TOPIC 1

MANUFACTURING ACCOUNTS.

Manufacturing accounts are accounts prepared by organization engaged in manufacturing of goods or services. It means organization buys raw materials and convert that raw materials into finished goods. The finished goods are then sold in the market.

THE PURPOSE OF MANUFACTURING ACCOUNTS ARE:-

- To find the cost of goods manufactured

- To calculate the amount of any profit realized in the manufacturing process.

FEATURE OF MANUFACTURING ACCOUNTS

1) Price cost: This is cost of raw material consumed, direct wages and any other direct expenses.

2) Factory cost: These are indirect expenses which are incurred it includes: salaries, factory power, rent, rates insurance, depreciation of plants.

3) Working progress: This is the cost of those items which remain incomplete at the end of accounting period. The difference between work in progress W/P at start and work in progress at the W/P at the end is added to factory cost.

Factory profit:- Goods manufactured during the period are transferred to the trading account. These may be transferred as under:

a) At the actual factory cost (factory cost of goods manufactured) In this case will, DR. Trading account, CR. Manufacturing account.

b) At the market value are inflated price. In this case the goods manufactures are transferred at a specific price which include the factory cost and profit on manufacturing process. This profit is called manufacturing margin or profit.

In this case we DR. Manufacturing account and CR. Profit and Loss account.

FORMAT OF MANUFACTURING ACCOUNT STATEMENT.

KBC Manufacturing statement for the year ended 31 Dec, XXX

Stock of R.M at start XX

Add Purchases of R.M XX

Add carriage inward of R.M XX

Less return outward of R.M XX

Less stock of R.M at the end XX

COST OF RAW MATERIALS USED XXX

Add direct wages XX

Add direct expenses XX

PRIME COST (XXX)

Factory overhead expenses

Fuel and power XX

Wages XX

Lubricants XX

Rent XX

Depreciation of plants XX

Factory cost XX

Add W/P at start XX

Less W/P at close (XX)

COST OF GOODS MANUFACTURED (XXX)

Example:- KBC had the following information.

1st January, 1997 stock of raw materials 8,000

31st December, 1997 stock of raw materials 10,500

1st January, 1997 W/P 3,500

31st December, 1997 W/P 4,200

Wages. Direct 39,600

Indirect 25,500

Purchases of raw materials 87,000

Fuel and power 9,900

Direct expenses 1,400

Carriage inward R.M 2,000

Rent and Rates of factory 7,200

Depreciation of factory plant 4,200

General factory expenses 9,600

Required: Prepare manufacturing statement account at 31 December, 1997 for KBC.

Solution:

KBC MANUFACTURING ACCOUNT/STATEMENT AT 31DECEMBER, 1997.

Opening stock R.M 800

Add purchases 87,000

Carriage inwards 2000

97,000

Less stock R.M at end (10,500)

COST OF RAW MATERIAL CONSUMED 86,600

Direct wages 39,600

Direct expenses 1400

PRIME COST 127,500

Factory overhead expenses

Fuel and power 9,900

Indirect wages 25,500

Rent and rates 7,200

Depreciation of plant 4,200

General expenses 9,600

183,900

Add W/P at start 3,500

187,400

Less W/P at close (4,200)

COST OF GOODS MANUFACTURED 183,200

FORMAT FOR TRADING ACCOUNT OF MANUFACTURING ACCOUNT

Opening stock finished goods XX Sales XX

Add Cost of goods manufactured XX Return in ward XX

Less: Closing stock of finished goods XX Net sales XX

COST OF GOODS SOLD XXX

GROSS PROFIT c/d XXX

XXX XXX

FORMAT FOR TRADING PROFIT AND LOSS ACCOUNT FOR MANUFACTURING ACCOUNT.

Opening stock finished goods XX Sales XX

Add: Cost of goods manufactured XX Return inward XX

Less: Closing stock of finished goods XX Net sales (XXX)

Cost of goods sold XXX

Gross profit c/d XX

Expenses Gross profit b/d XX

Advertisement XX

Insurance XX

Transport XX etc.

Net profit XXX

XXX XXX

Example:

From the following details extruded from the books of Amanda prepare the manufacturing trading profit and loss account for the year ended 31 December, 2012

1st January, 2012 Raw materials 18,410

Finished goods 56,970

Purchases of raw materials 138,430

Direct expenses 9,140

Sales of finished goods 597,560

Factory power – Light and heat 8,930

Office power – light and heat 960

Rate (  factory,

factory,  office) 5,550

office) 5,550

Insurance (  factory

factory  office) 700

office) 700

Carriage on raw materials 970

Carriage on sales 2,890

Direct wages 147,480

Office 17,800

Salesman 24,350

Indirect salaries (factory) 48,000

Administration salaries 22,000

Commission salesman 47,140

Depreciation machinery 31,500

Furniture 860

Advertising 25,500

Stock 31 December,

Raw materials 16,980

Finished goods 51,860

Example 2.

1 Jan. 1997 stock of raw materials 8,000

31 Dec. 1997 stock of raw materials 10,800

1 Jan. 1997 Work in Progress 3,500

31 Dec. 1997 Work in Progress 4,200

Wages Direct 39,600

Indirect 25,500

Purchase of raw – materials 87,000

Fuel and power 9,900

Direct expenses 1,400

Carriage inward on raw materials 2,000

Rent and rates of factory 7,200

Depreciation of factory plant and machinery 4,200

General factory expenses 9,600

Prepare Manufacturing a/c

MANUFACTURING TRADING AND PROFIT AND LOSS a/c OF BWIKA LTD. ON DEC. 31. 1997.

Stock at January, 1997 184,500

Work in progress 236,000

Finished goods 174,700

Purchases raw materials 643,000

Carriage on raw materials 16,050

Direct labour 658,100

Office salaries 169,200

Rent and rates 27,000

Office lighting and air condition 57,600

Depreciation works machinery 83,000

Office equipment 19,500

Sales 2,006,000

Factory fuel and power 59,200

Rent and rates are to be apportioned

Factory  office

office

31 Dec. 1997 stock of raw materials 202,100

Work in progress 173,900

Finished goods 214,850

Example:

30 Dec. 1993 1994

Stock of raw materials at cost 84,600 109,700

Work in progress 30,700 24,600

Finished goods stock 123,800 145,200

Raw materials purchased 387,200

Manufacturing wages 209,700

Factory expenses 126,500

Depreciation

Plant and machinery 75,600

Delivery vans 30,400

Office equipments 8,070

Factory power 61,200

Advertising 50,800

Office and administration expenses 59,100

Sales men’s salaries and expenses 64,200

Delivery van expenses 58,900

Sales 1,346,100

Carriage inwards 27,200

TOPIC 2

CONSIGNMENT ACCOUNTS

Nature of consignment:

It is common for trader to sells goods directly to customers when they are within or outside the country these are ordinary sells.

But when traders send goods to an agent to sell them for him, these goods are said be sent on consignment.

Common terminologies:-

a) Consignment of goods: Is the sending of goods by the owner the (consignor) to his agent (consignee) who agrees to collect store and sell the goods on behalf of the owner.

b) Consigner: The owner or person who send goods on consignment.

c) Consignee: an agent who sell goods on behalf of owner with anticipation of getting commission.

d) Delcrelere commission: Is an additional commission paid to an agent who guarantees the debts incurred by customers supplied by him. This is the form of credit insurance to consigner.

e) Pro – foma invoice: Is an invoice sent to a customer who is required to pay for goods before they are delivered to him or her. It is used when the supplier does not know the credit worthiness of customer. In consignment means a value to be used for overseas custom purposes or minimum selling.

f) A consignment account: Is a combined trading profit and loss account related solely to the consignment.

Below is the format of consignment account.

DR Consignment account CR

| Cost of goods xx Transport cost xx Agent disbursement Import duties xx Dock charges xx Warehouse rent xx Distribution expenses xx Commission xx Net profit xxx | Sales xx |

| xxx | xxx |

FEATURES OF CONSIGMENT.

- The consigner send goods to consignee. The goods do not belong to consignee (agent) his job is to sell the goods.

- Consignee store the goods until they are sold by him.

- Consignee will receive the commission from consignor for his work.

- The consignee will called money from his/her customers to whom he/she sells the goods. He / she will pay this over to the trader after deducting his/her expenses and commission. The statement from agent / consignee to consignor showing these is known as account of sales.

Consignment account is common to overseas trade.

Accounting for consignment.

Goods consigned and Expenses paid by the consigner.

- Goods consigned

DR. Consignment a/c

CR. Goods sent on consignment a/c

- Expenses paid

DR. Consignment account

CR. Cash book.

EXPENSES OF AGENT (Consignee) AND SALES RECEIPTS.

When the sales have been completed the consignee will send account of sales to the owner/consignor.

Bellow is format of account of sales.

Sales XX

Less: Expenses XX

Commission XX

XXX

Balance how paid XXX

Double entry record:

(i) Sales

DR. Consignee a/c

CR. Consignment a/c

(ii) Expenses of Consignee

DR. Consignment a/c

CR. Consignee a/c

(iii) Commission of consignee.

DR. Consignment a/c

CR. Consignee’s a/c

(iv) Cash received from consignee

DR. Cash

DR. Consignee a/c

Example.

Clarisa of Sweden whose financial year ends 31 Dec. consigned goods to Omolo his Agent in Nairobi on 16th Jan. 2012. Clarisa purchased the goods for Shs. 500,000/= and had paid shs. 50,000/= on 28.02 for carriage and freight to Nairobi. Omolo paid shs. 25,000 import duty and shs. 30,000/= distribution expenses. He sold the goods for shs. 750,000/= He deducted his disbursement at the rate of 6% of the sales.

On April 2012 he remitted the balance to Clarisa.

Required: Show the necessary accounts and account of sale.

Soln:

DR Consignment to Omolo (Nairobi) a/c CR

| Goods sent on consignment 500,000 Carriage and freight 50,000

Import duty 25,000 Distribution expenses 30,000 Commission on sale 45,000 Profit and loss 100,000 | Sales 750,000 |

| 750,000 | 750,000 |

DR Goods sent on consignment a/c CR

| Trading a/c 500,000 | Consignment to Omolo 500,000 |

DR Omolo a/c CR

| Sales 750,000 | Import duty 25,000 Distribution cost 30,000 Commission 45,000 Bank 650,000 |

| 750,000 | 750,000 |

DR Profit and Loss on consignment a/c CR

| General P & L a/c 100,000 | Consignment to Omolo 100,000 |

Sales a/c

Sales 750,000

Less: Agent disbursements

Import duty 25,000

Distribution costs 30,000

Commission 40,000 100,000

Bank sight draft 650,000

Example:

John of London whose financial year ends on 31 Dec. consigned goods to Adams his agent in Canada. All transactions were started and completed in 1998.

16th Jan. John consigned goods costing Tshs. 500,000/= to Adams

Adam sends the account of sale on 31st July when all the goods have been sold with the following details.

- Sales amounted Tshs. 750,000/=

- Adam expenses:- Import duty Tshs. 25,000/=

- Distribution expenses Tshs. 30,000/=

- Commission of 6% of Tshs. 45,000/=

- Balance owing Tshs. 650,000/=

INCOMPLETE CONSIGNMENT.

The above example have looked at consignments which all goods were sold by the agent before the end of financial year. Sometime this is not the case. i.e. consignee may still have unsold goods at the end of financial year, this is called incomplete consignment at the date of balance sheet.

In this case the value of unsold consignment should be determined and recorded in balance sheet as current asset. On other hand it should appear in the consignment to agent credit side.

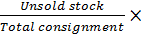

HOW TO CALCULATE THE VALUE OF ICOMPLETE CONSIGNMENT.

- Find or determine the proportion of unsold stock e.g. 20% or 10 cases out 100.

- Calculate the total costs of consignment by consignor. This includes costs of consignment plus cost incurred by consignor to deliver goods to consignee.

- Take total costs incurred by consignee, excluding sales and distribution costs like commission and bad debts.

- Then take proportion of unsold stock multiply by total cost above.

i.e.

(Total costs by consignor + costs by consignee excluding distribution and selling expenses and commission.

(Total costs by consignor + costs by consignee excluding distribution and selling expenses and commission.

Example:

Brown of London consigned 300 cases of soap @ 1200 to Green of Canada on 10th Jan. 2004. On 25th Dec. 2004 Green forwarded an account sales with a draft for the balance showing the following transactions.

- 250 case sold for 590,000

- Forty and duty charges 72,000

- Storage charges 41,000

- Commission sales 5% + 1% delcredere.

Additional information.

Consignor incurred 100,000 for insurance and 27,000 for freight when goods sent to Green.

Required: Prepare the consignment outwards show the profit on consignment.

Solution:

DR. Consignment outward a/c CR

| To trading a/c 360,000 | Goods to Green (300 |

| 360,000 | 360,000 |

DR Consignment to Green in Canada a/c CR

| Consignment outward 360,000 Bank: Insurance 100,000 Freight 27,000

25 Dec. Green Import duty 720,000 Storage charge 41,000 Commission 5% 29,000 Delcredere 1% 5,900 | Sales proceeds 590,000 Add: unsold stock c/d 60,000 Expenses 40,000 = 100,000 |

| 690,000 | 690,000 |

| Jan. 1 2005 Bal. of stock 100,000 |

|

DR Green a/c CR

| 25 Dec. consignment Sales |

590,000 | Consignee expenses Port and duty 72,000 Storage charge 41,000 Commission 5% + 1% 35,400 Bank draft 441,600 |

|

| 590,000 | 590,000 |

Workings:

(i) Expenses on unsold stock

=  Total expenses excluding selling expenses, commission and distribution cost.

Total expenses excluding selling expenses, commission and distribution cost.

i.e.

(100,000 + 27,000 + 41,000)

(100,000 + 27,000 + 41,000)

=

240,000 = 40,000

240,000 = 40,000

(ii) Unsold stock value = No of unit Unsold  cost price per unit

cost price per unit

= (300 – 250)  1,200

1,200

= 50  1,200

1,200

= 60,000

EXERCISE:

- Define consignment and explain the feature of consignment.

- Define the following terms:-

? Consignment

? Consignee

? Consignor

? Pro foma invoice

? Delcredere commission

- What is the relationship between consignor and consignee

- How does consignment differ from sales

- A consignee sold goods for Tshs. 400,000/=. His commission is 5% and expenses of 20,000/=. Prepare the account of sales.

- On 15 Nov. 2013 Chagula consigned 300 cases of Wooden goods to Jerome of Bukoba. On 31 Dec. 2013 Jerome forwarded an account of sales with a draft for the balance showing the following transactions

? 250 cases sold at 2,000 and 50 cases sold at 1800 @

? Port duty charges Tshs. 72,000/= storage and carriage charges Tshs. 41,000/=

? Commission on sales 5% + 1% Delcredere.

Required:- Prepare account of sales.

Show the consignment inward account in the books of Jerome.

- On 8th Feb 2013 Joshua consigned 120 cases of goods to Michael. The cost of goods was Tshs. 12,500/= a case. Joshua paid carriage to the port Tshs. 14,700/= and insurance Tsh. 9,3000/=. On 31 March 2013, Joshua received account of sales from Michael showing that 100 cases has been sold for Tshs. 350,000/= Michael paid freight at the rate of Tshs 200 a case and port charges amounting Tshs. 18,600/= on the same date. Michael was entitled to a commission of 5% or sales. A sight draft for net amount due was enclosed with the account sales.

Required to:-

(i) Prepare books sent on consignment account

(ii) Consignment to Michael account

(iii) Consignment account

(iv) Account of sales.

TOPIC SIX

PARTNERSHIP

Partnership is the long term commitment or two or more people joined together operate in business to make profit. People who own partnership are called partner/s

They do not have to be based or work in the same place, though most do;

However they maintain one set of accounting records and share profit and losses in agreed ratio.

NATURE OF PARTNERSHIP

? Partnership has the following characteristics

? It is formed to make profits

? It must obey the law as given in partnership act.

? Have minimum of two and maximum of twenty partners.

? Partners who are not limited partners are known as general partners.

? Except for limited partner each partner is liable to partnership debt.

? Have partnership deed/agreement.

TYPES OF PARTNERSHIP

a) Unlimited partnership

b) Limited partnership

For partnership to be formed there must be prior agreement between the partners or partnership deed

CONTENT OF PARTNERSHIP DEED OR AGREEMENT.

? Partnership agreement / deed contain the following information.

? The capital to be contributed by each member

? The ratio to which profit or losses will be shared

? Rate of interest if any to be charged to partners drawings.

? Salaries to be paid to partners

? Arrangement/conditions for admission of new partners

? Procedures to be carried out when a partner retired or dies.

? Name address and location of partnership

? Name address and occupation of partners.

? Aim and objectives of partnership

Note: In case partnership in formed without partnership deed the partnership act will apply information, in partnership act include:-

? No interest on drawings

? No interest on capital

? Profit or loss should be shared

? 5% interest to loan made to partners.

ADVANTAGES OF PARTNERSHIP

a) It is easy to form

b) Contribution of capital is easily done by the partners.

c) Better decision are made since they are contributed by each partners

d) The losses are shared among partners.

e) Partnership enjoy freedom as there is minimum interference from the government.

DISADVANTAGES OF PARTNERSHIP.

a) Most of business partner have unlimited liabilities i.e. partners personal property may be used to offset the business debt.

b) Profit are share this reduce amount that could be earned by one partner.

c) Continuous misunderstandings and disagreements among the partners may lead to dissolution of the partnership business.

d) Slow decision making because every partners has to be consulted before reaching final decision.

e) I ease of one partner messes the other partners will suffer the consequence since they will be forced to contribute toward the mess.

f) Capital may fail to expand since the only source of capital in partners.

g) It lack perpetual existence since each partner may lead to dissolution of the business.

MAIN TYPES OF ACCOUNTS IN PARTNESHIP

(i) Trading profit and loss accounts.

(ii) Appropriation account

(iii) Partner’s current account

(iv) Partner’s capital account

(v) Partners balance sheet, trading account.

There is no difference in preparing the trading, profit and loss account of a partnership and of any other business. Everything is treated the normal way. The aim of preparing trading profit and loss is to determine the gross profit and later the net profit or net loss attained in a given period of time.

APPROPRIATION ACCOUNT

- This account is prepared to divide the net profit obtained from the partnership business among partners as specified in partnership agreement.

Format two partner X and Y

DR Partnership appropriation a/c CR

| Interest on capital X XX Y XX Interest on loan XXX Salary XXX Commission XXX Goodwill written off XXX General reserve XXX | Net profit XXX Interest on charges XXX X XX Y XX Dividends XXX |

| XXXX | XXX |

FORMAT FOR PARTNER’S CURRENT ACCOUNT.

| Date | Detail | X | Y | Date | Details | X | Y |

|

| Interest on drawing

Drawing | xx

xx | xx

xx |

| Interest on capital Interest on loan Salary Commission Share of profit | xx

xx

xx xx xx | xx

xx

xx xx xx |

FORMAT OF BALANCE SHEET.

Capital a/c

X XX

Y XX

Current accounts X Y

Interest on capital xx xx

Share of profits xx xx

Salary xx xx

xxx xxx

Less: Drawings xx xx

Interest on drawing xx xx

Example

Partnership between Juma and Bura.

Capital

Juma 2,000

Bura 1,000

Profit sharing ratio  :

:

| Year | 1 | 2 | 3 | 4 | 5 | Total |

| Net profit Tshs. | 1800 | 2400 | 3000 | 3600 | 3600 |

|

| | 1200 | 1600 | 2000 | 2000 | 2400 | 9200 |

| | 600 | 800 | 1000 | 1000 | 1200 | 4600 |

Interest on capital is deldeclered prior to the calculation of profit. Interest on capital in the agreement among the partners but should be equal the return which they would have revealed it they had invested the capital elsewhere.

Example:

If Juma and Bura agree to share profit equally after deducting 5% interest on capital the division of profits would become.

| Year | 1 | 2 | 3 | 4 | 5 | Total |

| Profit Tshs. | 1800 | 2400 | 3000 | 3000 | 3600 | 13,800 |

| Interest on capital |

|

|

|

|

|

|

| Juma | 100 | 100 | 100 | 100 | 100 | 500 |

| Bura | 50 | 50 | 50 | 50 | 50 | 250 |

| Remainder share profit |

|

|

|

|

|

|

| Juma | 825 | 1125 | 1425 | 1425 | 1725 | 6,525 |

| Bura | 825 | 1125 | 1425 | 1425 | 1725 | 6,525 |

Summary Juma Bura

Interest on capital 500 250

Balance of profit 6525 6525

7,025 5,775

- Juma has received Tshs. 250 more than Bura this being adequate return (if the partners estimation) for having invested an extra Tshs. 1000 in the firm for five years.

Interest on Drawings.

Cash withdrawn from the firm by partner follow two basic principles

? As little as possible

? As late as possible.

This is because the more cash that is left in the firm the more expansion can be financed, the greater the economics of having ample cash to take advantages of bargains and not missing cash discounts because cash is not available and so on.

To reduce the chances of drawing interest on drawing. Calculated from the date of withdrawal to the end of financial year was introduced. Interest charged are used to increase the amount of profit divisible between partners.

The rate of interest is agreed among partners must be sufficient but not too harsh.

Example

Juma and Bura interest on drawing was 5%. Juma and Bura made the following drawings.

Juma Interest

1st Jan. 1000 1000

12 = 50

12 = 50

1st March 2400 240

10 = 100

10 = 100

1st May 1200 120

8 = 40

8 = 40

1st July 240 240

6 = 60

6 = 60

1st October 800 800

3 = 26

3 = 26

Bura Interest

Drawings Tshs.

1st Jan. 600 600  5%

5%  12 month = 30

12 month = 30

1st August 4800 4800  5%

5%  5 month = 100

5 month = 100

1st December 2400 2400  5%

5%  1 month = 10

1 month = 10

140

Salaries to Partners.

It a partners will directly work in partnership will be castled to salary which will be deducted before sharing the balance of profit.

Performance related payments to partners.

If there is any bonus or commission related to partners etc. also deducted before sharing profit.

Example:

X Y and Z are in partnership. They agreed to share profit and losses according the proportion of their capital. They agreed the 8% interest on capital and interest on drawings. 10% per annum.

Z entitled salary of Tshs. 75,000/= per annum and 2% commission on the net profit after charging the salary but before charging interest on capital.

Partners capital on Jan. 2012 were as follows.

X Y Z

100,000 200,000 500,000

Current accounts on 1st January 2012 were as following:-

X Y Z

25,000 CR 5,000 CR 10,000 DR

Drawings

30 June 2012 X Tshs. 130,000

28 February 2012 Y Tshs. 90,000

31 December 2012 Z Tshs. 120,000

Net profit for the year ended 31 December 2012 was Tshs. 365,000.

Required to:-

a) Prepare profit and loss appropriation account

b) Partners current account in columnar form

c) Balance sheet

(a) Solutions:

DR X, Y and Z profit and loss appropriation a/c CR.

| Interest on capital X 8,000 Y 16,000 Z 40,000 64,000 Salary to Z 75,000 Commission 5,800 Share of profit X 29,300 Y 58,600 Z 146,300 234,200 | Net profit 365,000 Interest on drawings X 6,500 Y 7,500 14,000 |

| 379,000 | 379,000 |

(b)

DR Partners Current Account CR

| Date | Details | X | Y | Z | Date | Details | X | Y | Z |

| 2012 Jan. 1 31 Dec.

2013

Jan.1 | Bal. b/d

Interest on drawings Drawings Bal. c/d

Bal. c/d | -

6500

130,000 -

136,500

74,200 | 5000

7500

90,000 -

102,500

27,900 | 10,000

-

120,000 137,100

267,100

- |

2013 Jan. | Bal. b/d Interest on capital Salary Commission Share of profit Bal. c/d

Bal. b/d

| 25,000

8,000 - -

29,300 74,200 136,500

- | -

16,000 - -

58,600 27,900 102,500

- | -

40,000 75,000 5,800

146,300 - 267,100

137,100 |

Balance sheet extract.

Asset Capital and liabilities

Current account Capital X 100,000

X 79,200 Y 200,000

Y 27,900 Z 500,000

Z 137,100

Example 2:

The following balances were taken from the books of H. Muya and Mr. Komba on 31 Dec. 2003.

Capital H. Muya shs. 250,000

M. Komba shs. 200,000

Current account H.Muya 14,500 DR

M. Komba 27,000 CR

Drawings H. Muya 36,000

M.Komba 12,000

Net profit for the year 2003 sh. 111,000

Partnership deed.

(i) 5% interest on capital

10% interest on drawings.

(ii) Komba is entitled to monthly salary of shs. 2500

(iii) Profit sharing ratio Muya  and Komba

and Komba

Required to:

a) Show the partner’s profit and loss appropriation account and current account in column for.

DR Partners profit and loss appropriation a/c CR

| Current account Interest on capital H. Muya 12,500 M. Komba 10,000 Salary Komba 30,000 Share of profit H. Muya M. Komba | 31/12/2003 Net profit b/d 111,000

Partners current a/c Interest on drawing H. Muya 3600 M. Komba 1200 4800 |

| 115,800 | 115,800 |

Partners current a/c

| Details | H. Muya | M. Komba | Details | H. Muya | M. Komba |

| 1/1/2003 Balance b/d

Drawings

Int. on drawings 31 De. 03 bal. c/d

1.1.2004 Balance. b/d

|

14500

36000

3600 - 54,100

3620 |

12,00

1200 79,120 92,320 | 1/1/2003 Bal. b/d P and L App. a/c Interest on capital Salary Share of profit 31/12/2003 Bal. c/d

1/1/2004 To Balance b/d | -

12500

37,980 3620

54,100

- | 27,000

10,000 30,000 25,320 -

92,320

79,120 |

REVISION QN.

- Write a short notes on the following:-

? Partnership

? Partners

? Drawing

? Interest

? Interest on drawing

- Name the characteristics of partnership

- State the advantages and disadvantage of partnership

- Mention the content of partnership deed

- In case no partnership deed the partnership act is used. What are the information contained in partnership act?

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256