FORM ONE BKEEPING EXAM SERIES 228

FORM ONE BKEEPING EXAM SERIES 228

FORM ONE BKEEPING EXAM SERIES 216

FORM ONE BKEEPING EXAM SERIES 216

3.

3.

FORM ONE BKEEPING EXAM SERIES 210

FORM ONE BKEEPING EXAM SERIES 210

PRESIDENT OFFICE REGIONAL ADMINISTRATION

AND LOCAL GOVERNMENT

SECONDARY EXAMINATION SERIES

COMPETENCE BASED ASSESSMENT

FORM ONE

MID TERM EXAMS-AUG– 2023

062 BOOK-KEEPING

Time: 2:00 Hours August, 2023

Instructions

- This paper consists of sections A, B and C with a total of nine (9) questions.

- Answer all questions.

- Sections carries fifteen (15) marks and B carries forty (40) marks and Section C carries forty-five (45) marks.

- All writings must be in blue or black ink.

- All answers A must be written in the spaces provided.

- Programmable calculators, cellular phones and any unauthorized materials are not allowed in examination room.

SECTION A (15 Marks)

Answer all questions in this section.

- For each of the items (i) – (x), choose the correct answer from among the given alternatives and write its letter in the box provided:

- Form one students were arguing on which primary and basic objective of preparing a trial balance is. Which of the following uses is the basic purpose of preparing a trial balance?

- A trial balance is used as a tool for preparing financial statements

- A trial balance is used to check arithmetical accuracy of double entry

- A trial balance is used to present a list of balances at one place

- A trial balance is used to determine profit or loss of a business

- On 20th July, 2023, Nathan, a sole trader purchased a machinery for cash paying TZS 3,500,000/=. What would be a double entry for this transaction?

- Debit: Cash account, Credit: Machinery account

- Debit: Purchases account, Credit: Machinery

- Debit: Machinery account, Credit: Purchases account

- Debit: Machinery account, Credit: Cash account

- The debit side of the cash account is used to:

- Record amount received in the business

- Record amount of capital

- Record amount paid out of the business

- Recording amount of goods sold on credit

- What is meant by book keeping?

- An art of recording business transactions

- An art of recording cash transactions

- An art of recording bank transactions

- An art of recording credit transactions

- Which of the following is the objective of book keeping?

- Bridge the gap between buyer and seller

- Fair tax assessment

- Paying tax to the government

- Creation of employment

- Posting the transactions in book keeping means:

- Making the first entry of double entry transaction

- Entering items in cash book

- Making the second entry of a double entry

- Recording a transaction once

- ______________ are the books under which the transactions are entered before being posted to their respective ledgers.

- Accounts

- Subsidiary books

- Cash books

- Ledger books

- “A company does not include the value of skills gained by its employees from training programs in its financial records.” Which accounting concept is applied?

- Dual aspect concept

- Matching concept

- Money measurement concept

- Business entity concept

- A subsidiary book that records transactions that owing to their nature are inadmissible to any other book of prime entry is:

- General journal

- Sales day book

- Purchases journal

- Cash book

- _________ is a principle of book keeping which calls for “every business transaction must be recorded twice:

- Journalizing

- Double entry

- Posting

- Trial balance

- Match the items in Column A with the responses in Column B by writing the letter of the correct responses below the corresponding item number in the table provided:

| Column A | Column B |

|

|

SECTION B (40 Marks)

Answer all questions in this section.

- Complete the following table by identifying the account to be credited and debited as well:

| S/N | Transactions | Account to be debited | Account to be credited |

| i | Cash paid to Rahima |

|

|

| ii | A payment of rent by cash |

|

|

| iii | Sales of goods to Mtumzima |

|

|

| iv | Cash received from Julius |

|

|

| v | Purchased goods for cash |

|

|

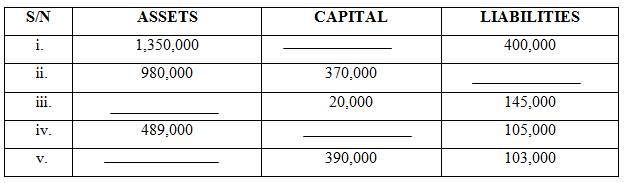

- Use the knowledge of accounting equation to fill in the gap in the following table

| S/N | ASSETS | CAPITAL | LIABILITIES |

| i | TZS 3,500,000 | TZS 1,700,000 | TZS __________ |

| ii | TZS ___________ | TZS 8,000,000 | TZS 4,100,000 |

| iii | TZS 4,900,000 | TZS _________ | TZS 2,100,500 |

| iv | TZS25,600,000 | TZS 17,900,000 | TZS __________ |

| v | TZS ____________ | TZS 15,500,000 | TZS 3,400,000 |

- Briefly describe the meaning of the following terms as used in book keeping

- Trial balance

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

- Book keeping

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

- Credit transaction

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

- Sales day book

________________________________________________________________________________________________________________________________________________________________________________________________________________________

- Capital

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

- Complete the table below by indicating whether the accounts are Nominal account, Real account or Personal account:

| S/N | Name of accounts | Classification |

| i | Building account |

|

| ii | Advertising account |

|

| iii | Noreen account |

|

| iv | Furniture account |

|

| v | Mtumzima enterprises account |

|

| vi | Capital account |

|

| vii | Motor car account |

|

| viii | Sales account |

|

| ix | Salaries and wages account |

|

| x | Abdul-Karim account |

|

SECTION C (45 Marks)

Answer all questions in this section.

- MTUMZIMA, a wholesaler, made the following credit purchases during the month of April 2023:

April 1. Bought goods on credit from Matheo Store:

10 Dozen of vitenge at TZS 80,000 a dozen

25 Dozen of khanga at TZS 100,000 dozen

April 5. Credit purchases from Joshua Suppliers:

12 Pairs of shoes at TZS 20,000 a pair.

20 Pairs of boots at TZS 30,000 a pair

April 12. Credit purchases from Emelda Shop:

70 Dozens of exercise books at TZS 30,000 a dozen

10 Reams of papers at TZS 25,000 each.

April 22: Credit purchases from Nuzart Book store:

20 Advanced leaner’s dictionaries at TZS 20,000 each.

80 Fiction books at TZS 5,000 each.

Record above transactions in the Purchases journal for the month of April 2023.

_____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

- On 1st Jan 2023, Brayden started a business with Capital TZS. 200,000 in cash:

TZS

Jan 2: Bought gods for cash __________________________ 25,000

Jan 3: Sold goods for cash ____________________________ 60,000

Jan 5: Purchased goods for cash _________________________20,000

Jan 8: Bought furniture for cash _________________________ 50,000

Jan 10: Paid advertising charges __________________________ 8,000

Jan 15: Sold goods for cash ______________________________ 72,000

Required:

Enter above transactions into a Cash Account, balance it and bring down the balance and complete a double entry

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________From the following list of balances of Mtumzima Traders, prepare a trial balance as at 31st March, 2023.

|

| TZS |

| Capital | 70,000 |

| Stock at 1.4.2022 | 25,000 |

| Purchases | 55,000 |

| Sales | 80,000 |

| Insurance | 2,500 |

| Sundry Debtors | 12,000 |

| Creditors | 26,100 |

| Rent | 12,000 |

| Wages and Salaries | 18,000 |

| Motor car | 15,000 |

| Furniture | 10,000 |

| Insurance | 10,500 |

| Commission received | 4,500 |

| Cash at Bank | 20,600 |

|

|

|

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Page 1 of 12

FORM ONE BKEEPING EXAM SERIES 146

FORM ONE BKEEPING EXAM SERIES 146

PRESIDENT OFFICE REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

BOOK - KEEPING - FORM ONE MID TERM TEST MARCH - 2023

TIME: 2:30HRS

INSTRUCTIONS

- This paper consists of sections A,B and C.

- Answer all questions.

- All writing must be in blue or black ink.

- Write your examination number (name) at the top wrote corner of every page.

SECTION A ( 20 MARKS)

1. For each of the items (i) – (x) choose the correct answer and write its letter in the box provided.

(i) The cash or goods taken out of the business for private uses are known as;

- Profit

- Loss

- Drawings

- Balance

(ii) Which of the following is the best definition of a trial balance?

- It shows the financial position of the business

- It is a list of balances on the book

- It shows all the entries in the books

- It is a especial account

(iii) A document issued to the customer whenever a customer returns goods to the supplier is

- An invoice

- A pro – forma invoice

- A debit note

- credit note

(iv) Which of the following is not ma book of original entry?

- Returns inwards journal

- Purchases journal

- Sales ledger

- Cash book

(v) The correct heading for a trial balance is;

- Trial balanced as at . . . . .

- Trial balance of . . . ...

- Trail balance for the period ended . .

- Trial balance of . . ... for the period ended . ...

(vi) Which of the following should not be called “purchases”?

- Items bought for prime purpose of resale

- Goods bought on credit

- Office stationary

- Goods bought for cash

(vii) Which of the following has a credit balance in the ledger?

- Carriage inwards

- Carriage outwards

- Returns inwards

- Returns outwards

(viii) Capital and drawings accounts are classified as;

- Personal accounts

- Nominal account

- Real accounts

- Proprietors accounts

(ix) The total of purchases Journal is entered on the

- Debit side of the purchases Journal

- Credit side of the bought Journal

- Debit side of the purchases account

- Debit side of the purchases returns account

(x) One of the following reasons allows the goods to be returned to the supplier.

- Expired goods

- Durable goods

- Consumable goods

- Perishable goods

2. Choose the correct term from group A which matches with the explanation in Group B and then write it against the number of the relevant explanation.

| GROUP A | GROUP B |

| (i) . . . . . . . . are unsold goods at any given date (ii) . . is a book of original entry for sales returns. (iii) . ... these are goods returned by customers (iv) . . . . refers to goods bought for resale (v) . . . ... means goods sold by a business previously bought for resale vi) Goods, returned to suppliers refers to . . ... vii) . . . . .Unsold goods at the beginning of the accounting period. (viii) . .refers to a book of original entry for purchases returns. (ix) It is a book of prime entry for credit sales ... (x) . . . . Is a book of original entry for credit purchases. |

|

3. Mention any five accounting concepts

SECTION B (20MARKS)

4. Complete the following table and show which accounts are t be debited and which are to be credited.

| Transactions | Accounts to be debited | Accounts to be credited |

| i) Cash sales ii) Credit sales iii) Sold goods for cash iv) Cash drawings v) Bought office furniture for cash |

SECTION C (60 MARKS)

5. From the following accounts balances prepare E.EMA’S Trial balance as at 31 December 2017.

| T.Sh | |

| Buildings | 14000 |

| Accounts receivable | 26000 |

| Returns outwards | 10,000 |

| Sales returns | 910 |

| wages | 10090 |

6. SOMA UFAULU and Co. stared business on 1st February 2018 with capital in cash sh 150,000

Other transactions were (Tsh)

| Feb 1 | Bought goods for cash | 20,000 |

| 2 | Credit purchases from katumba | 70,000 |

| 4 | Cash sales | 30,000 |

| 5 | Bought more goods for cash | 50,000 |

| 6 | Sold goods on credit to S. Mtoto | 50,000 |

| 9 | Paid wages | 10,000 |

Required to prepare a cash account, balance it and bring down the balance.

N.B: Other accounts not required.

FORM ONE BKEEPING EXAM SERIES 121

FORM ONE BKEEPING EXAM SERIES 121

THE PRESIDENT’S OFFICE MINISTRY OF EDUCATION, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

COMPETENCY BASED SECONDARY EXAMINATION SERIES

FORM THREE EXAMINATION

062 BOOK-KEEPING FORM ONE

![]() Time: 2:00 Hours 2022

Time: 2:00 Hours 2022

Instructions

- This paper consists of Section A, B and C with a total of seven (07) questions.

- Answer ALL questions.

- All writing must be in blue or black ink except all drawings which must be in pencil.

- All answers must be written in the spaces provided.

- All unauthorized materials are not allowed in the examination room.

SECTION A (15 Marks)

Answer all questions in this section.

- For each of the items (i) – (x), choose the correct answer from among the given alternatives and write its letter in the box provided:

- Goods returned to a business of TZS 40,000/= by Reginald are recorded in:

- Purchases journal

- Purchases return journal

- Sales journal

- Sales returns journal

- Anna and Nathan were arguing on the primary and basic objectives of recording and keeping accurate financial information of daily business transactions in the books of accounts. Which one of the following is the objective of book-keeping in a business?

- Bridge the gap between buyer and seller

- Fair tax assessment.

- Paying tax to the government

- Creation of employment

- The debit side of a cash book is used to_________

-

Record amount cash received in the business - Record amount of capital

- Record amount of cash paid out of the business

- Recording amount of goods sold or bought on credit

- The act of recording transactions in any subsidiary books is called ________

- Posting

- Book keeping

- Accounting

- Journalizing

- The column in the account which is used to record pages of reference in the books of accounts is called:

- Details

- Amount

- Folio

- Particulars

- Susan bought goods costing TZS 200,000 on credit from Luis Suppliers. Therefore, Susan is a:

- Supplier

- Creditor

- Debtor

- Seller

- A systematic recording of business transactions is called __________

- Book keeping

- Double entry

-

Record keeping - Posting

- The column where the description of a transaction is recorded in the books of accounts is called:

- Details

- Amount

-

Folio - Particulars

- Franklin wants to start up a business dealing with Clothing Wholesale Store, but he does not have enough capital to commence his business. The following can be used as the sources of capital for his business Except:

- Money borrowed from bank

- Money saved for business start up

- Money saved for building a private house

- Cash received from sale of a private car

- If the Assets of the business amounted to TZS 85,000/= and Capital is TZS 60,000/= How much is the amount of Liabilities of the business?

- TZS 45,000/=

- TZS 145,000/=

- TZS 25,000/=

- TZS 85,000/=

- Match the items in Column A with the responses in Column B by writing the letter of the correct response below the corresponding item number in the table provided.

| COLUMN A | COLUMN B |

|

|

| Column A | i | ii | iii | iv | v |

| Column B |

SECTION B (40 Marks)

Answer all questions in this section.

- Gailynn is an international businessperson who imports goods from various nations, last week she received two boxes of Electronic equipments from China. Upon serious investigation, she decided to return some of the equipments back to her supplier.

In five (05) outline the reasons for this to happen.

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- Mtumzima is a sole trader, owning a clothing wholesale store in Arusha. He is not knowledgeable of the source documents required to obtain the information which are used in preparation of the books of prime entry. Name five documents used as evidence of transactions in businesses.

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- Accounting conceptsare the fundamental rules, ideas and assumptions needed in accounting and book keeping. They are fundamental rules that must be followed while recording transactions in the books of accounts. A clear disclosure must be made in the financial records if these rules are not followed. List down five (05) accounting concepts used in book keeping.

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- ______________________________________________________________________

- Use the fundamental accounting equation to complete the table below:

SECTION C (45 Marks)

Answer all questions in this section.

- Gladness Suppliersmade the following credit sales during the month of March 2022.

March11: Sold to Diana Shop:

4 cartons of mango juice TZS 5,000/= each

6 cartons of apple juice TZS 4,000/= each

5 cartons of guava juice TZS 6,000/= each

March 22: Sold to Anneth traders:

10 pairs of socks TZS 3,000/= each

5 pairs of sandals TZS 10,000/= each

March 27: Sold to Felix Shop:

6 bags of wheat flour TZS 10,000/= each.

4 buckets of cooking oil TZS 20,000/= each

Required:

Record above transactions into a Sales day book and post to the respective ledgers.

- Rachel traders made the following transactions during the month of April 2022:

2022

1st April: Returns from Merry stores:

6 bags of salt @ 5,000, under weight

20 bags of sugar @ 7,500, expiry

10th April: Credit note from Nelson Suppliers:

5 boxes of cooking fats @ 17,000, Not suitable for consumption

10 pairs of sandals @ 65,000; wrong size

16th April: Sales returns from Dyness shop:

20 pairs of bed sheets @ 30,000, wrong colour

- T-Shirts @ 5,000; not up to sample ordered

Enter above transactions in the Sales returns day book.

- Princess, a wholesaler, made the following credit purchases during the month of April 2022:

April 1. Bought goods on credit from David Store:

10 Dozen of vitenge at TZS 8,000 a dozen

25 Dozen of khanga at TZS 10,000 dozen

April 5. Credit purchases from Joshua Suppliers:

12 Pairs of shoes at TZS 2,000 a pair.

20 Pairs of boots at TZS 3,000 a pair

April 12. Credit purchases from Dainess Shop:

70 Dozens of exercise books at TZS 3,000 a dozen

10 Reams of papers at TZS 15,000 each.

April 22: Credit purchases from Star Book store:

20 Advanced leaner’s dictionaries at TZS 2,500 each.

80 Fiction books at TZS 500 each.

Record above transactions in the Purchases journal for the month of April 2022.

Page 1 of 8

FORM ONE BKEEPING EXAM SERIES 107

FORM ONE BKEEPING EXAM SERIES 107

THE PRESIDENT’S OFFICE MINISTRY OF EDUCATION, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

BOOK - KEEPING - FORM ONE MID TERM TEST APRIL - 2022

TIME: 2:30HRS

INSTRUCTIONS

1. This paper consists of sections A,B and C.

2. Answer all questions.

3. All writing must be in blue or black ink.

4. Write your examination number (name) at the top wrote corner of every page.

SECTION A (20MARKS)

1. For each of the items (i) – (x) choose the correct answer and write its letter in the box provided.

i)The cash or goods taken out of the business for private uses are known as;

- Profit

- Loss

- Drawings

- Balance

ii) Which of the following is the best definition of a trial balance?

- It shows the financial position of the business

- It is a list of balances on the book

- It shows all the entries in the books

- It is a especial account

iii) A document issued to the customer whenever a customer returns goods to the supplier is

- An invoice

- A pro – forma invoice

- A debit note

- A credit note

iv)Which of the following is not ma book of original entry?

- Returns inwards journal

- Purchases journal

- Sales ledger

- Cash book

v) The correct heading for a trial balance is;

- Trial balanced as at ……………

- Trial balance of …………..

- Trail balance for the period ended……

- Trial balance of ……….. for the period ended ……..

vi) Which of the following should not be called “purchases”?

- Items bought for prime purpose of resale

- Goods bought on credit

- Office stationary

- Goods bought for cash

vii) Which of the following has a credit balance in the ledger?

- Carriage inwards

- Carriage outwards

- Returns inwards

- Returns outwards

viii) Capital and drawings accounts are classified as;

- Personal accounts

- Nominal account

- Real accounts

- Proprietors accounts

ix)The total of purchases Journal is entered on the

- Debit side of the purchases Journal

- Credit side of the bought Journal

- Debit side of the purchases account

- Debit side of the purchases returns account

x) One of the following reasons allows the goods to be returned to the supplier.

- Expired goods

- Durable goods

- Consumable goods

- Perishable goods

2. Choose the correct term from group A which matches with the explanation in Group B and then write it against the number of the relevant explanation.

| GROUP A | GROUP B |

| A. Purchases B. Sales C. Purchases returns D. Sales returns E. Inventory F. Inventory of close G. Inventory of start H. Purchases journal I. Sales journal J. Return outward journal K. Journal proper L. Returns inwards journal | i)…………………… are unsold goods at any given date ii) …… is a book of original entry for sales returns. iii)…….. these are goods returned by customers iv)………… refers to goods bought for resale v) ………….. means goods sold by a business previously bought for resale vi) Goods, returned to suppliers refers to ……….. vii) ……………Unsold goods at the beginning of the accounting period. viii) ……refers to a book of original entry for purchases returns. ix) It is a book of prime entry for credit sales….. (x)………. Is a book of original entry for credit purchases. |

SECTION B (20MARKS)

3. Mention any five accounting concepts

4. Complete the following table and show which accounts are t be debited and which are to be credited.

| Transactions | Accounts to be debited | Accounts to be credited |

| i) Cash sales ii) Credit sales iii) Sold goods for cash iv) Cash drawings v)Bought office furniture for cash |

|

|

SECTION C (60 MARKS)

5. From the following accounts balances prepare E.EMA’S Trial balance as at 31 December 2017.

| Motor vehicles | 28000 |

| Capital | 63000 |

| Purchases | 7000 |

| Cash in hand | 6000 |

| Sunday creditors | 19000 |

| Buildings | 14000 |

| Accounts receivable | 26000 |

| Returns outwards | 10,000 |

| Sales returns | 910 |

| wages | 10090 |

6. Wema and co. stared business on 1st February 2018 with capital in cash sh 150,000. Other transactions were

| Tsh | |

| Feb 1 Bought goods for cash | 20000 |

| 2 Credit purchases from katumba | 70000 |

| 4 Cash sales 5 Bought more goods for cash | 30000 50,000 |

| 6 Sold goods on credit to S. Mtoto 9 Paid wages | 50,000 10,000 |

Required to prepare a cash account, balance it and bring down the balance.

N.B: Other accounts not required.

FORM ONE BKEEPING EXAM SERIES 87

FORM ONE BKEEPING EXAM SERIES 87

THE MINISTRY OF EDUCATION AND LOCAL GOVERNMENT

FORM ONE MID TERM EXAMINATION- MARCH 2020

062 BOOK KEEPING

Duration: 2:30 Hours

INSTRUCTIONS.

- This paper consists of sections A, B and C with a total of seven (7) questions.

- Answer all questions.

- All writing must be in blue or black ink except drawing which must be in pencil.

- Calculators, cellular phones and any unauthorized materials are not allowed in the examination room.

- Write your Examination Number at the top right corner of every page.

SECTION A (20 Marks)

Answer all questions in this section.

1. Choose the most correct answer.

(i) Which of the following is not a reason why we study book – keeping?

- To balance income statement

- To determine profit.

- For business control

- For fair tax assessment.

(ii) A person to whom money is owned for goods and service is called?

- Debtor

- Investor

- Creditor

- Proprietor.

(iii) Identify a non current asset below.

- Motor van

- Bank balance

- Premises

- Land

(iv) Credit transaction are:

- Entries recorded on credit side of an account.

- Creditors transactions

- Transaction made for future payments.

- Transaction for credit note.

(v) Which statement below is not correct?

- Asset – Capital = Liabilities

- Liabilities + Assets = Capital

- Assets – Liabilities = Capital

- Liabilities + Capital = Assets.

(vi) Identify a liability below.

- Office furniture

- Creditor

- Debtors

- Cash and bank.

(vii) A business transaction is:

- Information related to buying and selling of goods and service.

- Art of keeping books of account.

- The movement of money or money worth from one person to another.

- None of the above.

(viii) An art of recording financial business transaction in a set of books and in terms of money or money worth is known as?

- Closing entries

- List of Assets and Liabilities

- Book - keeping

- Classification of Business transaction.

(ix) Accounting convention of prudence means.

- Accounting information should give full and fair information

- One method of accounting once chosen should be used consistently

- Financial accounts are drawn on conservative basis.

- Consider significant items only when preparing financial statement.

(x) In accounting, going concern means.

- Business is assumed to continue its operations indefinitely

- Accounting activities should be measurable in money terms.

- Enter transactions in book of account at amount actually involved.

- Treat business entity as separate from owner.

2. Match the items from list A with those in list B.

| LIST A | LIST B |

| (i) Loans which are repaid back for a period exceeding one year. (ii) Principle book of account required to record transaction by double entry system. (iii) Transaction is entered into book of account at amounts actually involved. (iv) Accounting is concerned with activities capable of being measured in monetary terms. (v) Revenue and expenses are recorded when they occur and not when cash is received or paid out. (vi) Reports should disclose fully and fairly the information they support to represent. (vii) Only significant items should be considered when preparing financial statements. (viii) Financial account is drawn up rather on conservation basis. (ix) Recognition of all aspects of accounting principle. (x) Legal activity or activities undertaken by a person or a firm. |

|

3. (a) Define the following terms.

(i) Accounting

(ii) Book – keeping

(iii) Capital

(b) Explain four objectives of book – keeping

4. (a) Differentiate assets from liability.

(b) Mention and explain two types of Transaction.

(c) Mention advantages of business control.

5. Complete the table below

| Transactions | Account to be debited | Account to be credited |

| a) Received cash from Debtors |

|

|

| b) Paid creditors by cheque |

|

|

| c) Bought office machinery on credit |

|

|

|

d) Paid Jonas by cheque |

|

|

| e) Putting additional capital by cheque |

|

|

6. Baba Songambele started a business on 1st Jan 2013 with capital worth Tshs. 500,000/= during the month of January 2013 the following transaction took place

January 3 purchased goods for cash 80,000/=

January 4 Bought painting materials for cash 80,000/=

January 5 Sold goods for cash 30,000/=

January 6 bought goods for cash 80,000/=

January 8 purchased goods paid cash 10,000/=

January 10 bought goods for cash 50,000/=

January 11 paid wages for cash 5,000/=

Required to: By using double entry principle records the above transactions in cash book and complete the double in respective ledger accounts.

7. The following information was obtained from the books of Kijana on Feb 2015.

February 1 Kijana started business with cash in hand 200,000/=

February 2 Purchases building for cash 15,000/=

February 3 bought goods for cash 12,000/=

February 4 bought machine for cash 5,000/=

February 7 paid rent for cash 10,000/=

February 8 received cash from Debtors 20,000/=

February 10 paid creditors by cheque 15,000/=

February 18 bought postage stamp for cash 40,000/=

February 21 cash sales 1,700,000/=

February 22 bought goods for cash 1,200,000/=

Required to record the above transaction using double entry principle, balance off the accounts and bring down the balances.

FORM ONE BKEEPING EXAM SERIES 5

FORM ONE BKEEPING EXAM SERIES 5

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256