THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY

(For Both School and Private Candidates)

Time: 3 Hours2016 p.m.

Instructions

1. This paper consists of seven (7) questions sections A and B.

2. Answer a total of three (3) questions from section A and two (2) questions from section B.

3. Each question carries twenty (20) marks.

4. Workings must be shown clearly and submitted.

5. Non programmable calculators may be used.

6. Cellular phones are not allowed in the examination room.

7. Write your Examination Number on every page of your answer booklet(s).

SECTION A

1.Describe why the following parties need accounting information:

(a)Management

(b)Business owners

(c)Creditors

(d)Employees

(e)Financial institutions

View Ans

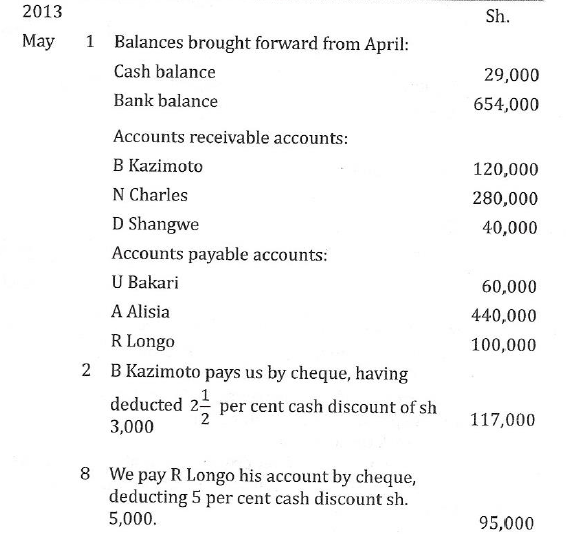

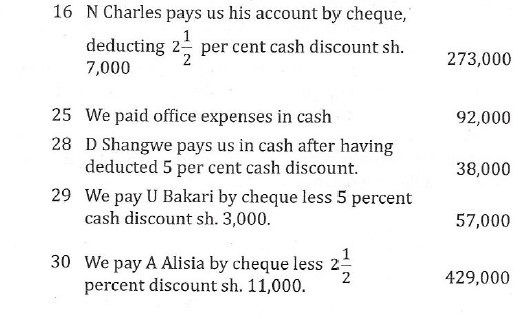

2.Enter the following transactions directly into the cash book, sales ledger as well as purchases ledger.

View Ans

3. (a) Manenge Furniture started a business of buying and selling furniture since 1stJanuary, 2010. Quality Furniture has a warehouse in Changombe - Temeke and a shop which is situated at Nyerere Road. Manenge Furniture prepares financial statement on 31stDecember each year.

The following transactions were made during that period:

1.For the year ended 31stDecember, 2010 bad debts written off amounted to sh. 140,000. It was also found necessary to create an allowance for doubtful debts of sh 260,000.

to create an allowance for doubtful debts of sh 260,000.

2.In 2011 debts amounting to sh. 220,000 proved as bad debts and written off.

3.Mangosongo, whose debts of sh. 21,000 were written off as bad debt in 2010, settled his account in full on 30thNovember, 2011.

4.On 31stDecember, 2011 total debts outstanding were sh. 9,200,000. It was decided to bring the provision up to 5% on this figure at that date.

5.In year 2012, sh. 380,000 of debts was written off during the year, and another recovery of sh. 320,000 was made in respect of debts written off in 2010. As at 31stDecember, 2012 total debts outstanding were sh. 7,200,000. The allowance of doubtful debts is to be charged to 60% of this figure.

Using the information above prepare:

(i)Bad debt accounts for the years ending 31stDecember, 2010, 2011 and 2012.

(ii)Bad debts recovered account for the year concerned. (iii) Allowance for doubtful debts account for the years 2010, 2911 and 2012.

View Ans

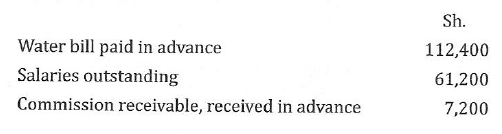

(b) Three of the accounts in the ledger of F Mangula indicated the following balance at 1stJanuary 2013:

Transactions during the year made by F Mangula:

Paid for water bill sh. 203,800 by bank standing order.

order.

Paid sh. 3,000,000 salaries in cash

Received sh. 520,000 commission, by cheque from the wholesaler.

At 31stDecember, 2013, water bill prepaid was sh. 69,000. On the same day commission receivable in arrears was sh. 21,000 and commission received in advance was sh. 9,000. Salaries accrued amounted to sh 83,800.

From the information given above, prepare:

(i)Water bill, Salaries and Commission Receivable accounts for the year ending 31stDecember, 2013.

(ii)Income Statement (extract) for the year ending 31stDecember, 2013.

View Ans

4.Royal Company Ltd. purchased 40,000 6% Government Stock at 94 plus brokerage charges of sh. 400 on 1stApril, 2006 at Cum div. Interest is receivable on 31stDecember and 30thJune each year.

The company prepares accounts on 31stMarch annually. On 1st August purchased 25,000 nominal value stocks at 92 ex div. and brokerage charges sh. 250. On 1stFebruary, 2007 sold 15,000 nominal value stocks at 102 cum div. and brokerage charges sh. 150. On 30thApril, 2007 sold 40,000 nominal value stocks at 97 ex div. Brokerage charge paid sh. 520.

August purchased 25,000 nominal value stocks at 92 ex div. and brokerage charges sh. 250. On 1stFebruary, 2007 sold 15,000 nominal value stocks at 102 cum div. and brokerage charges sh. 150. On 30thApril, 2007 sold 40,000 nominal value stocks at 97 ex div. Brokerage charge paid sh. 520.

Using the details above, prepare the Investment Account on 31stMarch, 2007 and 2008 valuing closing stock by using LIFO Method.

View Ans

SECTION B

5. (a) Majungu Company Ltd reported a Provisional Profit of sh. 440,000 fortheyear ending 30thNovember, 2013. Consequently, the errors and omissions below were detected.

(a) Majungu Company Ltd reported a Provisional Profit of sh. 440,000 fortheyear ending 30thNovember, 2013. Consequently, the errors and omissions below were detected.

1.Commission received sh. 8,000 had been debited in commission received account as sh.800.

2.An invoice of sh. 15,200 received from Majuto were not entered in the purchases accounts.

3.Sales journal was overcast by sh. 2,800.

4.Bad debts of sh. 1,800 which had been written off in the previous year was received but has not been recorded anywhere.

5.Repair of equipment sh. 14,000 cash were entered in equipment account.

6.Capital account credit balance of sh. 100,000 had not been brought forward from the previous accounting period.

From the information given above;

(i) Show the journal entries to correct the errors.

(ii) Prepare a statement of correct net profit.

View Ans

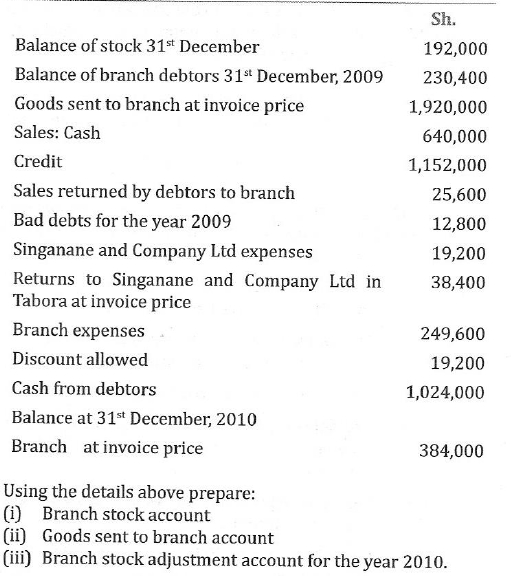

(b) Singanane and Company Ltd in Tabora invoiced goods to Dodoma Branch at cost plus 25%. All branch expenses are paid by Head Office, and the branch sells goods on credit and cash. Cash collected by branch has to be remitted immediately to the Head Office cash account.

During the year 2009 the following transactions were made:

Using the details above prepare:

(i)Branch stock account

(ii)Goods sent to branch account

(iii)Branch stock adjustment account for the year 2010.

View Ans

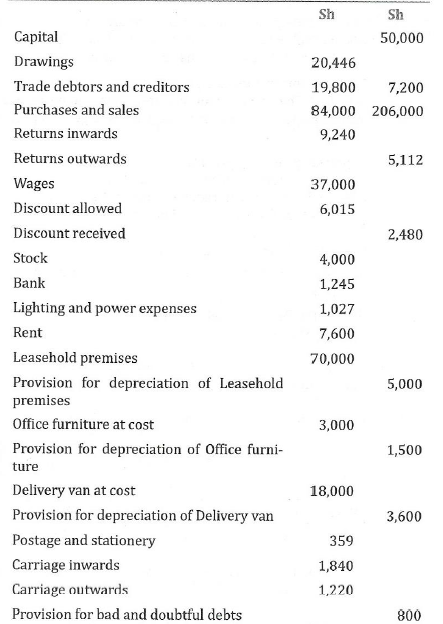

6.The following balances were extracted from the books of Izeize Nguka, a sole proprietor for the year ending 31stMarch 2014.

Nguka, a sole proprietor for the year ending 31stMarch 2014.

You have also been provided with the following information:

- Stock in trade on 31st March, 2014 amounted to sh. 5,000.

- Sales include goods sent on sale or return basis to a customer who has not indicated acceptance of the goods. The goods cost sh. 3,000 and the customer has been invoiced at sh. 4,000.

- Trade debtors include debts totaling sh. 1,700 which are known to be bad. The provision for doubtful debts is to be adjusted to include a specific provision of sh. 3,100 and general provision of 5%.

- Depreciation is to be provided for as follows: 5% on Leasehold premises at straight line basis 25% on Delivery van at reducing balance basis. 10% on office furniture at straight line basis

Using the information above prepare:

(a) Izeize Nguka Income Statement for the year ending 31stMarch, 2014.

(b) Izeize Nguka Statement of Financial position as at 31stMarch, 2014.

View Ans

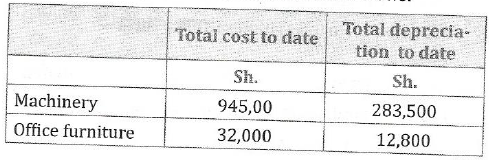

7.(a) A company maintains its non-current assets at cost. Depreciation provision accounts for each asset are kept.

At 31stDecember, 2013 the position was as follows:

The following additions were made during the financial year ending 31stDecember, 2013:

Machinery sh. 160, 000 office furniture sh. 4,600

A machine bought in 2009 for sh. 16,000 was sold for sh. 3, 600 during the year.

The rates of depreciation are:

Machinery 20 per cent and office furniture 10 per cent per annum. Using the straight line basis, depreciation was calculated on the assets in existence at the end of each financial year irrespective of the date of purchases.

Using the information above, show the asset and depreciation accounts for the year ending 31stDecember, 2013 and the Statement of Financial Position entries at that date.

View Ans

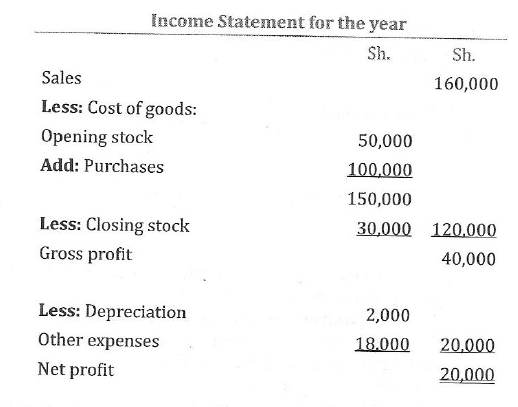

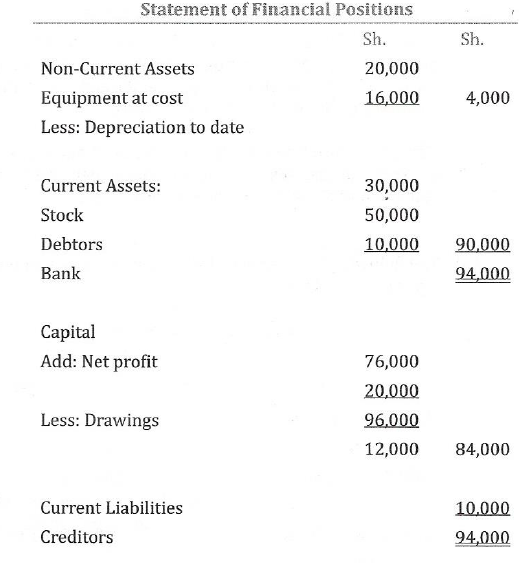

(b) The following is the financial statement for one man business types of retail store:

Using the information above calculate the following ratios:

(i)Gross profit as a percentage of sales

(ii)Net profit as a percentage of sales

(iii)Gross profit as a percentage of purchases

(iv)Expenses as a percentage of sales

(v)Stock turnover ratio

(vi)Rate of return of net profit on capital employed (use the average of the capital account)

(vii)Current ratio

(viii)Acid test ratio

(ix)Debtor's sales ratio

(x)Creditor's purchases ratio

View Ans

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256