THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY 1

(For Both School and Private Candidates)

Time: 3 Hours2012 p.m.

Instructions

1. This paper consists of seven (7) questions sections A and B.

2. Answer a total of three (3) questions from section A and two (2) questions from section B.

3. Each question carries twenty (20) marks.

4. Workings must be shown clearly and submitted.

5. Non programmable calculators may be used.

6. Cellular phones are not allowed in the examination room.

7. Write your Examination Number on every page of your answer booklet(s).

SECTION A

1.Briefly explain the following accounting terms.

(a)Bank Giro Credit

(b)Gearing ratio

(c)Accounting Cycle

(d)Depletion

(e)Errors of Principle

View Ans

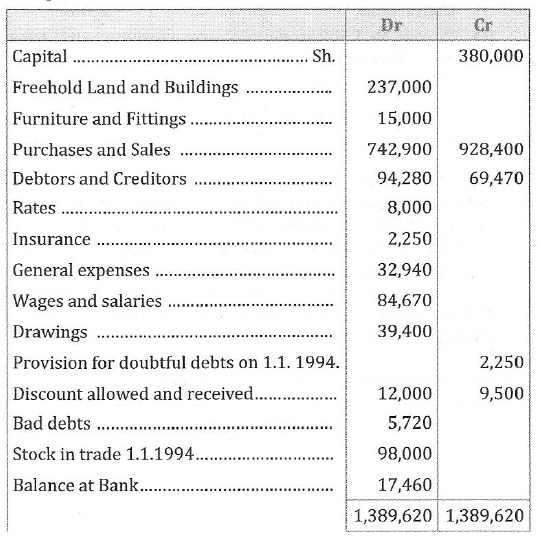

2.The following Trial Balance was extracted from the books of Maisha Mafupi, a trader as at 31stDecember, 1994.

Additional information:

(a)Stock in trade on 31stDecember, 1994 was Sh. 104,500.

(b)At 31stDecember, 1994, insurance prepaid amounted to Sh. 550 and rates paid in advance Sh. 1,500.

(c)Wages and salaries outstanding at 31stDecember, 1994 was Sh. 3,200.

(d)Provision for doubtful debts is to be increased to Sh. 2, 900.

(e) On 1stJanuary, 1994 Maisha Mafupi sold his private car for Sh. 15,000 and used Sh. 10,000 of that amount to buy a delivery car for use in the business. On the same date he took from the business goods costing Sh. 1,500 for his own use. No entries have been made in the books of the firm recording these transactions.

transactions.

(f) Provide Sh. 1,500 for depreciation of furniture and fittings and allow for depreciation on the delivery van at the rate of 20% per annum on cost.

From the above information, you are required to prepare the Income Statement and the Balance Sheet as at 31stDecember, 1994.

View Ans

3.On July 1st2000, Namaru Investment Ltd held Sh. 200,000 6% Debenture of Steel Master Ltd. which appeared in the books at Sh. 193,000. Interest is payable on 31stJuly and 31stJanuary. October 1st2000, further 100,000 debentures in Steel Master Ltd. were bought at 98 cum interest and on January 1st2001, further 60,000 debentures were bought at 97 ex-interests. On 31stMarch 2001, 160,000 debentures were sold at 101 cum interest and on 1stJune, 2001, 120,000 debentures were sold at 102 ex-interests.

You are required to prepare the investment Account for the period ending on June, 2001 (Assume the OR company uses FIFO method).

View Ans

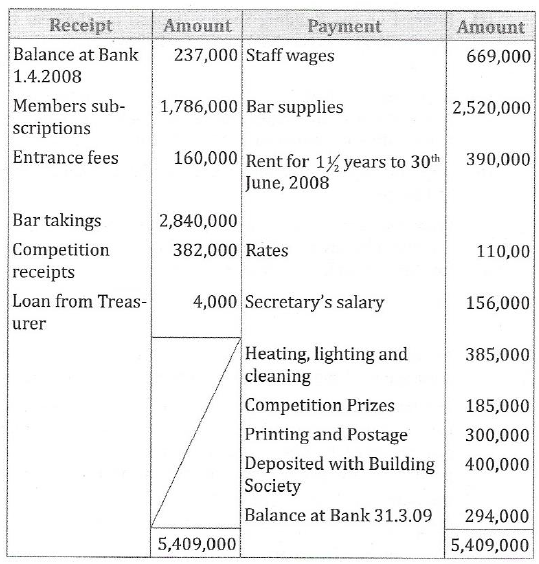

4.The following is a summary of the Cash Book of Tendawema Social Club.

(a)The assets of the Club on 1stApril, 2008, were furniture and equipment Sh. 2,400,000, Bar stock Sh. 130,000 and prizes in hand Sh. 40,000; Sh. 260,000 owed for bar supplies.

(b)On 31stMarch, 2009, the bar stock were Sh. 150,000 prizes Sh. 25,000 and Sh. 280,000 owed for bar supplies.

(c)It appeared from the register of members that subscriptions unpaid at 31stMarch, 2009 amount to Sh. 50,000.

(d)Subscriptions received during the year under review included Sh. 35,000 in respect of the previous year and Sh. 20,000 in respect of the year beginning 1stApril, 2009.

(e)The secretary is to be allowed Sh. 25,000 per annum for the use of his own motor car in connection with Club affairs.

(f) Interest on the Building Society Deposit for the year to 31stMarch, 2009 was received on 1stApril, 2009 amounting to Sh. 12,000.

(g)It was agreed that the steward of the Club should receive a bonus of 5% of bar taking in excess of an average of Sh. 200,000 per month for the year to 31stMarch, 2009.

(h)Write off depreciation on furniture and equipment at the rate of 10% per annum.

From the above information, you are required to prepare Bar Trading account as well as Income and Expenditure account for the year ended 31stMarch, 2009.

View Ans

SECTION B

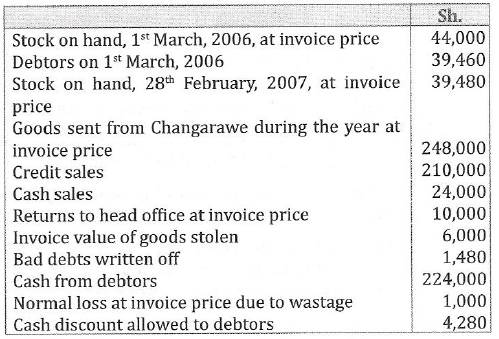

5. Machinga Ltd, whose head office is at Changarawe, operates a branch at Uyole. All goods are purchased by the head office and invoiced to and sold by the branch at cost plus 33% per cent. Other than sales ledger kept at Uyole, all transactions are recorded in the books at Changarawe. The following particulars are given of the transactions at the branch during the year ended 28thFebruary, 2007.

Using the details above, prepare the Branch Stock Account and Branch Total Debtors Account for the year ended 28thFebruary, 2007 as they would appear in the head office books.

View Ans

(b) Chihoko Company uses accrual basis of accounting. The Company owns real estate that it rents to various lessees. Rent collected in cash during year five amounted to Sh. 543,000. The amounts of rent receivable and unearned rent revenue on two successive balance sheet dates were as follows:

Dec. 31StYr4Dec. 31StYr 5

Rent Receivable. Sh.18,000Sh. 24,500

Unearned rent revenue .... Sh.22,000Sh. 8,200

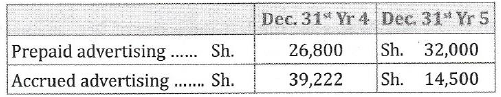

The Company advertises its goods through T BC, Radio One and Daily Newspapers, some of the advertising costs are paid in advance and some is paid on receipt of invoices. Advertising expenses on the accrual basis of accounting for year five was Sh. 321,000. The amounts of prepaid and accrued advertising expenses at the beginning and at the end of year 5 were as follows

You are required to compute the amount of:

(i)Rent revenue that should appear in the profit and loss account for the year five.

(ii)Cash paid for advertising during year five.

View Ans

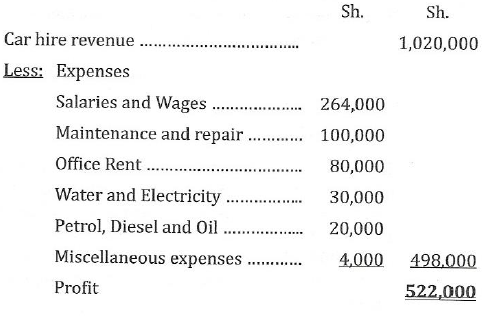

6.(a) Green Rental Car Hire completed its first year of operations on December 31st, 2001. Because this is the end of the annual accounting period, the company book keeper prepared the following provisional income statement.

Green Rental

Income Statement

Additional information:

- Wages for the last three day of Dec. amounting to Sh. 6,000 were not recorded

- The telephone bill for Dec. 2001, amounted to Sh. 2,000 has not been recorded.

- Depreciation on vehicles, amounting to Sh. 200,000 for 2001, was not recorded.

- Interest Sh. 200,000 one year 12% on loan from CRDB Ltd was not recorded.

- Car hire revenue includes Sh. 20,000 of car hire revenue for the month of January 2002.

- Maintenance and repairs expenses include Sh. 10,000 which is the cost of replacement parts still in store at December 31st, 2001. These will be used the following year.

From the above information you are required to prepare:

(i)Journal entries for the adjustment

(ii)Income Statement after adjustment

View Ans

(b) Pass necessary journal entries for adjustment and closing entries for the following adjustments as at 31st March, 2001 and narrate for the transactions.

(i)Stock on March, 2001 was Sh. 350,000

(ii)Salaries at the rate of Sh. 20,000 per month were paid for 11 months only.

(iii)Insurance paid Sh. 40,000 (including premium of Sh. 30,000 per annum up to 30thJune, 2011.

(iv)Apprenticeship premium received on 31stOctober, 2010 Sh. 90,000 was for three years.

View Ans

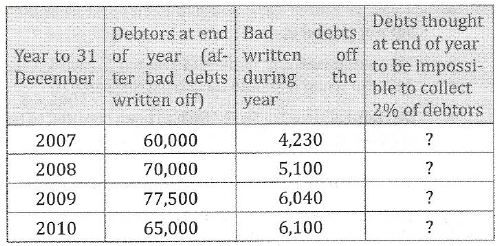

7.A business started on 1stJanuary, 2007 and its financial year end is 31stDecember. A table of debtors, the bad debts written off and the estimated doubtful debts at the rate of 2% of debtors at the end of each year has shown below:

From the above information, you are required to:

(i)Ascertain the amount for estimated doubtful debts at the end of each year.

(ii)Prepare provision for doubtful debts account and bad debts account for the year ended 31stDecember, 2010.

View Ans

(b) MwacheniMwenyewe extracted a trial balance as at 31stDecember, 2010. He was unable to balance it, but as urgently needed his accounts for tax purposes; he opened a suspense account and entered Sh. 7,050 debit balance in it.

In the next year he found the following errors listed:

- The sales returns day book had been under cast by Sh. 1,000

Drawings of Sh. 800 had been debited to wages account.

Drawings of Sh. 800 had been debited to wages account. - A payment of bank charges Sh. 2,700 had not been posted to the expense account.

- A sale of goods Sh. 3,850 to Utalijua Jiji on 30thDecember, 2010 had not been entered at all.

- Carriage inward Sh. 750 had been debited to carriage outwards

- A rent rebate of Sh. 2,000 had been entered in the cash book but not posted elsewhere.

- The purchases day book had carried forward a figure of Sh. 247,980 when it should have been Sh. 248,970.

- Discount allowed of Sh. 2,180 had been credited to the discount allowed account.

From the above information, you are required to prepare:

(i) The journal entries needed to correct the errors.

(ii) The suspense account balanced off.

View Ans

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256