THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY

(For Both School and Private Candidates)

Time: 3 Hours2015p.m.

Instructions

1. This paper consists of seven (7) questions sections A and B.

2. Answer a total of three (3) questions from section A and two (2) questions from section B.

3. Each question carries twenty (20) marks.

4. Workings must be shown clearly and submitted.

5. Non programmable calculators may be used.

6. Cellular phones are not allowed in the examination room.

7. Write your Examination Number on every page of your answer booklet(s).

SECTION A

1.Briefly explain the following accounting terms:

- Investors

- Transactions

- Liabilities

- Prepaid expenses

- Drawings.

2 (a) Pachoto Limited is a family-controlled company which operates a chain of retail outlets specializing in motor spares and accessories.

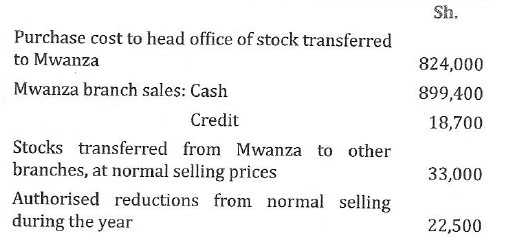

Branch stocks are purchased by a centralised purchasing function in order to obtain the best terms from suppliers. A 10 per cent handling charge is applied by head office to the cost of the purchases, and branches are expected to add 25 per cent to the resulting figure to arrive at normal selling prices. Although branch managers are authorised to reduce normal prices in special situations, the effect of such reductions must be notified to head office.

On 1stApril, 2012, a new branch was established at Mwanza. The following details have been recorded for the year ending 31stMarch, 2013:![]()

All records in respect of branch activities are maintained at the head office, and the branch profit margin is dealt with through a branch stock adjustment account.

From the information given above:

(i)Prepare the branch stock account at selling prices.

(ii)Prepare the branch stock adjustment account.

(iii)Prepare a statement which shows the stock difference.

(iv)List four possible reasons for the stock difference revealed when a physical stocking at the Mwanza branch on 31stMarch, 2013 showed stock valued at selling prices amounting to sh. 148, 500.

View Ans(b) An account clerk extracts a trial balance in the books of M Mjaliwa which fails to agree by sh. 70,700. He places the difference on the credit side in a suspense account and then proceeds to prepare draft income statement for the year ending 31stMay, 2012 which results in a net profit of sh. 50.000. Later he attempts to find the errors which had caused the difference. Investigations reveal the following:

1.Sales day book was undercast by sh. 100,000

2.Discount received of sh. 10,800 from Dandu supplies, has been correctly entered in the cash book but has not been posted to the account of Dandu supplies.

3.Purchases day book has been undercast by sh. 58,500.

4.Sh. 22,000 received from a debtor had been debited to his account.

5.Discount allowed, sh. 2,000 have been posted to the credit side of discounts received account.

6.The cost of new equipment sh. 120,000 had been debited to the repairs account.

Using the above details:

(i) Pass journal entries to correct the above errors. (ii) Prepare suspense account duly balanced.

View Ans3. A firm had the following balances on 1stJanuary, 2012.

| Provision for bad debts | 25,000 |

| Provision for discount on debtors | 12,000 |

| Provision for discount on creditors | 10,000 |

During the year bad debts amounted to sh. 20,000, discount allowed were sh.1,000 and discount received were sh. 2,000 During 2013 bad debts amounting to sh. 10,000 were written off while discount allowed and received were sh. 20,000 and sh. 5,000 respectively.

Total debtors on 31stDecember, 2012 were sh. 480,000 before writing off bad debts but after writing off discounts. On 31st December, 2013 the amount of debtors were sh. 190,000 after writing off the bad debts but before allowing discounts. Total creditors on these two dates were sh. 200,000 and 250,000 respectively.

It is the firm's policy to maintain a provision of 5% against bad and doubtful debts and 2% for discount on debtors and a provision of 3% for discount on creditors.

Using the information provided prepare:

(i)Provision for bad and doubtful debts account.

(ii)Provision for discount on debtors account.

(iii)Provision for discount on creditors account.

View Ans(b) On 1stApril, 2012 Komba Ltd purchased 10,000 ordinary shares of sh. 10 each fully paid in Mbawala Ltd at a cost of sh. 205,000. During the year the following transactions were made:

(i)On 1stSeptember, 2012 Mbawala Ltd declared and paid a dividend of 15% on its shares for the year ending 30thJune, 2012.

(ii)On 1stOctober, 2012 Mbawala Ltd gives its eight members the right to subscribe for one ordinary share for every eight held on 1stNovember, 2012, at a price of sh. 15 per share payable in full on application.

(iii)On 15thNovember, 2012 Komba Ltd purchased for sh. 4 per share the right of another shareholder in Mbawala Ltd to subscribe for 750 shares under the right issue.

(iv)On 30thNovember, 2012 Komba Ltd applied and paid for all the shares in Mbawala Ltd to which it was then entitled.

(v)On 8thSeptember, 2013 Mbawala Ltd declared and paid a dividend for the year ended 30thJune, 2013, of 15% on all ordinary shares including those issued in 2012.

(vi)On 1stOctober, 2013 Komba Ltd sold 4,500 ordinary shares in Mbawala Ltd for sh. 98,750.

(vii)The accounting year of Komba Ltd ends on 31stDecember.

(viii)Komba Ltd does not make apportionments of dividend received or receivable. When part of a holding of shares is sold, it is practice of this company to calculate the cost of the shares sold as an appropriate part of the average cost of all the shares held at the date of the sale.

From the information given above, show the investment account in the books of Komba Ltd for the years ending 31stDecember, 2012 and 2013 bringing down the balance at the end of each year.

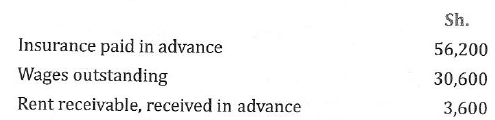

View Ans4. (a) Three of the accounts in the ledger of Goodluck indicated the following balance at 1stJanuary, 2012:

Transactions made by Goodluck during the year: Paid for insurance sh. 101,900 by bank standing order Paid sh. 1,500,000 wages in cash

Receivedsh. 260,000 rent, by chequefrom the tenant.

At 31stDecember, 2012, insurance prepaid was sh. 34,500. On the same day rent receivable in arrears was sh. 10,500 and rent received in advance was 4,500. Wages accrued amounted to sh. 41,900.

Using the above information prepare:

(i)Insurance, Wage and Rent Receivable accounts for the year ending 31stDecember 2012.

(ii)Income Statement (extract) for the year ending 31stDecember, 2012.

Transactions made by Goodluck during the year:

Paid for insurance sh. 101,900 by bank standing order

Paid sh. 1,500,000 wages in cash

Received sh. 260,000 rent, by cheque from the tenant.

At 31stDecember, 2012, insurance prepaid was sh. 34,500. On the same day rent receivable in arrears was sh. 10,500 and rent received in advance was sh. 4,500. Wages accrued amounted to sh. 41,900.

Using the above information prepare:

(i)Insurance, Wages and Rent Receivable accounts for the year ending 31stDecember, 2012.

(ii)Income Statement (extract) for the year ending 31stDecember, 2012.

View Ans(b) Malingumu Bus Services Ltd operates between Dar es Salaam and Kampala. The firm had two buses as at 1stJanuary, 2012 as shown below:

Bus 1(T 200 AAA) purchased on 31stMarch, 2008 for sh. Bus 2 (T 201 AAA) purchased on 1stApril, 2009 for sh.4,000,000.

Bus 2(T 201 AAA) purchased on 1stApril, 2008 for sh. Bus 2 (T 201 AAA) purchased on 1stApril, 2009 for sh.5,000,000

Depreciation is charged at 20% per annum on cost.

During the year ending 31stDecember, 2012, the following transactions took place:

1stMay Bus 3 (T 202 AAA) was bought for sh.6,000,000

30thJune Bus 2 (T 201 AAA) was involved in an accident at Korogwe. It was scraped off. Zanzibar Insurance Company paid sh. 2,500,000 as insurance claim.

1StJuly Bus 4 (T 203 AAA) was purchased for sh. 8,000,000. 1stOctober Bus 4 (T 203 AAA) proved uneconomical and it was traded in for Bus 5 (T 204 AAA) which cost sh. 7,500,000.

Malingumu Bus Services Ltd provides depreciation from the day of purchases to the date of disposal and makes its accounts to 31stDecember each year.

From the information given above, show the entries for the year ending 31stDecember, 2012: (i) Buses account

(ii) Accumulated for depreciation account (iii) Buses disposal account.

View AnsSECTION B

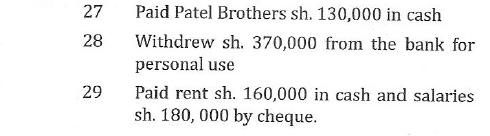

5.Identify the accounts affected by the following transaction and show the action to be taken in recording the accounts in the double entry system.

(i)A debtor S. Kaijage paid us in cash

(ii)Received rent paid in cash

(iii)Owner withdraws cash from business for personal use

(iv)Paid commission by cheque

(v)Bought furniture on credit from G. Opio

(vi)Sold goods receiving payment in cash![]()

(vii)Bought goods paying in cash

(viii)Sold goods on credit to S. Kaijage

(ix)Some of the goods bought from G. Opio were returned back to him for default reasons.

(x)S. Kaijage returned to us some of the goods bought, as they were in excess of his order.

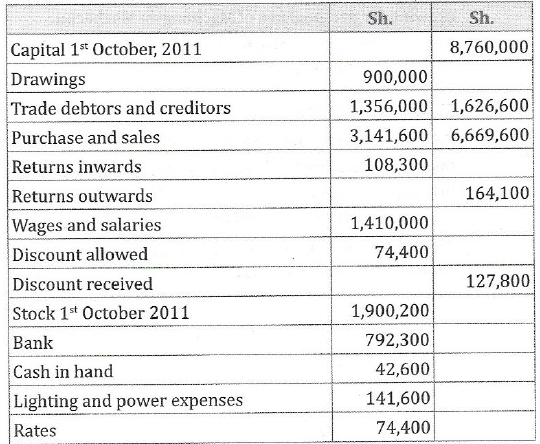

View Ans6.The following balances were extracted from the books of Machungwa Machachu, a sole trader for the year ending 30thSeptember, 2012.

You have also been provided with the following information:

1.Stock in trade on 30thSeptember, 2012 amounted to sh.1,320,000

2.One-quarter of lighting and power expenses is to be treated as drawing for personal use of Machungwa Machachu.

3.Depreciation is to be provided for as follows: 10% on fixture and fittings![]() 20% on motor vehicles. 5%on office buildings.

20% on motor vehicles. 5%on office buildings.

4.Rates prepaid amounted to sh. 19,200.

5.Insurance unexpired amounted to sh. 3,000.

6.Provision for bad and doubtful debts at the end of the year is to be equal to 10% of trade debtors.

Using the above information, prepare Income Statements for the year ending 30thSeptember, 2012 as well as Statement of Financial Position as on that date.

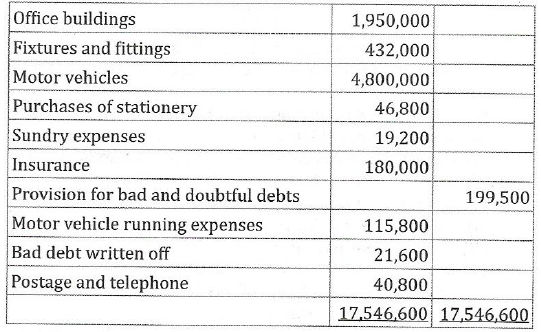

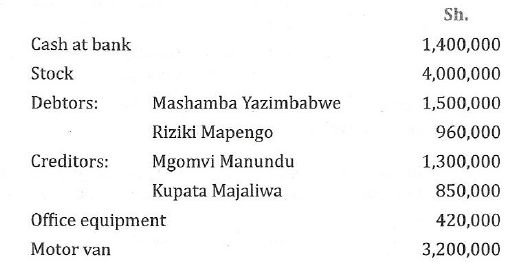

View Ans7.(a) On1stJanuary, 2014, S Kanjanja had the following assets and liabilities:

Post the above transactions to the Debtors' and Creditors' Ledger as well as Cash Account.

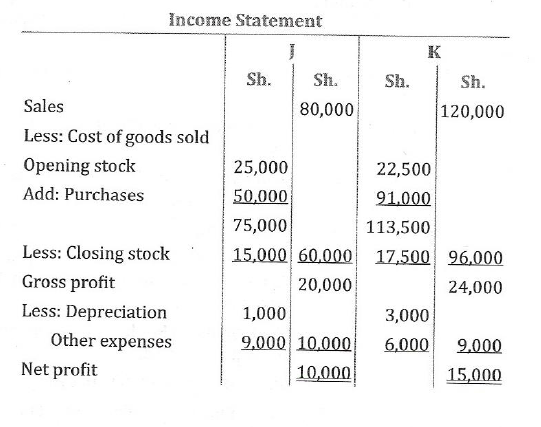

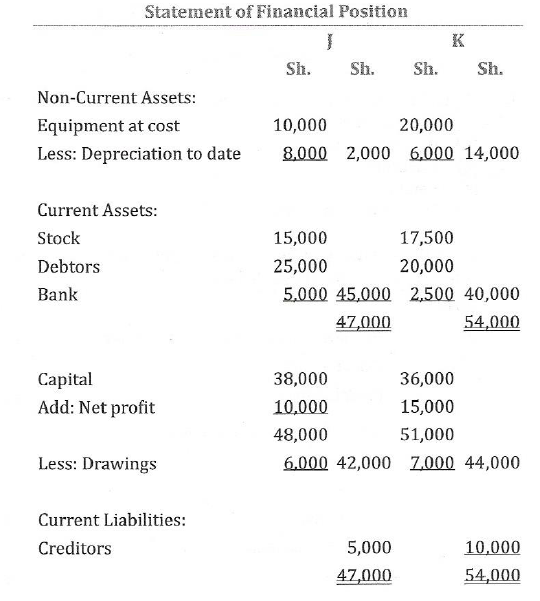

View Ans(b) The following are the Income Statements and Statements of![]() Financial Position for two similar types of retail stores:

Financial Position for two similar types of retail stores:

Using the above information, calculate the following ratios:

(i)Gross profit as a percentage of sales

(ii)Net profit as a percentage of sales

(iii)Gross profit as a percentage of purchases

(iv)Expenses as a percentage of sales

(v)Stock turnover ratio

(vi)Rate of return of net profit on capital employed (use the average of the capital account for this purpose)

(vii)Current ratio

(viii)Acid test ratio

(ix)Debtor's sales ratio

(x)Creditor's purchases ratio.

View AnsANSWER

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

WHATSAPP US NOW FOR ANY QUERY

App Ya Learning Hub Tanzania