THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY

THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY

(For Both School and Private Candidates)

Time: 3 Hours2013 p.m.

Instructions

1. This paper consists of seven (7) questions sections A and B.

2. Answer a total of three (3) questions from section A and two (2) questions from section B.

3. Each question carries twenty (20) marks.

4. Workings must be shown clearly and submitted.

5. Non programmable calculators may be used.

6. Cellular phones are not allowed in the examination room.

7. Write your Examination Number on every page of your answer booklet(s).

SECTION A

1.Briefly explain the following accounting terms:

- Single entry system

- Journal

- Closing stock

- Accrual concept

- Business entity

View Ans

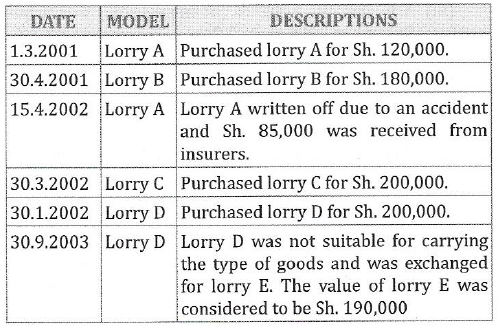

2.Nia Njema commenced business as a transport contractor on 01.03.2001. He makes up his accounts annually to 28thFebruary. He depreciates his vehicles at the rate of 20% on the straight line method. A full year's depreciation is charged in the year of purchases and none in the year of sale. His transactions are as follows:

Using the above transactions, you are required to write up in Nia Njema's books for the year ended 28.2.2002, 28.2.2003 and 28.2.2004 on the following:

(i)Lorries account

(ii)Provision for depreciation of lorries account, and

(iii) Disposal of Lorries account.

View Ans

(b) Pass necessary journal entries for adjustments and closing entries for the following adjustments as at 31stMarch, 2010 and narrate for the following transitions:

(i) Interest accrued on securities Sh. 50,000.

(ii)Bad debts during the year amounted to Sh. 10,000.

View Ans

3.Alizeti PLC whose accounting year ends 31stDecember, invested in marketable securities. The transactions during the year were as follows:

(i)Initial Investments on 1stSeptember, 2004 were Sh. 500,000 (nominal value) 12% Dar es Salaam City Council Loan Stock at Sh. 500,000 (normal value) 12% Dar es Salaam City Council Loan Stock at Sh. 0.92. Interest is payable half yearly on 30thJune and 31stDecember.

(ii)A further Sh. 100,000 (nominal value) was acquired on 1stOctober, 2005 at Sh. 0.95.

(iii)A further Sh. 100,000 (nominal value) was acquired on 1stDecember, 2005 at Sh. 0.94.

You are required to post and balance the investment account in Alizeti PLC's ledger, assuming that the appropriate amount of interest is received on the due dates.

View Ans

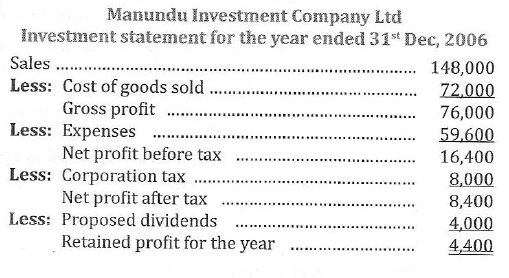

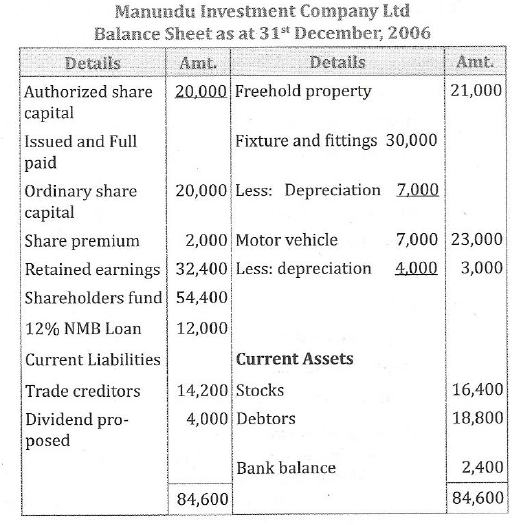

4.(a) The financial statement of Manundu Investment Company Ltd is as follows:

Addition information:

- Ninety percent (90%) of all sales were on credit.

- The only interest paid was on the 12% NMB Loan.

From the above information, you are required to compute:

(i)Current ratio

(ii)Acid test ratio

(iii)Debt service cover

(iv)Net income ratio

(v)Return on capital employed (ROCE)

(vi)Return on shareholders' equity

(vii)Inventory turn over

(viii)Debtors collection period

(ix)Debt equity ratio and

(x)Return on total assets.

View Ans

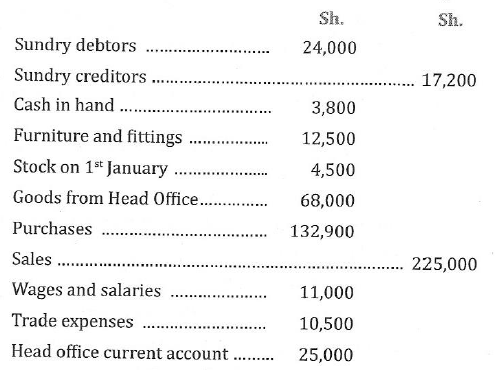

(b) The Big Noise Branch of Universal Traders Ltd. closed its books on 30thJune, when the following Trial Balance was compiled.

Additional information:

- The closing stock on 30thJune was Sh. 5,200

- The balance of Head Office current account on 1stJanuary was Sh. 23,000 and cash remitted to Head Office was Sh. 66,000.

By using the above information, prepare the:

(i)Branch Trading and Profit and Loss account for the year ended 30thJune.

(ii)Branch and Head Office current accounts.

View Ans

SECTION B

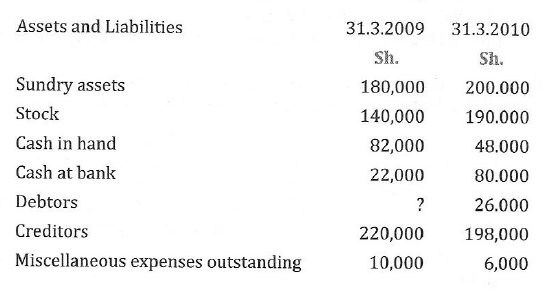

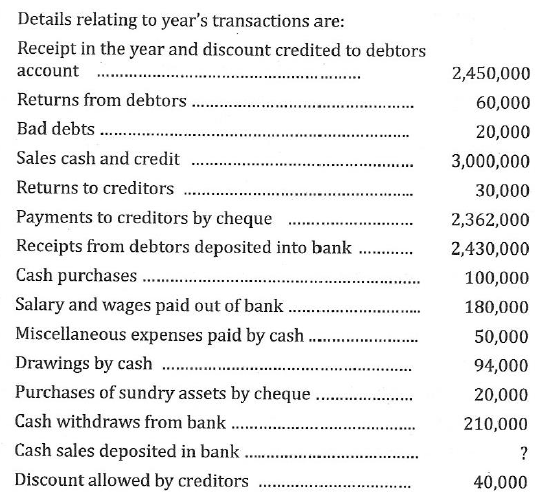

5.The following information is supplied from Nandenga Investment:

You are required to prepare:

(i)The Profit and Loss account for the year ended 31stMarch, 2010.

(ii)Balance sheet as at that date

(iii)Total Debtors Control account and Creditors Control account

View Ans

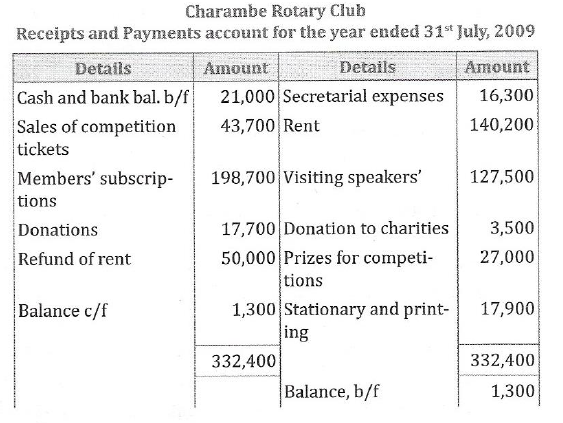

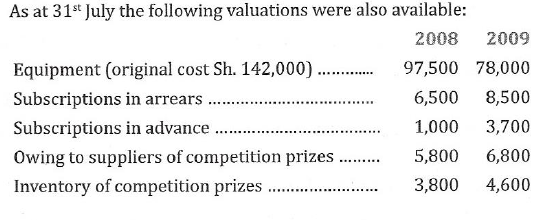

6.The following is a summary of the receipts and payments of the Charambe Rotary Club during the year ended 31stJuly, 2009.

Charambe Rotary Club

Receipts and Payments account for the year ended 31stJuly, 2009

Using the information provided:

(a)Calculate the value of the accumulated fund of the Charambe Rotary Club as at 1stAugust 2008.

(b)Reconstruct the subscriptions and competition prizes accounts for the year ended 31stJuly, 2009.

(c ) Prepare an income and expenditure account for the Charambe Rotary Club for the year ending 31stJuly, 2009 and a Balance as at that date.

View Ans

7.A book keeper extracted a trial balance on 31stDecember, 2010 which failed to agree by Sh. 210,000, a shortage on the credit side of the trial balance. A suspense account was opened for the difference. In January 2011 the followings errors made in 2010 were found:

- Sales day book had been under cast by Sh. 200,000.

- Sales of Sh. 610,000 to T. Majumu had been debited in error to T. Majuni's account.

- Rent account had been under cast by Sh. 90,000.

- Discount allowed account had been over cast by Sh. 100,000.

- The sales of a computer at net book value had been credited in error to the sales account Sh. 230,000.

By using this information:

(i)Show the journal entries necessary to correct the errors.

(ii)Write up the suspense account after the errors described have been corrected.

(iii)If the net profit had previously been calculated at Sh. 31,400,000 for the year ending 31stDecember, 2010, show how the calculations of the corrected net profit would appear.

View Ans

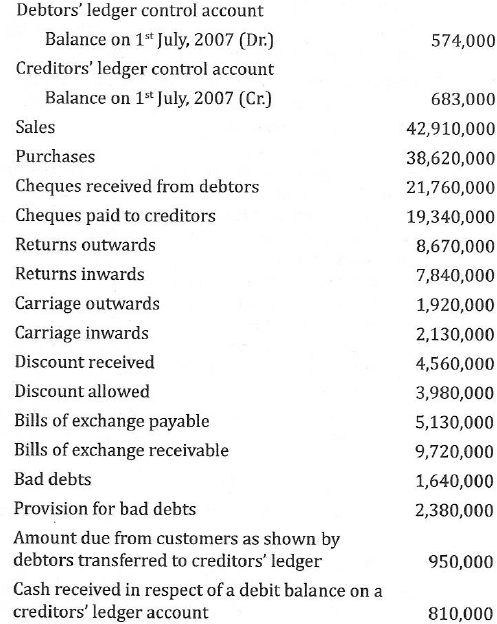

(b) The book of Mango Tree Ltd includes three ledgers comprising of an impersonal ledger, debtors' ledger and creditor's ledger. The impersonal ledger contains debtors’ ledger and creditors' ledger control accounts as part of the double entry.

The following information relates to the accounting year ended 30thJune, 2008.

You are required to prepare the debtors' ledger and creditors' ledger control accounts.

View Ans

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256