THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY 1

(For Both School and Private Candidates)

Time: 3 Hours2011 p.m.

Instructions

1. This paper consists of seven (7) questions sections A and B.

2. Answer a total of three (3) questions from section A and two (2) questions from section B.

3. Each question carries twenty (20) marks.

4. Workings must be shown clearly and submitted.

5. Non programmable calculators may be used.

6. Cellular phones are not allowed in the examination room.

7. Write your Examination Number on every page of your answer booklet(s).

1. Write short notes on the following terms

- Private ledgers

- Super profit

- Net realizable value

- Capital reserve

- Real accounts

View Ans

2.(a) List six (6) errors that are not disclosed by a trial balance.

View Ans

(b) Mention three (3) reasons that may lead to the trial balance disagreement.

View Ans

(c) Show how the following errors would be corrected through the general journal.

(i)

(ii)

(iii)

(iv)

(v)

(vii)

(viii)Purchases Shs. 630,000 from Jaba Ltd entered in the purchases journal correctly but credited to Jaba Ltd as Shs. 360,000.

(ix)

(x)

View Ans

3.stJanuary 2003, Kamwela Ltd bought Shs. 40,000 6% government stock at Shs. 90, the cheque of Shs. 36,800 paid being Shs. 36,000 for the stock and Shs. 800 for brokerage charges. Interest is received each year on 31stMarch, 30thJune, 30thSeptember and 31stDecember.

On 1stFebruary 2004, Shs. 10,000 nominal value of the stock was sold cum. div, the net proceeds being Shs. 9,500.

On 1stFebruary 2004, shs 20,000 nominal value was bought ex. div, net proceeds after brokerage being Shs. 17,100.

On 1stFebruary 2005 Shs. 50,000 nominal value was bought cum. div, the cost including brokerage being Shs. 43,700.

Prepare the investment account in Kamwela's books for the financial years ended 2003, 2004 and 2005.

View Ans

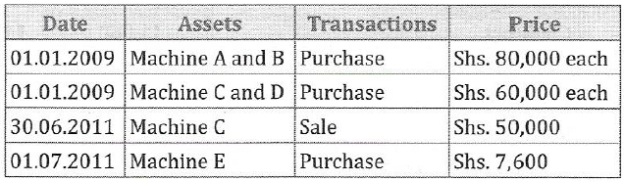

4.stDecember.

Each machine was estimated to last for 10 years and to have a residual value of 5% of its cost price. Depreciation was by equal installments and it is a company policy to charge depreciation for every month an asset is owned.

Required:

Calculate:

(i)

(ii)

(b)

View Ans

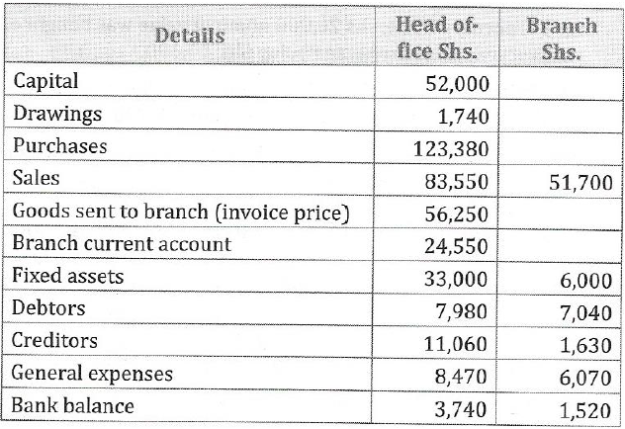

5.stJanuary, 2009 with a head office and one branch. All goods are purchased by head office and goods sent to the branch are invoiced at a fixed selling price of 25% above cost. All sales, both by the head office and the branch, were fixed at the fixed selling price.

The following information relates to head office and branch for the year ended 31stDecember 2009.

Notes:

(i) in transit from the branch to the head office at 31stDecember 2009, Shs. 1,000.

in transit from the branch to the head office at 31stDecember 2009, Shs. 1,000.

(ii)stDecember 2009 were extracted no entries had been made in the books of the branch for goods in transit on the date, from the head office to the branch, Shs. 920.

(iii)stDecember stock shortages of Shs. 300 at selling price was found at the branch.

Required:

(a)

(b)

View Ans

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256