THE UNITED REPUBLIC OF TANZANIA NATIONAL EXAMINATIONS COUNCIL ADVANCED CERTIFICATE OF SECONDARY EDUCATION EXAMINATION 153/1 ACCOUNTANCY 1

(For Both School and Private Candidates)

Time: 3 Hours2010 p.m.

Instructions

1. This paper consists of seven (7) questions sections A and B.

2. Answer a total of three (3) questions from section A and two (2) questions from section B.

3. Each question carries twenty (20) marks.

4. Workings must be shown clearly and submitted.

5. Non programmable calculators may be used.

6. Cellular phones are not allowed in the examination room.

7. Write your Examination Number on every page of your answer booklet(s).

1.

View Ans

2.st1990 appeared as follows:

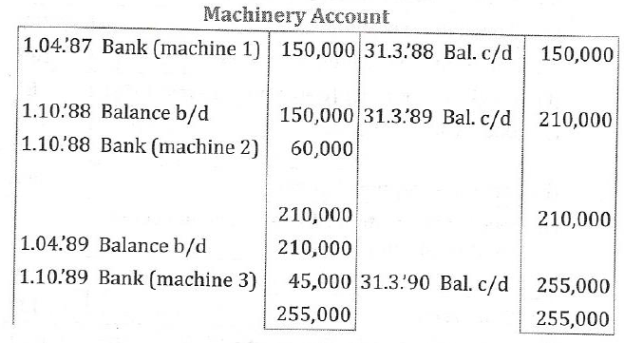

Machinery Account

Depreciation at 20% on the diminishing balance basis was accumulated in Provision for Depreciation Account. On January 1st1991 machine 2 was damaged and had to be replaced by a new machine costing Shs. 75,000. It was expected that machine 2 will fetch Shs. 3,300 but was insured and an insurance claim for Shs. 37,200 was admitted by the insurers.

Depreciation at 20% on the diminishing balance basis was accumulated in Provision for Depreciation Account. On January 1st1991 machine 2 was damaged and had to be replaced by a new machine costing Shs. 75,000. It was expected that machine 2 will fetch Shs. 3,300 but was insured and an insurance claim for Shs. 37,200 was admitted by the insurers.

Required:

Show, for the year ended 31stMarch 1991, the Machinery account, Provision for depreciation account, and Machinery disposal account.

View Ans

3.

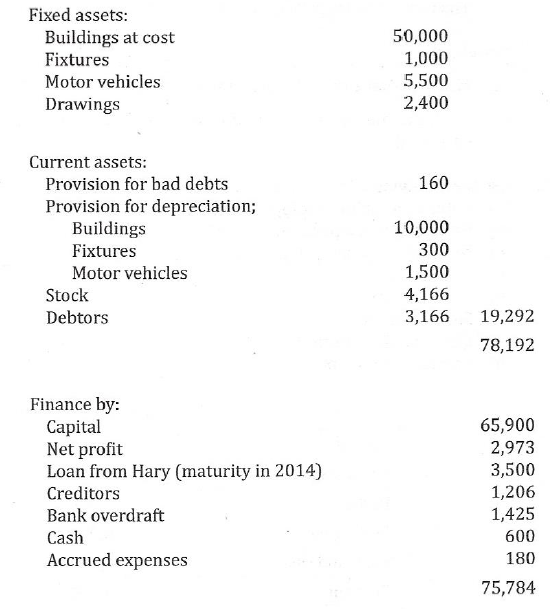

C. JUMA

BALANCE SHEET AS AT 30.11.2009

After a thorough investigation, the following issues were discovered:

(i)

(ii)

(iii)

(iv)

(v)

Required:

(a)

View Ans

(b)

View Ans

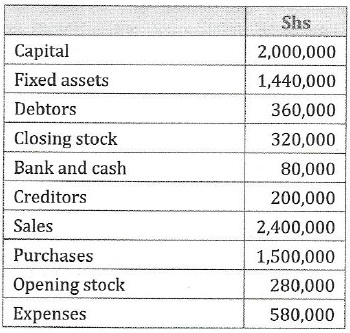

4.

- Return on capital employed

- Gross profit as a percentage of sales

-

- Current ratio

- Acid test ratio

- Stock turn over

- Debts payment period

- Creditor's payment period

View Ans

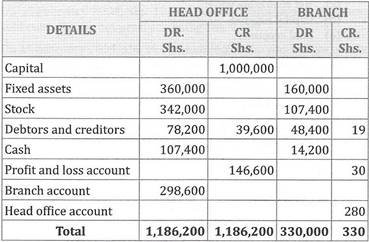

5.stMarch, 2009 after ascertainment of profit and making all adjustments except those referred in the following.

Set out the balance sheet of the business as on 31stMarch; 2009 after making the following adjustments:

- On 31st March, 2009, the branch had sent a cheque for Shs 10,000 to the head office, neither received by them nor credited to branch till next month.

- Goods valued at Shs. 4,400 had been forwarded by the head office to the branch on 30th March, 2009 were neither received by the branch nor dealt with in their books till next month.

- It was agreed that the branch should be charged with Sh. 3,000 for administration services rendered by the head office during the year.

- Stock stolen in transit from the head office to the branch and charged to the branch books as the manager denied admitting any liability; Shs 4,000 was not covered by insurance.

- Depreciation of branch assets of which accounts are maintained by the head office, not provided for, Shs 2,500.

- The balance of profit shown by the branch is to be transferred to the head office books.

View Ans

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256