on the books

- Shows the financial position of the business

- It is a special account.

- It shows total receipts and total payments plus balance.

- It shows all the entries in the books.

(vii) Amina of Iringa consigned 200 cases of goods to Halima of Kigoma. Then Halima is

- Principal

- Consignor

- Partner

- Agent

- Consignee

(viii) Errors are corrected via the journal because

- It provides a good record explaining the double entry records

- It is much easier to do so

- It saves entering them in the ledger

- It saves the book keeper time

- It is a special journal.

(ix) The sales day book best described as

- Containing real account

- A list of credit sales

- Containing customers’ accounts

- Part of double entry system

- A list of cash sales.

(x) When there is partnership agreements profit and losses must be shared

- Equally

- In the same proportion as capital

- In the same proportion as current account

- Equally after adjustments

- According to partnership deeds.

(xi) Bank reconciliation statement is?

- A process of rectifying the difference between cash book and bank statement

- A statement which is prepared in order to rectify the difference between cash book and bank statement

- A summary of customer’s bank account

- An instructions made by the customer to the bank to pay specific amount of money to a specific persons on a specific dates.

- Usually done by the customers.

(xii) Which one of the following does not appear in a statement of manufacturing cost?

- Depreciation on factory machinery

- Depreciation on office equipment

- Royalties

- Foremen’s wages

- Factory power

(xiii) An audit which cover only part of trading period is called

- Procedural audit

- Final audit

- Management audit

- Balance sheet audit

- Interim audit

(xiv) Costs of building warehouse would be classified as

- Capital receipts

- Revenue expenditure

- Revenue receipts

- Recurrent expenditure

- Capital expenditure.

(xv) A club’s receipts and payments account is similar to a firms’:

- Balance Sheet

- Capital account

- Trading, and Profit and loss account

- Cash Book

- Trial balance

2. Choose the correct term from LIST B which matches with the explanation in

LIST A and write its letter in the answer sheet provided.

| LIST A | LIST B |

| i. A ledger for impersonal accounts ii. A ledger for debtors accounts iii. A ledger for creditors accounts iv. A ledger for capital and drawing accounts v. A ledger for cash and bank accounts |

|

SECTION B (40 Marks)

Answer all questions in this section

3. Briefly explain the following accounting concepts:

(a) Business entity

(b) Money measurement concept

(c) Accruals

(d) Going concern

(e) Dual aspect

4. A partnership may be formed through an oral or a written legal agreement among the partners. Suppose there is no written partnership agreement, explain briefly five provisions of the Partnership Act that would govern the operations of the partnership

5. From the following information extracted from the books of MAKINIKIA, you are required to prepare the appropriate control account.

2010 August 1

Sales ledger balances -

- Debit 11,448

- Credit 66

2010 August 31 Transactions for the month

- Cash received 312

- Cheque received 18,717

- Credit sales 21,270

- Bad debts written off 918

- Discount allowed 894

- Returns inwards 1,992

- Refund to overpaid customers 111

- Dishonored cheque 87

- Interests charged by us on overdue debt 150

At the end of the month:

Sales ledger balances -

- Debit 10,287

- Credit 120

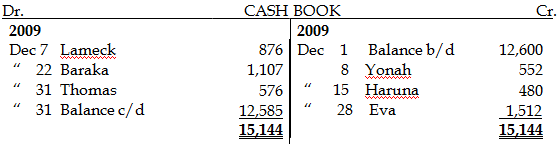

6. The following are the extracts from the cash book and bank statement of Peter.

You are required to:

(a) Adjust the cash book

(b) Draw up bank reconciliation statement as on 31st December 2009.

| |

|

SECTION C (40 Marks)

Answer only two (2) questions in this section

7. (a) Shirima Traders has two departments A and B some items of income and expenditure are allocated directly to the two departments. The remaining expenses are to be allocated to each department in the ratio provided, except Rent & rate and Heat & light should be apportioned equally:

Department A – two – fifths

Department B – three – fifths

You are required to draw up Departmental Income Statement to show the gross and net profit for each department.

| Details | Department A (TZS) | Department B (TZS) |

| Opening Stock | 8,000 | 12,000 |

| Purchases | 16,000 | 20,000 |

| Closing Stock | 9,000 | 4,000 |

| Sales | 38,000 | 52,000 |

| Wages & Salaries | 15,000 | 23,000 |

Expenses to be allocated between departments are:

- Heat and light TZS 4,000

- Rent and rates TZS 1,200

- Carriage Inwards TZS 1,000

- Carriage outwards TZS 500

- Office expenses TZS 2,000

(b) Record the following transactions in the cash account of Mayele.

2022 Jan, 1. Commenced business with capital …………. 50,000

2. Bought goods for cash………………………… 40,000

4. Sold goods on credit to Masi ……………… 15,000

5. Sold goods to Suma and Company …………. 20,000

12. Sold goods for cash ………………………… 25,000

15. Bought goods from Bite …………………… 10,000

16. Paid wages in cash ………………………… 9,000

20. Bought furniture for cash…………………… 11,500

25. Paid transport charges in cash..……………… 1,000

29. Paid rent in cash……………………………. 500

8. Somi, Mumi, and Jessa are partners sharing profits and losses in the ratio of 2:2:1 respectively. Somi draws TZS 10,000 every month, and Mumi and Jessa TZS 8,000 each every month and interest on drawings was calculated to TZS 6,000 , TZS 4,800 and TZS 4,800 respectively. Also charging interest on capital at 5 percent per year. A partnership salary of TZS 80,000 to Mumi per year and TZS 60,000 to Jessa per year. The profit for the year ending December 31st 2020 was TZS 1,152,000.

You are required to write up profit and loss appropriation account and current account.

Given the following additional information.

| Details | Somi | Mumi | Jessa |

| Capital (1.1.2020) Current accounts (1.1.2020) | TZS 1,000,000 90,000(Cr) | TZS 800,000 50,000(Dr) | TZS 300,000 10,000(Cr) |

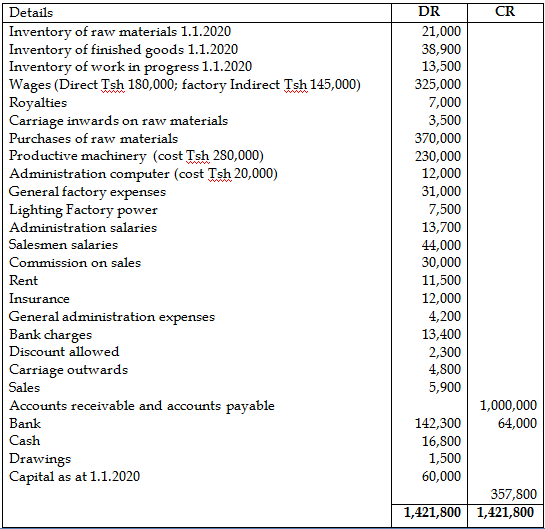

9. The following is a trial balance of Mr. Masantula for the year ended 31st December 2020 Mr. Masantula’s Trial Balance as at 31st December 2020

|

Notes at 31/12/2020

i. Inventory of raw materials Tsh 24,000, Inventory of finished goods Tsh

40,000 and Inventory of work in progress Tsh 15,000

ii. Lighting, rent and insurance are to be apportioned: Factory 5/6, Administration 1/6

iii. Depreciation on productive machinery and administration computer at

10% per annum on cost iv. Net profit was Tsh 89,800

Use the given information to prepare the Statement of Manufacturing Cost for the year ending 31st December 2020 and the Statement of Financial Position as at 31st December 2020.

FORM FOUR BKEEPING EXAM SERIES 142

FORM FOUR BKEEPING EXAM SERIES 142

THE PRESIDENT’S OFFICE

MINISTRY OF EDUCATION AND VOCATIONAL TRAINING

MID TERM EXAMIATIONS

024 BOOK- KEEPING FORM FOUR

Duration: 2:30 Hours

INSTRUCTIONS:

1. This paper consists of sections A, B and C.

2. Attempt ALL questions

3. Answers for section A and B should be written in the space provided in the question paper

and for section C should be written in the answer sheet provided.

1. For each of the following items write the letter of the correct answer in the table provided

- Given opening account receivable of 11,500, sales 48,000 and receipts from debtors 45,000, the closing account receivable total should be

a) 8,500 b) 14,500 c) 83500 d) 18,500

- If cost price is 90 and selling price is 120 then

i) Mark-up 25 percent ii) Margin is 331/2 percent

iii) Margin is 25 percent iv) Mark –up is 331/2 percent

a) (i) and (ii) b) (i) and (iii) c) (iii) and (iv) d) (iii) and (iv)

- Receipts and payments account is one

a) Which is accompanied by a balance sheet

b) In which the profit is calculated

c) In which the opening and closing cash balances were shown

d) In which the surplus of income over expenditure is calculated

- If it is required to maintain fixed capitals the partners’ shares of profit must be

a) Debited to capital accounts b) Credited to capital accounts

c) Debited to partners current account d) Credited to partners current account

- Yu are to buy an existing business which has assets valued at building 50,000, motor vehicle 15,000 fixture 5000 and inventory 40,000. You are to pay 140,000 for the business this means that

a) You are paying 40,000 for goodwill

b) Buildings are casting you 30,000 more then their value

c) You are paying 30,000 for goodwill

d) You have made an arithmetical mistake

- If accounts payable at 1st January 2005 were 2500, accounts payable at 31st December 2003 were 4200 and payment to creditors 32,000, then purchases for 2003 are.

a) 30,300 b) 33,700 c) 31,600 d) 38,700

- An allowance for doubtful debts is created

a) When debtors became bankrupt b) When debtors cease to be in business

c) To provide for possible bade debts d) To write –off bad debts

- If an accumulated provision for depreciation account is in use then the entries for the year’s depreciation would be

a) Credit provision for depreciation account, debit profit and loss account

b) Debit assets account, credit profit and loss account

c) Credit assets account, debit provision for depreciation account

d) Credit profit and loss account, debit provision for depreciation account

- A firm bought a machine for 3200 it is to be depreciated at a rate of 25% using the reducing balance method. What would be the remaining book value after two years?

a) 1600 b) 2400 c) 1800 d) some other figure

- We originally sold 25 items at 12 each, less 331/2 percent trade discount. Our customer now returns 4 of them to us. What is the amount of credit note to be issued?

a) 48 b) 36 c) 30 d) 32

| i | ii | iii | iv | v | vi | vii | viii | ix | x |

|

|

|

|

|

|

|

|

|

|

|

2. Choose the correct term from GROUP A which match with the explanation in GROUP B and

write its letter against the of the relevant explanation

| GROUP A | GROUP B |

| a) Cost concepts b) Money measurement concept c) Going concern concept d) Business entity concept e) Realization concept f) Prudence concepts g) Consistency concepts h) Accrual concept i) Dual aspect concept | i) The concepts implies that the business will continuous to operate for foreseable future ii) Assets are normally shown at cost price and this is the basic of evaluation iii) When the firm has due method of treatment of an item it will use the same method in coming years. iv) Means normally an account should under state the figure rather than overstate the profit v) This states that there are two aspect of accounting, one represented by assets of the business and assets of the business and other by the claim against them vi) The net profit is the results of the difference between revenue and expenses vii) The concept implies that the affairs of a business are to be treated as being quite separated from non-business activities of its owner viii) This concept holds to the view that profit can be taken only into account when goods/services are provided for the buyer ix) Accounting is concerned only with those facts. People will agree to the money value transactions. |

| i | ii | iii | iv | v | vi | vii | viii | ix |

|

|

|

|

|

|

|

|

|

|

SECTION B (20 MARKS)

3.a) Write short notice on the following term

- Deferred revenue (01 mark)

- Conversion costs (01 mark)

- General journal (01 mark)

- Accounting (01 mark)

- Bed debts (01 mark)

b) Differentiate between fixed installment method and written down value method. (05 marks)

c) Show accounting entries in the books of consignor

- On dispatch of goods (01 mark)

- On payment of expenses on dispatch (01 mark)

- On receiving advance (01 mark)

- On the consignee reporting sales as per A/S (01 mark)

- For expenses incurred by the consignee as per A/S (01 mark)

- For commission payable to the consignee (01 mark)

- When advance is given (01 mark)

- In case of profit (01 mark)

- In case of loss (01 mark)

- When consignment is partly sold (01 mark)

SECTION C (60 MARKS)

4. Peter and Paul are in partnership sharing profit and loss according to the partnership act their

balance sheet shows the following at 31st December 1990

| Capital: Peter 10,000 Paul 10,000 20,000 Current account: Paul 2,000 Long term liabilities 5% Loan 30,000 Current liabilities Creditor 5,000 Bank over draft 1,000 58,000 | Building 19,000 Furniture 10,000 Current assets Stock 20,000 Debtors 5,000 Cash in hand 3,000 Current a/c (Peter) 1,000

58,000 |

On the same date they agreed to admit Pendo on the following conditions

- Pendo to contribute a capital of shs 10,000 for cash

- Pendo to pay shs 1000 in cash as premium

- The premium is raised in the books and with drawn by old partners.

- Pendo to pay in cash shs 500/= to credit his current account

- Pendo come with creditor shs 3000/= and stock shs 5000/=

- The money collected were paid into a firm’s bank account.

REQUIRED:

- Open relevant ledger account for the admission of Pendo

- Balance sheet after admission of Pendo (15 marks)

5. The following information relating to power Mabula Ltd for the period ended 31/12/2007

- Tsh 60,000/= were debited against the bank account under the directions of chief accountant in respect of clearing an overdue liabilities

- The bank statement showed a debit of Tsh 43,500/= being charges against the account holder power Mabula

- Tsh 16,000/= were paid but recorded as a receipt in the cash book. The cheque for this had been encashed in the bank

- Issued cheque but not presented to the bank for payment was Tshs 177,000/=

- Tshs 39,000/= had been credited to the account but it related to another bank account holder

- A payment of Tshs 66,900 had been recorded as Tsh 69,600 in the cash book.

- Tshs 48,000/= had been deposited directly to the bank where the account was credited

- Cheque totaling Tshs 70,000/= were received by the bank account holder and entered in his cash book as having deposited but were returned by the bank while marked “refer to drawer”

- Tshs 50,000/= were debited in error by the bank account holders another bank account and hence credited to this account

- Tsh 75,000/= in cheque had been deposited at the bank and shown as such in the cash book but had not been realized by the bank at the close of the months.

- The cash book balance was Tshs 228,310/= while the bank statement balance was Tshs 227,510/= both balances were favourable

REQUIRED:

Prepare bank reconciliation statement start with balance as per cash book (15 marks)

6. The following balances were extracted from Bagamoyo research station’s books of account as

at 30th November 1007

Cash at bank 1,254,000

Account receivable 24,000

Research fees receivable 80,000

Research suppliers 102,000

Prepaid insurance 5,500

Leasehold 400,000

Building 1,200,000

Insurance expenses 500

Accumulated depreciation

Building 10,000

Research equipment 24,000 34,000

Research equipment 1,440,000

Salaries payable 12,000

Interest payable 6,280

Service to be rendered 1,100,000

Notes payable 1,300,000

Capital 2,000,000

Research supplier expenses 18,000

Depreciation expenses:

Research equipment 24,000

building 10,000 34,000

Interest expenses 6,280

Salaries expenses 132,000

Revenue from services 244,000

REQUIRED:

- Prepare a trial balance as at 30th November 1997 and

- Profit and loss account for the year ending 30th November 1997 (15 marks)

7. Kibaha social club had the following assets and liabilities on the date shown

Club premises 100,000 ?

Subscription received in advance 1,700 2,400

Subscription due 4,100 7,300

Rate due 1,200 1,600

Prepaid insurance 1,300 2,200

Office furniture 7,500 11,600

Accrued wages 700 1,000

Sports equipment 6,400 ?

Its Treasurer prepared the following summary of its cash transactions

RECEIPTS AND PAYMENT ACCOUNT

| Subscription 36,200 Donations 18,500 Sales of sports equipment 2000 | Wages & salaries 13,700 New furniture 6,000 New sports equipment 15,000 Rates 3,700 Insurance 5,500 Transport 6,600 General expenses 4,800 Entertainment 3,900 Balance c/d 1,800 |

The following additional information is also available

- The sports equipment sold during the year had a book value of shs 3500/=. Depreciation on sports equipment is provided at 20%

- The premises that had cost 120,000 some years ago are held on a 60 year lease

REQUIRED:

a) Balance sheet as at 1.1.1991

b) Subscription account for 1991

c) Income and expenditure

d) Balance sheet as at 31st December 1991 (15 marks)

END

FORM FOUR BKEEPING EXAM SERIES 5

FORM FOUR BKEEPING EXAM SERIES 5

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256