THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY

(For Both School and Private Candidates)

Time: 3 Hours2014p.m.

Instructions

1. This paper consists of seven (7) questions sections A and B.

2. Answer a total of three (3) questions from section A and two (2) questions from section B.

3. Each question carries twenty (20) marks.

4. Workings must be shown clearly and submitted.

5. Non programmable calculators may be used.

6. Cellular phones are not allowed in the examination room.

7. Write your Examination Number on every page of your answer booklet(s).

SECTION A

1.Briefly explain the following accounting terms:

- Goodwill

- Creditors and liability

- Realisation concept

- Double entry system

- Credit note

View Ans

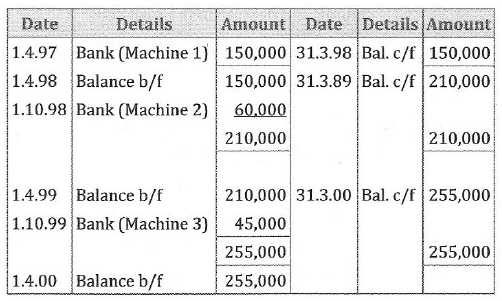

2. The machinery account of a firm for the three years ending on 31stMarch, 2000 appeared as follows:

The machinery account of a firm for the three years ending on 31stMarch, 2000 appeared as follows:

Depreciation of 20% on diminishing value basis was accumulated on provision for depreciation account. On 1stJanuary, 2001 machine two was damaged and had to be replaced by a new machine four costing sh. 75,000. Machine two was insured and an insurance claim for sh. 37,200 was admitted by the insurers.

For the year ended 31stMarch, 2001 prepare the:

(i)Machinery account

(ii)Provision for depreciation account

(iii)Machinery disposal account

View Ans

(b) Write up journal entries needed to record the corrections of the following errors:

(i)Goods taken for own use sh. 14,400 had been debited to sundry expenses account.

(ii)Purchases of goods from Chiwanga sh. 49,200 had been entered in the books as 85,200.

(iii)Extra capital of sh. 1,000,000 paid into banks had been credited to sales account.

(iv)Returns inwards of Sh. 39,000 from Godson had been entered in error to Masantula's account.

(v)Cash banked of sh. 82,000 had been credited to the bank column and debited to the cash column in the cash book.

View Ans

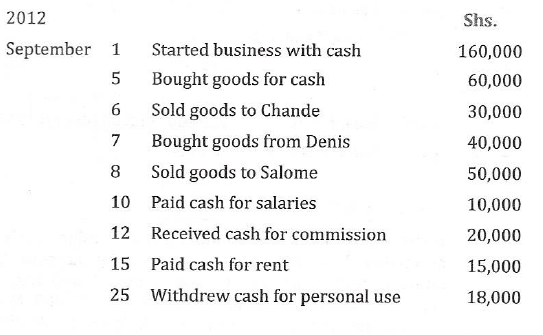

3.Enter the following transactions directly into ledger:

View Ans

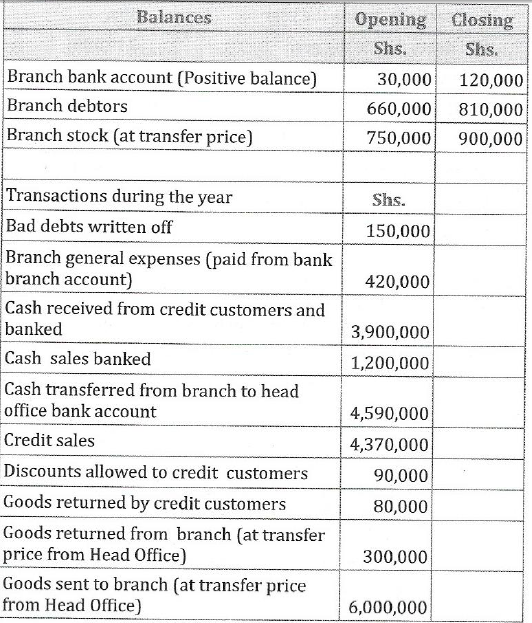

4. Uaminifu Products has a Head Office in Mwanza and a branch in Dodoma. The following information has been extracted from the Head Office books of accounts as at 31stMarch, 2006.

Information relating Head Office:

Additional information:

(i)Most of the accounting records relating to the branch are kept by the Head Office in its own books of account.

(ii)All purchases are made by the Head Office and goods are invoiced to the branch at selling price, that is, at cost price plus 50%.

(a)Using the information provided, prepare the following ledger accounts for the year ended 31stMarch 2006:

(i) Goods sent to branch account

(ii)Branch stock account

(iii)Branch stock adjustment account (iv) Branch debtors account.

View Ans

(b)Compile Uaminifu Products Income Statement for the year ended 31stMarch, 2006.

View Ans

SECTION B

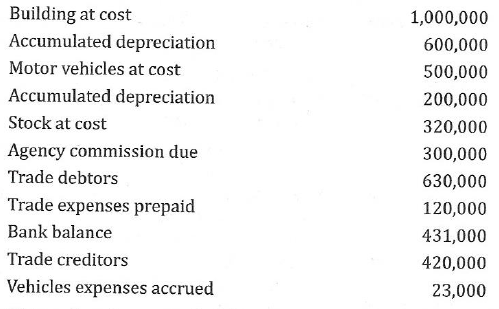

5.Majuto is a sole distribution Agent in Eastern Region for General Tyre under agreement with the manufacturer. Majuto purchases the tyres at price list less 5% trade discount and receives annually an agency commission of 1% of his purchases.

In January 2001 Majuto lost stock costing sh. 50,000 as well as many of his accounting records. However, careful investigations were made in which the following information has been obtained covering the year ended 31stMarch, 2001.

(i)Assets and liabilities at 31stMarch, 2001

(ii)Majuto has been notified that he will receive an agency commission of Sh. 44,000 on 10thApril, 2001.

(iii)Stock at cost on 31stMarch, 2001 was valued at Sh. 300,000 more than previous year.

(iv)Trade creditors at 31stMarch, 2001 related entirely to goods received Sh. 760,000.

(v)Discount allowed were Sh. 162,000 while discount received were Sh. 120,000.

(vi)Trade debtors (for sale at 31stMarch 2001 were Sh. 670,000).

(vii)Trade expenses prepaid at 31stMarch 2001 were Sh. 8,000.

(viii)Vehicles expenses for the year ended 31stMarch, 2001 amounted to Sh. 702,000.

(ix)Drawings were Sh. 430,000.

(x) Other bank payments were vehicle expenses Sh. 672,000 and trade expenses Sh. 736,000.

(xi)All receipts and payments are passed through the bank account, as such balance as per banks statement was Sh. 481,000.

(xii)For several years Majuto has obtained gross profit of % of sales cost.

(xiii)Depreciation is provided annually, buildings 5% on cost and Motor vehicles 20% on cost.

(xiv) Majuto is not insured against loss of stock owing to burglary.

Prepare Majuto's Income Statement for the year 31stMarch, 2001 and the Statement of Financial Position as on that date.

View Ans

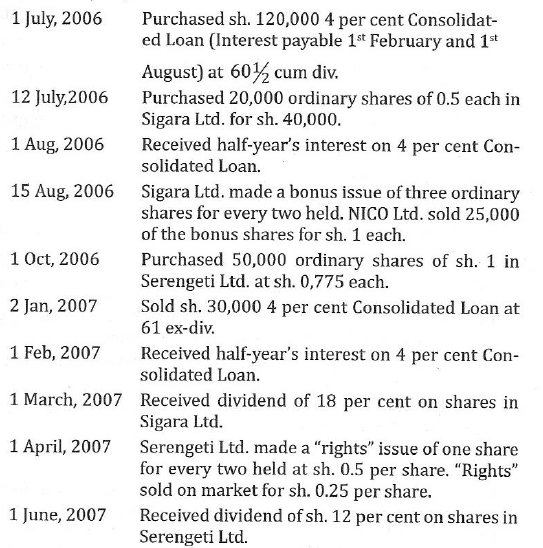

6.The following transactions of NICO Ltd. took place during the year ended 30thJune, 2007.

Using the information provided, write up the relevant Investment accounts as they would appear in the books of NICO Ltd. for the year ended 30thJune, 2007, (bringing down balances as on that date and ignore brokerage and stamp duty).

7.(a) Three of the accounts in the ledger of Narudi Nyumbani indicated the following balances at 1stJanuary, 2010: Insurance paid in advance Sh. 562,000

Insurance paid in advance Sh. 562,000

Wages outstanding Sh. 306,000 Interest receivable, received in advance Sh. 36,000

During 2010 Narudi Nyumbani:

Paid for insurance sh. 1,019,000by bank standing order.

Paid sh. 15,000,000 wages in cash.

Received sh. 2,600,000 interest by cheque from the business. At 31stDecember, 2010, insurance prepaid was sh. 345,000. On the same day interest receivable in arrears was sh. 105,000 and wages accrued amounted to sh. 419,000.

and wages accrued amounted to sh. 419,000.

Using the information provided:

(i)Prepare the Insurance, Wages and Interest receivable accounts for the year ended 31stDecember, 2010, showing the year end transfers and the balances brought down.

(ii)Prepare the Income Statement extract showing clearly the amounts transferred from each of the above accounts for the year ending 31stDecember, 2010.

(iii)Explain the effects on the Statement of Financial Position of accounting for expenses accrued and income received in advance at year end.

View Ans

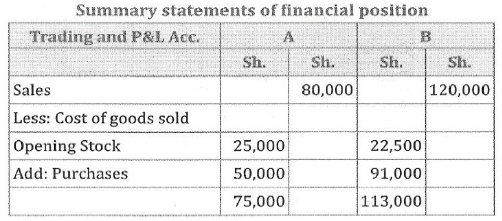

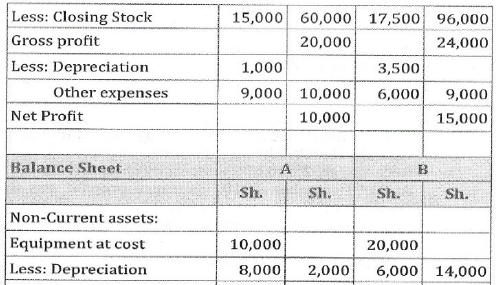

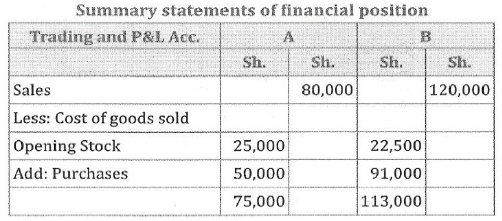

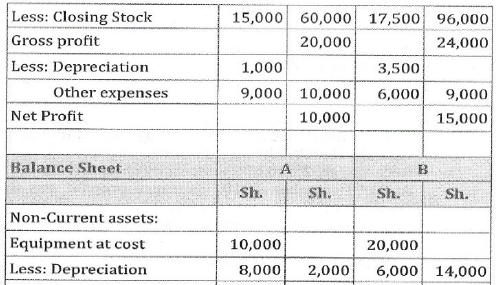

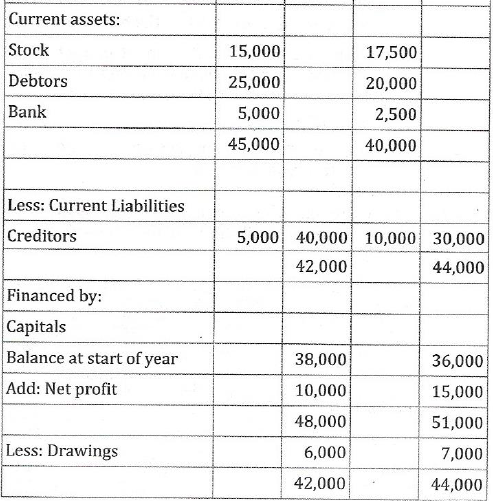

(b) Study the following Statements of Financial Position for similar types of retail store and then answer the questions that follow.

similar types of retail store and then answer the questions that follow.

Using the information in 7 (b):

(i)Calculate gross profit as percentage of sales; Net profit as percentage of sales; Expenses as percentage of sales; stock turn; Rate of return of net profit on capital employed (use the average of the capital account for this purpose); Current ratio; Acid test ratio; Debtors sales ratio and creditors purchases ratio.

(ii)Find out the business that seems to be the most efficient. Give any two possible reasons.

View Ans

7.(a) Three of the accounts in the ledger of Narudi Nyumbani indicated the following balances at 1stJanuary, 2010: Insurance paid in advance Sh. 562,000

Insurance paid in advance Sh. 562,000

Wages outstanding Sh. 306,000 Interest receivable, received in advance Sh. 36,000

During 2010 Narudi Nyumbani:

Paid for insurance sh. 1,019,000by bank standing order.

Paid sh. 15,000,000 wages in cash.

Received sh. 2,600,000 interest by cheque from the business. At 31stDecember, 2010, insurance prepaid was sh. 345,000. On the same day interest receivable in arrears was sh. 105,000 and wages accrued amounted to sh. 419,000.

and wages accrued amounted to sh. 419,000.

Using the information provided:

(i)Prepare the Insurance, Wages and Interest receivable accounts for the year ended 31stDecember, 2010, showing the year end transfers and the balances brought down.

(ii)Prepare the Income Statement extract showing clearly the amounts transferred from each of the above accounts for the year ending 31stDecember, 2010.

(iii)Explain the effects on the Statement of Financial Position of accounting for expenses accrued and income received in advance at year end.

(b) Study the following Statements of Financial Position for similar types of retail store and then answer the questions that follow.

similar types of retail store and then answer the questions that follow.

Using the information in 7 (b):

(i)Calculate gross profit as percentage of sales; Net profit as percentage of sales; Expenses as percentage of sales; stock turn; Rate of return of net profit on capital employed (use the average of the capital account for this purpose); Current ratio; Acid test ratio; Debtors sales ratio and creditors purchases ratio.

(ii)Find out the business that seems to be the most efficient. Give any two possible reasons.

View Ans

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256