OFFICE OF THE PRESIDENT

REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

SECONDARY EXAMINATION SERIES

FORM TWO TERMINAL EXAMINATION-MAY-2023

BOOK-KEEPING

062

TIME: 2:30Hours

Instructions

- This paper consists of section A, B and C with a total of nine (9) questions.

- Answer all questions.

- All answers must be written in the spaces provided.

- All writings must be blue or black ink except drawings which must be in pencil.

- Calculators, cellular phones and any unauthorized materials are not allowed in the examination room.

- Write your Examination Number on the top right of every page.

SECTION A (15 Marks)

Answer all questions in this section

- For each of the items (i) – (x), choose the correct answer form among the given alternatives and write its letter beside the item number in the box provided.

- After balancing all accounts, Mwangumi prepared a trial balance. He did this because of

- Reducing errors in the double entry accounts

- Indicating errors where they have occurred

- Checking the arithmetic accuracy of double entry

- Preventing errors and frauds in accounts.

- Kabila, the owner of WATOTO WAVAE SHOP, separates his business transactions from his personal transactions. What accounting concept does he apply?

- Historical cost

- Going concern

- Money measurement

- Business entity

- Suluhu started business last week and bought goods from various suppliers. He is now planning to return some goods to some of his suppliers. His decision may be due to

- The goods were durable

- The goods were so expensive

- The goods were expired

- The goods were perishable

- When preparing statement of financial position, you have decided to arrange the current assets in their descending order. How will they be presented?

- Inventory, trade receivables, bank, cash

- Cash, bank, trade receivables, inventory

- Trade receivables, inventory, cash, bank

- Inventory, trade receivable, cash, bank

- Kale has banked some of her business cash into the bank. What term is given to this transaction?

- Double entry

- Single entry

- Contra entry

- Two – sided entry

- Mungiya is a sole proprietor of a retail shop. The capital of his business will decrease if:

- His profit is equal to his capital

- His drawings is bigger than his profit

- His drawings is less than his profit

- His profit is bigger than his capita.

- The government has rented a house which is not used at all. What type of expenditure is this?

- Recurrent expenditure

- Capital expenditure

- Development expenditure

- Nugatory expenditure

- After posting all transactions in their respective ledgers and balancing them, Mwakapala prepared a statement showing a list of balances on 30th April, 2022. Which name is given to this statement?

- Bank statement

- Income statement

- Trial balance

- Final/closing statement

- The amount of cash or stock taken from the business by Mwahija, a sole proprietor, for her personal use is termed as

- Expenses

- Income

- Drawings

- Asset

- When recording transactions in the three column cash book, the memorandum column on the debit side will record

- Cash received

- Cash paid

- Discount allowed

- Discount received

- For each items (i) – (v), match the descriptions of officers in government accounting and budgeting in List A with their corresponding names in List B by writing the letter of the response below corresponding item number in the table provided

| LIST A | LIST B |

|

|

SECTION B (40 Marks)

Answer all questions in this section

- Mswahili is a very reluctant business owner. He claims that, preparing financial statements is wastage of time because they end up being used by the business owner himself. You as his closed friend, briefly explain to him to clear his claim. (five (5) points)

- ________________

- ___________________

- _______________________

- ___________________________

- ______________________________

- Binti Mabuluu is a sole trade. She sells and buys goods by cash and on credit. State the transactions that she will record in each of the following journals.

- Sales journal

- Returns inwards journal

- Returns outwards journal

- Purchases journal

- Cash book

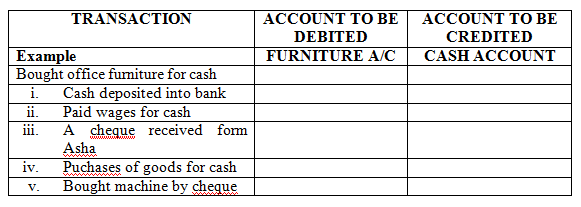

- In your school, the form one students are not much competent entry e-records. You as a competent form two student , help them by using transactions indicated in the table below:

| S/N | Transaction | Account to be debited | Account to be credited |

| | Bough goods by cash |

|

|

| | Sold goods by cheque |

|

|

| | Credit purchases |

|

|

| | Sold goods on credit to Tabu |

|

|

| | Paid cash into bank |

|

|

- Khuwayriy operates a current account with Amana Bank. He has received a bank statement dated 30th April 2022 from the bank. Surprisingly, he discovered that the balance in it is TZS 2,000,000/= while that shown in his cash is TZS 1,500,000/= Educate him on causes for this situation. (5 points)

- ________________

- ________________

- ________________

- ________________

- ________________

SECTION C (45 Marks)

Answer all questions in this section

- Bwana Mayowe has given you the following information concerning his cash transactions for the month of March, 2018

March 1 Cash balance 54,000debit, bank balance 150,000 credit

March 2 Received cheque from Kakulu 182,000 after deducting cash discount of 1,000

March 5 Withdrew 6,500 from bank for personal use

March 9 paid kato by cheque 5,200 after deducting 520 cash discount

March 12 Received 12,600 cash and 11,500 cheque from Kipchoge.

March 15 deposited 40,000 cash into bank

March 19 Bought a computer 60,000 and paid half amount by cheque on account

March 22 Paid stationery 14,800 cash

March 24 Sold some old furniture and received cash 7,500

March 28 Paid Exim Bank loan 15,000 by cheque

March 29 Withdrew 16,000 from bank for office use

March 31 Paid salaries 2,000 cash and 35,000 by cheque

Help Bwana Mayowe to record the above transactions in a suitable cash book and show the opening balances as at 1st April, 2018

- The following information were obtained from your school shop.

TZS

Stock a 1st January 2018 ......................................... 3,249

Purchases ............................................................... 11,380

Sales ...................................................................... 18,462

Motor expenses ....................................................... 520

Salarie ..................................................................... 150

Rent and rates .......................................................... 670

Insurance ............................................................... 111

General expenses ..................................................... 105

Premises .............................................................. 1,500

Motor vehicles .................................................. 1,200

Debtors .............................................................. 1,950

Cash at bank ....................................................... 1,654

Creditors ......................................................... 1,538

Cash in hands ................................................ 2,040

Drawings ........................................................ 895

Capital ......................................................... 5,424

Stock on 31st December, 2018 .................... 2,548

As a form two book keeping student, use the relevant financial statements to determine.

- School shop’s profit or loss

- School shop’s financial position

- Majigambo is a businessman, but he does not know well to record transactions. He committed many mistakes when recording transactions.

You as business studies student, use the knowledge of book keeping to draw the journal and show the corrections of the following mistakes made by Majigambo;

- Sales of goods for 200,000 have been credited to motor vehicle accounts

- Purchases of goods for cash 100,000 has not been entered in the ledger accounts.

- Sales of goods on credit of 82,000 to Tunu were entered by mistake in Tuna’s account

- Returns outwards of 117,000 to Chepesi were entered in both accounts as 171,000

- A cash drawings of 32,000 was debited to the cash account and credited to the drawings account

- Purchases of motor van by cash 89,000 was recorded in purchases account

- Sales account was undercasted by 358,000

Note: (Narrations are not required)

FORM TWO BKEEPING EXAM SERIES 152

FORM TWO BKEEPING EXAM SERIES 152

PRESIDENT’S OFFICE REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

MID TERM TWO MIDTERM EXAMINATIONS

062 BOOK KEEPING

TIME: 2:30 HOURS March 2023

INSTRUCTIONS

- This paper consists of section A, B and C with a total of nine (09) questions.

- Answer all questions

- Non programmable calculators may be used.

- Cellular phones and any unauthorized materials are not allowed in the examination room.

- Write your Examination Number on every page of your answer sheet(s).

SECTION A (15 Marks)

Answer all questions in this section

1. For each of the items (i) – (x) choose the correct answer from among the given alternatives and write its letter in the box provided

(i) Which of the following is not the objective of studying Book keeping?

- To control business

- To determine profit

- To assure fair tax assessment

- To provide opportunity for employment

(ii) Given a desired cash float of sh 20,000, if sh 14,600 are spent in the period, how much will be reimbursed at the end of the period?

- Sh. 20,000

- Sh. 5,400

- Sh. 14,600

- Sh. 25,400

(iii) A petty cash book is used for recording

- Cash payments

- Small payments

- Bank payments

- Small bank payments

(iv) The document used to deposit money in the bank account is known as

- Bank statement

- Pay in slip

- Invoice

- Payment voucher

(v) Which of the following best describe a trial balance?

- It show financial position of a business

- It is a list of ledger accounts balances

- It is a list of non-current assets

- It is a list of all ledger accounts

(vi) It is both a book of prime entry and part of ledger

- Purchases journal

- Sales journal

- Journal

- Cash book

(vii) What is meant by contra entry?

- Cash is banked before it has been paid out

- Double entry is completed within the cash book

- The proprietor has repaid capital in cash

- Sales have been paid by cash

(viii) The three column cash book records;

- Cash transactions and cheque transactions

- Cash transactions, cheque transactions and cash discounts

- Cash transactions and credit transactions

- Credit transactions and cash discounts

(ix) Which of the following statement is not a business transaction?

- Payment of wages to a house girl

- Payment of wages to a shop attendant

- Receipts of cash against sale of goods

- Purchases of fixed assets for the business

(x) Capital and drawings account are classified as;-

- Personal accounts

- Nominal accounts

- Real accounts

- Proprietors accounts

2. For each of the items (i) – (x), match the descriptions of the terms used in Book keeping in Column A with their corresponding names in Column B by writing the letter of the correct response below the corresponding item number in the table provided

| Column A | Column B |

|

|

Answers

| Column A | (i) | (ii) | (iii) | (iv) | (v) |

| Column B |

SECTION B (40Marks)

Answer all questions in this section

3. Why cash book and bank statement balances differs? Give five reasons.

4. Why buyers sometimes return goods to suppliers? Give five reasons

5. Classify the following , whether are Real account, Nominal account or Personal account

| Name of account | Classification |

| (i)Cssc western zones | |

| (ii) Sales account | |

| (iii) Furniture account | |

| (iv) Discount allowed account | |

| (v) William account |

6. Below are the Assets, Capital and Liabilities of Kazimoto Traders as at 31st December 2020

| Capital | 30,000 |

| Loan from Johari | 15,000 |

| Creditors | 5,000 |

| Bank overdraft | 3,000 |

| Buildings | 20,000 |

| Machinery | 11,000 |

| Furniture | 4,000 |

| Stock | 3,500 |

| Debtors | 8,500 |

| Cash in hand | 6,000 |

Required;

(a) From the above details mention:

(i) Fixed assets

(ii) Current assets

(iii) Current liabilities

(b) Calculate the amount of working capital

SECTION C (45Marks)

Answer all questions in this section

7. Revlon Company does not know how to prepare a proper trial balance. Its trial balance appeared in the books of accounts as at 31st December 2018 as follows:-

TRIAL BALANCE AS AT 31 DECEMBER 2012

| S/N | NAME OF ACCOUNTS | DR | CR |

| 1 | Stock 1.1.2018 | 2,000 | |

| 2 | Capital | 35,000 | |

| 3 | Motor van | 9,000 | |

| 4 | Purchases | 15,000 | |

| 5 | Sales | 42,000 | |

| 6 | Wages and salary | 1,000 | |

| 7 | Rent and rates | 1,500 | |

| 8 | Insurance and postage | 500 | |

| 9 | Drawings | 2,000 | |

| 10 | Premises | 14,000 | |

| 11 | Interest received | 300 | |

| 12 | Debtors | 5,000 | |

| 13 | Creditors | 7,000 | |

| 14 | Fixture and fittings | 7,000 | |

| 15 | Cash in hand | 13,000 | |

| 16 | Advertising | 3,300 | |

| 17 | Cash at bank | 8,000 | |

| 18 | Repair to motor van | 3,000 | |

| Total | 88,300 | 80,300 |

Using the information above, prepare the correct trial balance as at 31st December 2018

8. From the given balances, prepare the Journal Proper of Mrs. Godlove and ascertain her capital as at 31st December 2015

| Cash in hand | 1,400 |

| Cash at bank | 2,000 |

| Machinery | 3,200 |

| Stock | 1,760 |

| Motor van | 4,050 |

| Furniture and fittings | 1,000 |

| Bank overdraft | 1,680 |

| Debtors;- -Mariam -Martin | . 280 1,300 |

| Creditors;- -Rhoda 320 -Neema 1,750 | . 320 1,750 |

| Loan from Wambura | 4,400 |

9. From the following transactions you are required to prepare the Sales day book. Posting to the ledger is not required.

May 1st Sold to Mbasi & Sons Ltd

- 10 dozens of vitenge at 800/= a dozen

- 25 dozens of khanga at 1,000/= a dozen

May 5th Sold to Mkubwa:

- 10 pairs of rubber shoes at 200/= a pair

- 20 pairs of boots at 300/= a pair

May 8th Sold the following goods to Mayole Ltd:

- 60 bags of ammonium sulphate @ 680/=

- 50 rambo bags @ 120/= a bag

May 12th Sold to Mbaya &Sons:

- 10 dozens stencil at 300/= a dozen

- 20 reams of dublicating paper at 150/= each

May 22th Sold to Kadoda Book store:

- 20 advance Learner’s dictionaries at 250/= each

- 80 fiction books at 500/= each

FORM TWO BKEEPING EXAM SERIES 137

FORM TWO BKEEPING EXAM SERIES 137

THE PRESIDENT’S OFFICE MINISTRY OF EDUCATION, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

COMPETENCY BASED SECONDARY EXAMINATION SERIES

BOOK KEEPING

FORM TWO- SEPT 2022

INSTRUCTIONS

- This paper consist of section A, B and C

- Answer all questions

- All writings should be in blue or black ink pen except drawings which must be in pencils

- Cellphone and calculators are not allowed in the examination room

SECTION A

Answer all question in this section.

- For each of the following items (i) to (x) choose the most correct answer and write its letter beside the item number in space provided.

- Which of the following is nominal account?

- Bank account

- Furniture account

- Motor running expenses

- Bank overdraft

- What would you consider to be the main source of government revenue

- Royalties

- Fees

- Penalties

- Taxes

- Net profit is calculated in the …………

- Statement of financial position

- Income statement

- Trial balance

- Columnar cash book

- An officers who control public money is known as

- Paymaster General

- Accounting Officer

- Authorized Officer

- Receiver of revenue

- A cheque which is not accepted for payment by the bank due to insufficient fund in the drawer’s bank account is known as

- Uncredited cheque

- Unrecorded cheque

- Open cheque

- Dishonoured cheque

- Which among the following is the correct record for the goods taken from business for personal use?

- Debit Pill’s A/C and credit purchases A/C

- Debit drawings A/C and credit cash A/C

- Debit Drawings A/C and credit cash A/C

- Debit purchases A/C and credit pill’s A/C

- The double entry for a credit sales transaction for Tshs.700 is

- Debits Debtor’s A/C and credit sales A/C

- Debit Cash A/C and credit sales A/C

- Debit Sales A/C and credit cash A/C

- Debit receivable A/C and credit cash A/C

- Assume that you are the manager of NMB, then you write a cheque and sent it to Mussa, then Musa is a

- Payee

- Drawer

- Receiver

- Drawee

- Suppose a petty cashier was given Tsh 1000/= as a cash float of the month. At the end of the period Tshs 850/= was spent. Now a petty cashier is to be reimbursed with

- Tshs 1000

- Tshs 150

- Tshs 850

- Tshs 1850

- Sometimes a transaction may appears on both credit and debit side of two column cash book, before that transaction is known as

- A discount entry

- A credit entry

- Simple entry

- Contra entry

- For each of the items(i) – (v) match the descriptions of accounting concepts terms in Column A with their corresponding terms in Column B by writing the letter of the correct response beside the item number in the answer booklet provided.

| COLUMN A | COLUMN B |

|

|

SECTION B (40 MARKS)

Answer all questions in this section.

- (a)Complete the following table and show which accounts are to be debited and which accounts are to be credited.

(b)Source documents are detailed documents from which information to be entered in the Subsidiary book are extracted and because of these documents a business owner is able to track all daily transactions to be recorded in the books of prime entry Outline five (5) source documents used in book-keeping.

- (a)Sometimes accounting errors occur but not affect the agreement of a trial balance, mention four (four (4) errors which do not affect the agreement of a trial balance.

(b)Accounting records reports provide information to various interested parties (Users) and serve very useful purposes in the business. Identify six (6) users of accounting information.

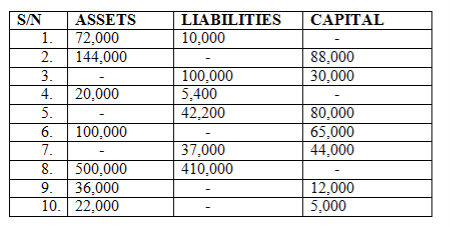

- By using ACCOUNTING QUATION, complete the following table

- Kulwa is a Star secondary school accounting expert who assist a school bursary office to perform bank reconciliation on 30th March 2022, he was issued with a cash book and a bank statement showing a closing balance of Tshs. 6,578,300/= and Tshs. 7,557,300/= respectively. In five (5) points mention the reasons of this difference to arise.

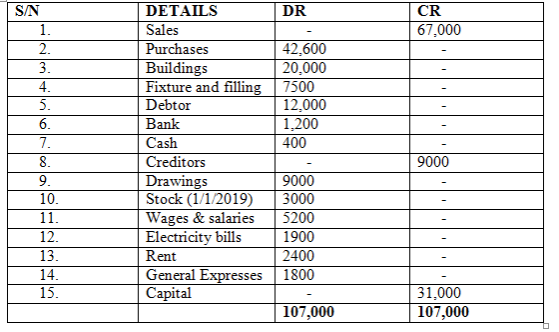

- From the following trial balance of Katundu, a sole trader extracted after one years of operations, prepare income statement for the year ended 30th June 2020 and statement of financial position as at 30th June 2020.

KATUNDU

TRIAL BALANCE AS AT 3OTH JUNE 2020

ADDITION INFORMATION

Closing stock (30/6/2020) was Tshs 5500/=

- ABC Co. ltd cash book showed the following balances on 31st March 2019

Cash column Tshs 28,000 (DR)

Bank Column Tshs 435,000 (CR)

The following transactions took place for the month of April.

April 2: received a cheque from Bongo in full settlement of his bill in Tshs. 450,000 less 3% cash discount.

April3: cash sales Tshs. 180,000/=

April 6: Received cash from Ndegu less 5% cash discount in settlement of his debt of Tshs. 650,000/=

April 6: Banked in the evening Tshs 730,000/=

April 14: Paid brazas Tshs. 712,000 by cheque in full settlement of his bill of Tshs 750,000/= as discount

April 16: Paid office cleaners half month salary in cash Tshs. 45,000

April 22: Cash sales amounted to Tshs. 112,000/=

April 25: made personal drawing by cheque Tshs 30,000/=

April 28: Draw a cheque for Tshs 40,000 for office use

Required: Prepare a three column cash book.

- While extracting a trial balance of MbatiCo.ltd as at 31st December 2008, it was observed that the total debit side exceeded the total credit ride by 23,800/= investigation through the year revealed the following

- TShs. 2200/= received from the debtor had been debited to his account ………….

- A payment of Chacha Tshs. 15,000/= had not been entered in his account ……….

- Sales had been over casted by Tshs 1500/= …………..

- A cash purchase of Tshs. 232/= had been recorded in the purchases account only but yet recorded in the cash Account. ……………..

- Returns outward account had not been credited with an amount of Tshs 6132/=

REQUIRED: Prepare the Journal entries to correct the above errors as well as the Suspense Account.

FORM TWO BKEEPING EXAM SERIES 120

FORM TWO BKEEPING EXAM SERIES 120

PRESIDENT’S OFFICE

REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

MID TERM ONE EXAMINATIONS

BOOK KEEPING

FORM TWO

062

TIME: 2:30 HOURS March 2022

![]()

Instructions

1. This paper consists of sections A, B and C with a total of seven (7) questions.

2. Answer all questions.

3. Section A and B carry twenty (20) marks each and section C carries sixty (60) marks.

4. All answers must be written in the spaces provided.

5. All writings must be in blue or black ink except for drawings which must be in pencil.

6. Calculators, cellular phones and any unauthorized materials are not allowed in the examination room.

7. Write Your Examination Number on the top right of every page.

| FOR EXAMINER’S USE ONLY | ||

| QUESTION NUMBER | SCORE | EXAMINER’S INITIALS |

| 1 |

|

|

| 2 |

|

|

| 3 |

|

|

| 4 |

|

|

| 5 |

|

|

| 6 |

|

|

| 7 |

|

|

| TOTAL |

|

|

| CHECKER’S INITIALS |

| |

SECTION A: (20 Marks)

Answer all questions in this section

1. For each of the items (i) - (x), choose the correct answer from among the given alternatives and write its letter in the box provided.

(i) What is the purpose of book keeping?

A. To interpret the double entry records

B. To prepare financial statements at a regular intervals

C. To record all the financial transactions of the business

D. To summarize the financial position of the business.

(ii) Which statement describes the purpose of trial balance?

A. It ensures the ledger accounts contain no errors

B. It indicates errors where errors have arisen

C. It checks the arithmetical accuracy of double entry

D. It prevents errors from occurring.

(iii) General ledger accounts that record incomes and expenses such as purchases, sales, wages and salaries: A.Real accounts

B. Personal accounts

C. General accounts

D. Nominal accounts.

(iv) Which statement describes development expenditure?

1. They are registered in the assets register of the government

2. They are the day-to-day running expenses of the government

3. They are assigned depreciation rate (if applicable)

A. 1 and 2

B. 2 only

C. 3 only

D. 1 and 3.

(v) The compulsory payments by individuals and firms to the government are of two categories:

A. Fines and penalties

B. Direct taxes and indirect taxes

C.Open taxes and closed taxes

D. Fees and dividends.

(vi) Why an income statement is prepared?

A. To account for the revenues and expenses of a period

B. To calculate the surplus or deficit of the organization

C. To list the ledger balances on a particular date

D. To summarize the business bank account.

(vii) Which account concept states that the business transactions must be separated from the personal transactions of the owner?

A. Historical cost

B. Going concern

C. Money measurement

D. Business entity.

(viii) The amount of cash or stock taken from the business by the owner for their personal use:

A. Expenses

B. Income

C. Drawing

D. Profit.

(ix) What is the going concern principle?

A. Accounting records are prepared assuming that the business will continue to operate in the foreseeable future

B. Income and expense should be accounted for in the same way they were accounted for in previous periods

C. Profit should not be anticipated and losses should be written off as soon as they are taken

D. Revenue and costs should be recognized as they are earned or incurred, not when the money is received or paid.

(x) Why would a Bank Manager look at trader’s financial statement?

A. To calculate how fast trade creditors were being paid

B. To check if the trader would be able to repay a loan

C. To find out if customers will receive continuous supplies

D. To know if inventory levels are too high.

2. Match the items in column A with the response in column B by writing the letter of the response besides the item number in the space provided:

|

| COLUMN A | COLUMN B |

| (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x) | A day book where all credit sales are first recorded A document issued by the business making a sale containing detailed information about the sale A day book where all credit purchases transactions are first recorded A book containing all the accounts of the credit customers of the business A day book used to record all goods sold that are returned to business A sale invoice viewed from the perspective of the business making the purchase A place where transactions are first recorded before they are posted to the ledger account A book containing all the accounts of the credit suppliers of the business A document issued by the business when accepting returns inwards A day book used to record all goods that are returned by the business to the original supplier | A. Sales ledger B. Purchases ledger C. General ledger D. Subsidiary books E. Purchases day book F. Purchases invoice G. Cash book H. Trade discount I. Cash discount J. Discount allowed K. Discount received L. Sales day book M. Sales invoice N. Returns inwards day book O. Credit note P. Returns outwards day book Q. Debit note. |

Answers:

| Column A | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) | (viii) | (ix) | (x) |

| Column B |

|

|

|

|

|

|

|

|

|

|

SECTION B: (20 Marks)

Answer all questions in this section

3. Kibonde, an accountant for Bee& Cee Company is very happy as he has just finished preparing the trial balance as at 31st March 2021 in which the debit column seems to agree with the credit column. However he has been told by assistant that the agreement of trial balance totals is not a proof that the trial balance is free from errors. Outline the possible mistakes (five) that may have been committed in Kibonde’s accounts (ledger)

(a) _______________________________________________________________

(b) _______________________________________________________________

(c) _______________________________________________________________

(d) _______________________________________________________________

(e) _______________________________________________________________

4. Show the account to be debited and credited in each of the following transactions:

| Items | Transactions | Account to be Debited | Account to be credited |

| i | Purchases of goods by cash |

|

|

| ii | Cash sales of goods |

|

|

| iii | Credit sales of goods to Kitetemo |

|

|

| iv | Purchases of goods from Mano |

|

|

| v | Banked cash |

|

|

SECTION C: (60 Marks)

Answer all questions in this section

5. The following trial balance was extracted from the books of Muha as at 30th September 2019.

![]()

Trial balance as at 30th September 2019

| Name of account | Dr-TZS | Cr-TZS |

| Capital ………………………………………… | ……………… | . 149,000 |

| Cash in hand …………………………………… | 12000 |

|

| Cash at bank …………………………………… | 110,000 |

|

| Stock (1.10.2018) ……………………………... | . 210,000 |

|

| Trade creditors ……………………………… | ………………… | 100,000 |

| Trade debtors ………………………………….. | 80,000 |

|

| Returns inwards ……………………………….. | 5,000 |

|

| Sales ………………………………………… | ………………… | 560,000 |

| Purchases ……………………………………… | . 205,000 |

|

| Salaries ………………………………………… | 40,000 |

|

| Water and electricity ………………………….. | 6,000 |

|

| Postage ………………………………………… | 2000 |

|

| Drawings………………………………………. | 9000 |

|

| Furniture and fittings …………………………. | 75,000 |

|

| Motor van …………………………………….. | 320,000 |

|

| Equipment ……………………………………. | 30,000 |

|

| Loan ………………………………………… | ………………… | 300,000 |

| Rent received ………………………………… | ……………….. | 12,000 |

| Office rent …………………………………….

| 17,000 | 1,121,000 |

| 1,121,000 |

Closing stock was valued at TZS 135,000.

Required:

(a) Prepare his income statement for the year ended 30th September 2019.

(b) Prepare his statement of financial position as on that date and clearly show the total assets, net assets and owner’s equity.

_

6.The bank column in the cash book for November 2004 and the bank statement for that month for Kamgunda are:

Cash book

| 2004 |

| TZS | 2004 |

| TZS |

| Nov 5 Pengo |

| 8,000 | Nov 1 balance b/d |

| 21,000 |

| Nov 14 Flora |

| 11,500 | Nov 4 Hassan |

| 7,400 |

| Nov 18 Renatus |

| 8,600 | Nov 21 Nova |

| 9,500 |

| Nov 24 Ummy |

| 19,000 | Nov 24 Boris |

| 16,700 |

| Nov 26 Yayale |

| 13,000 | Nov 30 balance c/d

|

|

|

| 60,500 |

| 2004 | Dr | Cr | Balance |

|

| TZS | TZS | TZS |

| Nov 1 Balance b/d |

|

| 21,000 (Dr) |

| Nov 9 Cheque | 7,400 |

| 28,400 (Dr) |

| Nov 11 Sundries |

| 8,000 | 20,400 (Dr) |

| Nov 12 Bank charges | 4,100 |

| 24,500 (Dr) |

| Nov 17 Standing orders | 7,500 |

| 32,000 (Dr) |

| Nov 18 Sundries |

| 11,500 | 20,500 (Dr) |

| Nov 20 Cheque | 9,500 |

| 30,000 (Dr) |

| Nov 27 Sundries |

| 8,600 | 21,400 (Dr) |

| Nov 29 Dividend |

| 6,400 | 15,000 (Dr) |

Required:

(a) Write up the cash book up to date and state the new balance as on 30th November 2004.

(b) Draw up a bank reconciliation statement as on 30th November 2004 starting with the balance as per adjusted cash book.

7.Bwana Fulani started business on 1st January 2021 to deal with cheap items with capital of TZS 500,000 in cash. He made the following transactions during the month of January.

Jan 2 Purchased goods for cash TZS 17,500

| Jan 12 | Sold goods for cash TZS 7,000 |

| Jan 16 | Sold goods to Jumong TZS 10,500 |

| Jan 19 | Bought goods from Lee TZS 12,000 |

| Jan 22 | Paid general expenses in cash TZS 2,000 |

| Jan 23 | Sold goods to Koboko TZS 15,000 |

| Jan 24 | Paid wages to all employees TZS 3,000 |

| Jan 26 | Paid cash to Lee TZS 12,000 |

| Jan 27 | Received cash from Jumong TZS 10,000 |

| Jan 29 | Paid TZS 3,000 for advertisement |

Required:

Enter the above transactions into the following accounts, balance them at the end of January and bring forward the balances on 1st February where necessary:

(a) Cash account

(b) Jumong account

(c) Koboko account

FORM TWO BKEEPING EXAM SERIES 93

FORM TWO BKEEPING EXAM SERIES 93

THE PRESIDENT’S OFFICE

MINISTRY OF EDUCATION, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

COMPETENCE BASED SECONDARY EXAMINATION SERIES

ANNUAL EXAMINATION

FORM TWO

BOOK KEEPING

062

TIME: 2:30 HOURS November, 2021

![]()

Instructions

1. This paper consists of sections A, B and C with a total of seven (7) questions.

2. Answer all questions.

3. Section A and B carry twenty (20) marks each and section C carries sixty (60) marks.

4. All answers must be written in the spaces provided.

5. All writings must be in blue or black ink except for drawings which must be in pencil.

6. Calculators, cellular phones and any unauthorized materials are not allowed in the examination room.

7. Write Your Examination Number on the top right of every page.

| FOR EXAMINER’S USE ONLY | ||

| QUESTION NUMBER | SCORE | EXAMINER’S INITIALS |

| 1 |

|

|

| 2 |

|

|

| 3 |

|

|

| 4 |

|

|

| 5 |

|

|

| 6 |

|

|

| 7 |

|

|

| TOTAL |

|

|

| CHECKER’S INITIALS |

| |

SECTION A: (20 Marks)

Answer all questions in this section

1. For each of the items (i) - (x), choose the correct answer from among the given alternatives and write its letter in the box provided.

(i) What is the purpose of book keeping?

A. To interpret the double entry records

B. To prepare financial statements at a regular intervals

C. To record all the financial transactions of the business

D. To summarize the financial position of the business.

(ii) Which statement describes the purpose of trial balance?

A. It ensures the ledger accounts contain no errors

B. It indicates errors where errors have arisen

C. It checks the arithmetical accuracy of double entry

D. It prevents errors from occurring.

(iii) General ledger accounts that record incomes and expenses such as purchases, sales, wages and salaries: A.Real accounts

B. Personal accounts

C. General accounts

D. Nominal accounts.

(iv) Which statement describes development expenditure?

1. They are registered in the assets register of the government

2. They are the day-to-day running expenses of the government

3. They are assigned depreciation rate (if applicable)

A. 1 and 2

B. 2 only

C. 3 only

D. 1 and 3.

(v) The compulsory payments by individuals and firms to the government are of two categories:

A. Fines and penalties

B. Direct taxes and indirect taxes

C.Open taxes and closed taxes

D. Fees and dividends.

(vi) Why an income statement is prepared?

A. To account for the revenues and expenses of a period

B. To calculate the surplus or deficit of the organization

C. To list the ledger balances on a particular date

D. To summarize the business bank account.

(vii) Which account concept states that the business transactions must be separated from the personal transactions of the owner?

A. Historical cost

B. Going concern

C. Money measurement

D. Business entity.

(viii) The amount of cash or stock taken from the business by the owner for their personal use:

A. Expenses

B. Income

C. Drawing

D. Profit.

(ix) What is the going concern principle?

A. Accounting records are prepared assuming that the business will continue to operate in the foreseeable future

B. Income and expense should be accounted for in the same way they were accounted for in previous periods

C. Profit should not be anticipated and losses should be written off as soon as they are taken

D. Revenue and costs should be recognized as they are earned or incurred, not when the money is received or paid.

(x) Why would a Bank Manager look at trader’s financial statement?

A. To calculate how fast trade creditors were being paid

B. To check if the trader would be able to repay a loan

C. To find out if customers will receive continuous supplies

D. To know if inventory levels are too high.

2. Match the items in column A with the response in column B by writing the letter of the response besides the item number in the space provided:

|

| COLUMN A | COLUMN B |

| (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x) | A day book where all credit sales are first recorded A document issued by the business making a sale containing detailed information about the sale A day book where all credit purchases transactions are first recorded A book containing all the accounts of the credit customers of the business A day book used to record all goods sold that are returned to business A sale invoice viewed from the perspective of the business making the purchase A place where transactions are first recorded before they are posted to the ledger account A book containing all the accounts of the credit suppliers of the business A document issued by the business when accepting returns inwards A day book used to record all goods that are returned by the business to the original supplier | A. Sales ledger B. Purchases ledger C. General ledger D. Subsidiary books E. Purchases day book F. Purchases invoice G. Cash book H. Trade discount I. Cash discount J. Discount allowed K. Discount received L. Sales day book M. Sales invoice N. Returns inwards day book O. Credit note P. Returns outwards day book Q. Debit note. |

Answers:

| Column A | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) | (viii) | (ix) | (x) |

| Column B |

|

|

|

|

|

|

|

|

|

|

SECTION B: (20 Marks)

Answer all questions in this section

3. Kibonde, an accountant for Bee& Cee Company is very happy as he has just finished preparing the trial balance as at 31st March 2021 in which the debit column seems to agree with the credit column. However he has been told by assistant that the agreement of trial balance totals is not a proof that the trial balance is free from errors. Outline the possible mistakes (five) that may have been committed in Kibonde’s accounts (ledger)

(a) _______________________________________________________________

(b) _______________________________________________________________

(c) _______________________________________________________________

(d) _______________________________________________________________

(e) _______________________________________________________________

4. Show the account to be debited and credited in each of the following transactions:

| Items | Transactions | Account to be Debited | Account to be credited |

| i | Purchases of goods by cash |

|

|

| ii | Cash sales of goods |

|

|

| iii | Credit sales of goods to Kitetemo |

|

|

| iv | Purchases of goods from Mano |

|

|

| v | Banked cash |

|

|

SECTION C: (60 Marks)

Answer all questions in this section

5. The following trial balance was extracted from the books of Muha as at 30th September 2019.

![]()

Trial balance as at 30th September 2019

| Name of account | Dr-TZS | Cr-TZS |

| Capital ………………………………………… | ……………… | . 149,000 |

| Cash in hand …………………………………… | 12000 |

|

| Cash at bank …………………………………… | 110,000 |

|

| Stock (1.10.2018) ……………………………... | . 210,000 |

|

| Trade creditors ……………………………… | ………………… | 100,000 |

| Trade debtors ………………………………….. | 80,000 |

|

| Returns inwards ……………………………….. | 5,000 |

|

| Sales ………………………………………… | ………………… | 560,000 |

| Purchases ……………………………………… | . 205,000 |

|

| Salaries ………………………………………… | 40,000 |

|

| Water and electricity ………………………….. | 6,000 |

|

| Postage ………………………………………… | 2000 |

|

| Drawings………………………………………. | 9000 |

|

| Furniture and fittings …………………………. | 75,000 |

|

| Motor van …………………………………….. | 320,000 |

|

| Equipment ……………………………………. | 30,000 |

|

| Loan ………………………………………… | ………………… | 300,000 |

| Rent received ………………………………… | ……………….. | 12,000 |

| Office rent …………………………………….

| 17,000 | 1,121,000 |

| 1,121,000 |

Closing stock was valued at TZS 135,000.

Required:

(a) Prepare his income statement for the year ended 30th September 2019.

(b) Prepare his statement of financial position as on that date and clearly show the total assets, net assets and owner’s equity.

___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

6.The bank column in the cash book for November 2004 and the bank statement for that month for Kamgunda are:

Cash book

| 2004 |

| TZS | 2004 |

| TZS |

| Nov 5 Pengo |

| 8,000 | Nov 1 balance b/d |

| 21,000 |

| Nov 14 Flora |

| 11,500 | Nov 4 Hassan |

| 7,400 |

| Nov 18 Renatus |

| 8,600 | Nov 21 Nova |

| 9,500 |

| Nov 24 Ummy |

| 19,000 | Nov 24 Boris |

| 16,700 |

| Nov 26 Yayale |

| 13,000 | Nov 30 balance c/d

|

|

|

| 60,500 |

| 2004 | Dr | Cr | Balance |

|

| TZS | TZS | TZS |

| Nov 1 Balance b/d |

|

| 21,000 (Dr) |

| Nov 9 Cheque | 7,400 |

| 28,400 (Dr) |

| Nov 11 Sundries |

| 8,000 | 20,400 (Dr) |

| Nov 12 Bank charges | 4,100 |

| 24,500 (Dr) |

| Nov 17 Standing orders | 7,500 |

| 32,000 (Dr) |

| Nov 18 Sundries |

| 11,500 | 20,500 (Dr) |

| Nov 20 Cheque | 9,500 |

| 30,000 (Dr) |

| Nov 27 Sundries |

| 8,600 | 21,400 (Dr) |

| Nov 29 Dividend |

| 6,400 | 15,000 (Dr) |

Required:

(a) Write up the cash book up to date and state the new balance as on 30th November 2004.

(b) Draw up a bank reconciliation statement as on 30th November 2004 starting with the balance as per adjusted cash book.

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ _____________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

7.Bwana Fulani started business on 1st January 2021 to deal with cheap items with capital of TZS 500,000 in cash. He made the following transactions during the month of January.

Jan 2 Purchased goods for cash TZS 17,500

| Jan 12 | Sold goods for cash TZS 7,000 |

| Jan 16 | Sold goods to Jumong TZS 10,500 |

| Jan 19 | Bought goods from Lee TZS 12,000 |

| Jan 22 | Paid general expenses in cash TZS 2,000 |

| Jan 23 | Sold goods to Koboko TZS 15,000 |

| Jan 24 | Paid wages to all employees TZS 3,000 |

| Jan 26 | Paid cash to Lee TZS 12,000 |

| Jan 27 | Received cash from Jumong TZS 10,000 |

| Jan 29 | Paid TZS 3,000 for advertisement |

Required:

Enter the above transactions into the following accounts, balance them at the end of January and bring forward the balances on 1st February where necessary:

(a) Cash account

(b) Jumong account

(c) Koboko account

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________

___________________________________________________________________________

FORM TWO BKEEPING EXAM SERIES 77

FORM TWO BKEEPING EXAM SERIES 77

THE PRESIDENT’S OFFICE MINISTRY OF EDUCATION, LOCAL ADMINISTRATION AND LOCAL GOVERNMENT

BOOKKEEPING- BACK TO SCHOOL EXAMINATION-JUNE

FORM TWO

Time 2:30 Hours JUNE 2020

INSTRUCTIONS.

- This paper consists of sections A, B and C with a total of seven (7) questions.

- Answer all questions.

- All writing must be in blue or black ink except drawing which must be in pencil.

- Calculators, cellular phones and any unauthorized materials are not allowed in the examination room.

- Write your Examination Number at the top right corner of every page.

SECTION A (20 Marks)

Answer all questions in this section.

1. For each of the items (i) – (x), choose the correct answer from among the given alternatives and write the letter in the box provided.

(i) The document used to deposit money in the bank account is known as

- Bank statement

- Pay in slip

- Invoice

- Payment voucher

(ii) Cash or goods taken out of business for private use are called

- Loan to owner

- Cash to owner

- Drawings by owner

- Property by owner

(iii) Which one should not be called sales?

- Goods sold in cash

- Goods sold on credit

- Sale of office fixtures

- Sales of items purchases.

(iv) Which of the following is a liability to a business?

- Loan from Hali safi

- Loan to Uncle

- Loan interest

- Loan repayment.

(v) Which of the following is correct about capital?

- Profit reduces capital

- Profit does not change capital

- Loss increase capital

- Profit increases capital

(vi) To which account is the total of the purchases returns journal transferred to?

- Returns outwards account credit side

- Returns outwards account debit side

- Returns inwards account credit side

- Returns inwards account debit side.

(vii) Which one of the following is not an asset to a business?

- Building

- Cash

- Creditors

- Debtors

(vii) Which of the following are personal accounts?

- Buildings and creditors

- Wages and debtors

- Debtors and creditors

- Wages and creditors.

(ix) In which account is the net profit of the business determined?

- Trading account

- Profit and loss account

- Cash account

- Bank account

(x) Which of the following is a ledger account?

- Profit and loss account

- Sales journal

- Trading account

- Cash account.

2. For each of the items (i) – (x), match the descriptions of the terms used in Book Keeping in List A with their corresponding names in List B by writing the letter of the correct response below the corresponding item number in the table provided.

| List A | List B |

| (i) The maximum amount of money an accounting officer can spend. (ii) The balance at any point in time remaining to the credit side of the exchequer account (iii) The Ministry which has been generally vested the task of accounting for all the government money. (iv) Any person who is appointed in writing to authorize the expenditures for specific items of expenditure. (v) Accounts for the basic services provided by the local authorities through the use of the general revenue. (vi) A group of people who are relate to each other and are entitled for government monetary benefits. (vii) A financial year of the government which starts on 1st July and ends 30th June of every year. (viii) Day to day expenses for executing operations of a government. (ix) Estimates to cater for the capital of long term projects of the government. (x) Government money for the benefit of all citizens in a country. |

|

SECTION B (20 Marks)

Answer all questions in this section

3. Mention five users of accounting information.

(i) ………………………………………………………………

(ii) ………………………………………………………………

(iii) ………………………………………………………………

(iv) ………………………………………………………………

(v) ………………………………………………………………

4. Briefly explain the following terms:

(a) Double entry book keeping system

(b) Account

……………… ……………………… ……… …………… …………………… ……………… ……………………

(c) Discount received

………………………………… …………………… ……… ……………………………… …………… …………………

(d) Debtors

…………… ……… ……………… ………… ………………… ……… …………… …………… ………………… …………… ………

(e) Current liabilities

……………………………… ………………… …………… ………… ……………… ……………… ……………………………………

SECTION C (60 Marks)

Answer all questions in t his section.

5. Enter the following balances and record the transactions for the month of April 2018 in the three column cash book of Mrs. Mwalongo, balance the cash book, and bring down the balances.

2018

April 1, Balance b/d TZS

Cash 11,000

Bank 38,500

Debtors:

L. Sempeo 16,000

L. Mushi 10,000

S. Sogodi 12,000

Creditors:

R. Fredy 12,000

L. Andrew 20,000

E. Sebogo 28,000

April 3, L. Mushi paid her account by cheque, after deducting 5 percent cash discount.

April 7, Mrs. Mwalongo paid amount owing to R. Fredy by cheque, less 2.5 percent cash account.

April10, withdrew TZS 15,000 cash from the bank for office use.

April 15, Mrs. Mwalongo sold goods worth TZS 24,000 on credit to L. Mushi.

April 17, L. Sempeo paid amount owing by cheque, les 2.5 percent cash discount.

April 20, Mrs. Mwalongo paid wages by cheque TZS 31,500.

April 22, Mrs. Mwalongo paid amount owing to L. Andrew by cheque, after deducting 5 percent cash discount.

April 25, S. Sogodi paid the amount owing by cheque, less 2.5 percent cash discount.

April 28, Mrs. Mwalongo paid the amount owing to E. Sebogo by cheque, after deducting 2.5 percent cash discount.

6. T. Thomas, a sole trader keeps his petty cash on the imprest system. The imprest amount is TZS 50,000. The petty cash transactions for the month of February 2017 were as follows:

2017

February 1, petty cash in hand TZS 4,670

February 1, Petty cash restored to imprest amount

February 3, paid wages TZS 8,760

February 7, purchased postage stamps TZS 2,940

February 10, paid wages TZS 9,110

February 14, purchased envelops TZS 2,280

February 17, paid wages TZS 8,840

February 20, paid cash to J. Mureithi a creditor, TZS 4,160

February 21, purchased stationary TZS 2,750

February 24, paid wages TZS 8,480

Record the given transactions in T. Thomas’s petty cash book for the month of February 2017 and show the restoration of the petty cash to the imprest amount as on 1st March 2017. Use the following analysis columns:

a) Wages

b) Stationery

c) Postage

d) Ledger

7. The following balances were extracted from the books of G. George for the year ended 31st December 2017. Use the information provided to prepare his statement of Financial Position as at 31st December, 2017.

Details TZS

Capital 200,000

Loan from K. China 50.000

Loan from Uncle 150,000

Sales 140,000

Furniture 50,000

Loan to Mwajuma 50,000

Buildings 50,000

Net profit 31,270

Land 50,000

Purchases 300,000

Drawings 25,400

Salaries 150,000

Bank overdraft 39,380

Wages 100,000

Creditors 90,200

Motor vehicle 50,000

Fixtures and Fittings 220,000

Stock 23,500

Debtors 41,950

Rent 20,000

FORM TWO BKEEPING EXAM SERIES 23

FORM TWO BKEEPING EXAM SERIES 23

THE MINISTRY OF EDUCATION AND LOCAL GOVERNMENT

FORM TWO MID TERM EXAMINATION- MARCH 2020

062 BOOK KEEPING

Duration: 2:30 Hours

INSTRUCTIONS.

- This paper consists of sections A, B and C with a total of seven (7) questions.

- Answer all questions.

- All writing must be in blue or black ink except drawing which must be in pencil.

- Calculators, cellular phones and any unauthorized materials are not allowed in the examination room.

- Write your Examination Number at the top right corner of every page.

SECTION A (20 Marks)

Answer all questions in this section.

(i) A list of debit and credit balances extracted from ledger is known as:-

- Extracts

- Transactions

- Trial balance

- Balance sheet.

(ii) Which of the following are not advantages of Trial Balance?

- Help in checking arithmetical accuracy of the ledger entry

- It shows personal Real and nominal a/c

- Used in preparation of final accounts

- Used for decision making by the owner and others.

(iii) ______ is not recorded in trial balance. It is shown in additional information.

- Opening stock

- Closing stock

- Assets

- Expenses

(iv) The two types of accounts are:-

- Nominal a/c and Real a/c

- Personal a/c Nominal a/c

- Personal and impersonal a/c

- Nominal and Real a/c

(v) Which of the following is not real account?

- Building a/c

- Furniture a/c

- Debtors a/c

- Stock a/c

(vi) A ledger comprises of customers accounts who bought goods on credit from business firm?

- General ledger

- Sales ledger

- Purchases ledger

- Private ledger

(vii) Which of these best describes a balance sheet?

- A account providing the book balance

- A record of closing entries

- A listing of balances

- A statement of assets.

(viii) The descending order in which current assets should be shown in the balance sheet in:-

- Stock, debtors, bank, cash

- Cash, bank, debtors, stock

- Debtors, stock, bank, cash

- Stock, debtors, cash, bank

(ix) Which of the following are personal accounts?

- Buildings and creditors

- Wages and debtors

- Debtors and creditors

- Wages and creditors.

(x) In which account is the net profit of the business determined?

- Trading account

- Profit and loss account

- Cash account

- Bank account

2. For each of the items (i) – (x), match the descriptions of the terms used in Book Keeping in List A with their corresponding names in List B by writing the letter of the correct response below the corresponding item number in the table provided.

| List A | List B |

|

|

Answers:

| List A | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) | (viii) | (ix) | (x) |

| List B |

|

|

|

|

|

|

|

|

|

|

SECTION B (20 Marks)

Answer all questions in this section

3. Mention five users of accounting information.

- ………………………………………………………………………………………..

- ………………………………………………………………………………………..

- ………………………………………………………………………………………..

- ………………………………………………………………………………………..

- ………………………………………………………………………………………..

4. Briefly explain the following terms:

(a) Double entry book keeping system

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

(b) Account

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

(c) Discount received

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

(d) Debtors

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

(e) Current liabilities

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

SECTION C (60 Marks)

Answer all questions in t his section.

5. On 31 Dec. 2007 the cash book balance of Kamwene was Tshs. 25,370. Whereas the bank statement should credit balance. The following were discovered.

- Cheques not presented for payment Tshs. 12,340/=

- Cheques paid into bank but not credited by the bank 12,340/=

- Items shown in the bank statement but not yet entered in the cash book.

- Bank charges 240/=

- Standing order 460/=

- Divided 850/=

Required to:

- Adjust the cash book to show the correct cash book balance

- Prepare a bank reconciliation statement starting with adjusted cash book balance.

6. Jackson commenced a business on 1st Jan. 2013. The following transactions were concerned:-

Jan. 1: commenced business with Tshs. 400,000 in cash

Jan. 2: purchase furniture by cheque 50,000

Jan. 3: purchased furniture by cash 300,000

Jan. 4: sold goods by cash Tshs. 40,000

Jan. 5: Paid electric bills by cheque 60,000

Jan. 6: paid advertising expenses 200,000

Jan. 7: paid wages 100,000

Jan. 8: sold goods paid by cheque 500,000

Jan. 21: paid transport by cash 60,000

Jan. 22: paid water bill by cheque 40,000

Jan. 23: sold goods by cheque 250,000

Jan. 24: bought goods by cheque 50,000

Jan. 28: bought goods by cash 40,000

Required to: Record the above transactions in two column cash book, balance off and bring down the balances.

7. Prepare the balance sheet from the following information

Capital 14,000

Net profit 6,000

Drawings 5,000

Creditors 2,000

Loan from NBC 12,000

Bank over draft 4,000

Machine 13,000

Motor vans 4,000

Furniture 2,500

Premises 5,300

Stock 1700

Debtors 1500

Cash at Bank 3,000

Cash in hand 2,000

FORM TWO BKEEPING EXAM SERIES 2

FORM TWO BKEEPING EXAM SERIES 2

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256