FORM THREE BKEEPING EXAM SERIES 216

FORM THREE BKEEPING EXAM SERIES 216

FORM THREE BKEEPING EXAM SERIES 204

FORM THREE BKEEPING EXAM SERIES 204

PRESIDENT OFFICE REGIONAL ADMINISTRATION

AND LOCAL GOVERNMENT

SECONDARY EXAMINATION SERIES

COMPETENCE BASED ASSESSMENT

FORM THREE

MID TERM EXAMS-AUG– 2023

062 BOOK KEEPING

Time: 2:30 Hours August, 2023

Instructions

- This paper consists of sections A, B and C with a total of nine (9) questions.

- Answer all the questions.

- Sections A carries fifteen (15) marks and B carries forty (40) marks and Section C carries forty-five (45) marks.

- All writings must be in blue or black ink.

- Non – programmable calculators may be used.

- All communication devices, programmable calculators and any unauthorized materials are not allowed in the examination room.

- Write your Examination Number on every page of your answer booklet (s).

SECTION A (15 Marks)

Answer all questions in this section

- For each of the items (i) – (x), choose the correct answer from among the given alternatives and write its letter besides the item number in the answer booklet provided:

- How could purchases of a non- current assets by cheques affect the statement of financial position?

- By decreasing non-current assets account and decreasing bank account

- By increasing bank account and decreasing asset account

- By increasing non-current asset account and decreasing cash account

- By increasing cash account and decreasing asset account

- By increasing non-current asset account and decreasing bank account

- Amount of surplus in a statement of income and expenditure account indicates:

- Excess of income over expenditure

- Excess of cash received over credit sales

- Excess of expenditure over income

- Excess of gross profit over expenses

- Excess of expenses over net profit

- Government expenditures on items from which the government attains no value are called.

- Development expenditure.

- Recurrent expenditure.

- Capital expenditure.

- Revenue expenditure

- Nugatory expenditure.

- Which items would appear under non-current liabilities in the statement of financial position?

- TZS 700,000/= 5 years Loan from NBC.

- TZS 900,000/= of Credit purchases

- TZS 500,000/= paid for expenses

- TZS 600,000/= 10 months Loan from NMB

- TZS 800,000/= 6 months Loan from CRDB

- On 20th July, 2023, Mtumzima, a sole trader purchased a machinery for cash paying TZS 3,500,000/=. What would be a double entry for this transaction?

- Debit: Cash account, Credit: Machinery account

- Debit: Purchases account, Credit: Machinery

- Debit: Machinery account, Credit: Purchases account

- Debit: Machinery Account, Credit: Bank account

- Debit: Machinery account, Credit: Cash account

- At the beginning of Accounting year, Wini Charity Foundation had TZS 140,000/= as non-current Assets, TZS 50,000/= as current Assets and TZS 60,000/= as liabilities. What would be its opening Accumulated fund?

- TZS 190,000/=

- TZS 200,000/=

- TZS 110,000/=

- TZS 130,000/=

- TZS 250,000/=

- Which of the following best describes Non-current assets?

- Expensive items bought for the business

- Items having long life and not bought for resale

- Items which will not wear out quickly

- Items which do not add value to a business

- Items bought to be used by the business

- ______________ are the books under which the transactions are entered before being posted to their respective ledgers.

- Accounts

- Subsidiary books

- Cash books

- Ledger books

- Note books

- “A company does not include the value of skills gained by its employees from training programs in its financial records.” Which accounting concept is applied?

- Dual aspect concept

- Matching concept

- Dual Aspect concept

- Money measurement concept

- Business entity concept

- A firm bought a Motor van for TZS 5,000,000 which had a scrap value of TZS 500,000, and useful life of 5 years. What would be the depreciation charge if a straight line method is used?

- TZS 1,000,000

- TZS 1,100,000

- TZS 900,000

- TZS 100,000

- TZS 500,000

- Match the items in Column A with the responses in Column B by writing the letter of the correct responses below the corresponding item number in the table provided.

| Column A | Column B |

|

|

SECTION B (40 Marks)

Answer all questions in this section.

- Complete the following table by identifying the account to be credited and debited as well:

| S/N | Transactions | Account to be debited | Account to be credited |

| i | Cash paid to Rahima |

|

|

| ii | A payment of rent by cash |

|

|

| iii | Sales of goods to Mtumzima |

|

|

| iv | Cash received from Julius |

|

|

| v | Purchased goods for cash |

|

|

- Use the knowledge of accounting equation to fill in the gap in the following table

| S/N | ASSETS | CAPITAL | LIABILITIES |

| i | TZS 3,500,000 | TZS 1,700,000 | TZS __________ |

| ii | TZS ___________ | TZS 8,000,000 | TZS 4,100,000 |

| iii | TZS 4,900,000 | TZS _________ | TZS 2,100,500 |

| iv | TZS 25,600,000 | TZS 17,900,000 | TZS __________ |

| v | TZS ____________ | TZS 15,500,000 | TZS 3,400,000 |

- Briefly describe the meaning of the following terms as used in book keeping:

- Accrued expenses

- Book keeping

- Credit transaction

- Carriage outwards

- Trial balance

- Winfrida is a business woman who owns a Jewels shop in Arusha. She is also a customer of CRDB bank. Winfrida prefers to settle her debts using cheques. In the last month, she wrote a cheque to Onesmo, her creditor, for which the bank refused to settle it. In five points outline the reasons for this to happen.

SECTION C (45 Marks)

Answer all questions in this section.

- Mtumzima Transport Company with the financial year ending on 31st December, bought two motor vans on 1st January 2011, No 1 for TZS 18,000,000 and No 2 for TZS 15,000,000. It also buys another van, No. 3 on 1st July 2012, for TZS 19,000,000 and another No 4 on 1st October, 2013 for TZS 17,200,000 the van No 1 was sold for TZS 6,290,000 on 30th September 2014. It is a company’s policy to charge depreciation at 15% per annum using a straight line method for each month of ownership basis.

Required: Prepare for the year ended 31st December, 2011, 2012, 2013 and 2014.

- Motor van account

- Accumulated Provision for depreciation account

- Motor van disposal account

- The following information is available from the books for Ethan Wholesale Store on 1st September, 2021:

Balances in purchases ledger TZS 120,000 (CR)

Balances in sales ledger TZS 7,100 (CR)

Balances in purchases ledger TZS 4,800 (DR)

Balances in sales ledger TZS 163,100 (DR)

During September 2021:

Sales 140,000

Purchases 88,000

Returns inwards from debtors 55,000

Returns outwards from creditors 7,300

Receipts from debtors 91,300

Payments to creditors 76,700

Discount allowed 4,000

Discount received 2,200

Bad debts written off 3,800

Debtors cheque dishonored 7,500

Interest charged to debtors on overdue accounts 500

Sales ledger debit transferred to purchases Ledger 9,600

Notes:

- 10% sales and discount allowed relate cash transactions

- 5% of the goods bought during the month were destroyed by fire, the insurance company had agreed to pay adequate claim.

You are required to prepare:

- A sales ledger control account

- A purchases ledger control account

- Mtumzima Entreprises had the following assets and liabilities on the date shown:

01.01.2021 31.12.2021

Premises 14,500 14,500

Motor cars 2,800 1,800 Furniture 3,500 3,200

Stock in Trade 11,200 13,100

Trade debtors 10,900 11,400

Trade creditors 14,600 17,200

Cash at bank 1,330 3,980

Prepaid expenses 670 1,120

Accrued expenses 1,300 600

During 2021, Mtumzima withdrew TZS 3,000 per month from the business bank account for his personal use. On 4 July 2021 he sold his personal car for TZS 12,000 and paid the proceeds into the business bank account.

Required:

Calculate the net profit or loss made by Mtumzima for year ended 31st December, 2021.

FORM THREE BKEEPING EXAM SERIES 149

FORM THREE BKEEPING EXAM SERIES 149

THE PRESIDENT’S OFFICE MINISTRY OF EDUCATION, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

COMPETENCY BASED SECONDARY EXAMINATION SERIES

FORM THREE EXAMINATION

062 BOOK-KEEPING

![]() Time: 2:30 Hours Sept, 2022

Time: 2:30 Hours Sept, 2022

Instructions

- This paper consists of sections A, B and C with a total of nine (9) questions.

- Answer all questions in sections A and B and two (2) questions from section C.

- Section A carries twenty (20) marks, section B forty (40) marks and section C carries forty (40) marks.

- All writings should be in blue or black ink pen and all drawings should be in pencil.

- Non programmable calculators may be used.

- Cellular phones, programmable calculators and any unauthorized materials are not allowed in the examination room.

SECTION A (20 Marks)

Answer all questions in this section

- For each of the items (i) – (xv), choose the correct answer from among the given alternatives and write its letter besides the item number in the answer booklet provided:

- Mtumzima bought 5 items of TZS 800 each, and given allowance of 25% trade discount and 5% cash discount, if he could settle within the agreed credit period, how much was paid?

- TZS 2,850

- TZS 2,800

- TZS 2,600

- TZS 4,000

- TZS 3,000

- Mr. MRAMBA as a Petty cashier was given a desired cash float of TZS 100,000/= if TZS 72,000/= is spent by him, under imprest system of petty cash how much will be reimbursed?

- TZS 28,000/=

- TZS 172,000/=

- TZS 72,000/=

- TZS 70,000

- TZS 100,000/=

- The book value of an Asset after two years, using straight line method at 10% was TZS 10,000/=. What was the cost price of the Asset?

- TZS 20,000/=

- TZS15,000/=

- TZS 12,500/=

- TZS 10,000/=

- TZS 30,000/=

- Amount of surplus in a statement of income and expenditure account indicates:

- Excess of income over expenditure

- Excess of cash received over credit sales

- Excess of expenditure over income

- Excess of gross profit over expenses

- Excess of expenses over net profit

- Which of the following errors would be disclosed by the Trial Balance?

- Credit sales of TZS 20,000/= entered in the books as TZS 2,000/=

- Cheque for TZS 65,000/= from R.James entered in R.James as TZS 59,000/=

- Cash sales TZS 100,000 were completely omitted in the books

- Selling expenses TZS 5,000 had been debited to sales Account.

- A purchase of goods worth TZS 2,500/= omitted from the books

- Government expenditures on items from which the government attains no value are called.

- Development expenditure.

- Recurrent expenditure.

- Capital expenditure.

- Revenue expenditure

- Nugatory expenditure.

- What is the effect of TZS 500,000/= being added to Purchases instead of being added to a non-current asset?

- Net profit would be understated

- Net profit would be overstated

- Both Gross profit and Net profit would be understated

- Net profit would not be affected

- Gross profit would be affected

- At the beginning of Accounting year, a club had TZS 14,000/= as non-current Assets, TZS 5,000/= as current Assets and TZS 5,000/= as liabilities. What would be its opening Accumulated fund?

- TZS 4,000/=

- TZS 14,000/=

- TZS 12,000/=

- TZS 24,000/=

- TZS 10,000/=

- When the financial statements are prepared, the bad debts Account is closed by being transferred to: -

- Statement of financial position

- Provision for doubtful debts Account

- Income statement

- Statement of affairs

- Trading account

- When business entity paid rent of TZS 800,000/=. The payment was recorded in the books as follows. Debit: “Bank” TZS 800,000/= and Credit: Rent TZS 800,000/=. What entries will be posted to rectify this error?

- Debit “Bank” TZS 800,000/= and credit “Rent” TZS 800,000/=

- Credit “Rent” TZS 800,000/= and credit “Bank” TZS 800,00/=

- Debit “Bank” TZS 800,000/= and Credit “Rent” TZS 1,600,000/=

- Debit “Rent” TZS 1,600,000/= and credit “Bank” TZS 1,600,000/=

- Debit “Bank” TZS 1,600,000/= and credit “Rent” TZS 1,600,000/=

- A business had an opening and closing capital balances of TZS 57,000/= and TZS 64,300/= respectively. The drawings during the same year amounted to TZS 11,800/= What was the amount of profit made by the business during that year?

- TZS 19,100/=

- TZS 16,600/=

- TZS 5,000/=

- TZS 19,600/=

- TZS 18,600/=

- Gloria General store sold goods worth TZS 100,000/= to Joshua on credit and were neither recorded in sales account nor in Pearl’s personal account. This represents an error of:

- Error of commission.

- Error of omission.

- Error of original entry

- Error of principle.

- Error of complete reversal of entries.

- Jeff and Witness were arguing on the primary and basic reason of preparing a trial balance. As form three student taking business studies, what is the basic reason for writing up a trial balance among the following reasons?

- A trial balance issued for internal control as back up document.

- A trial balance is used as a tool for preparing financial statement.

- A trial balance is used to determine a reliable financial position

- A trial balance is used to present a list of balances at one place.

- A trial balance is used to check arithmetical accuracy of double entry.

- Which of the following are the examples of revenue expenditure?

- Purchases of goods and payment for electricity bill in cash

- Repair of van and petrol costs for van

- Buying machinery and paying for installation costs

- Electricity costs of using machinery and buying van

- Purchases of office equipment

- A firm bought a Motor van for TZS 50,000 which had a scrap value of TZS 5,000, and useful life of 5 years. What would be the depreciation charge if a straight line method is used?

- TZS 10,000

- TZS 11,000

- TZS 9,000

- TZS 1,000

- TZS 5,000

- Match the items in Column A with the responses in Column B by writing the letter of the correct responses below the corresponding item number in the table provided.

| Column A | Column B |

|

|

SECTION B (40 Marks)

Answer all questions in this section.

- Book keeping involves the recording on a daily basis of a company’s financial transactions whether on single entry system or double entry system and because of book keeping, companies are able to track all financial information on its books to make key operating, investing, and financing decisions. Outline five reasons stating why double entry system is better in book keeping.

- On 1st July, 2017 Mtumzima Company bought a machinery for TZS 18,000,000, and decided to sell it for TZS 12,000,000 after using it for four (04) years. In four (04) points describe briefly why the company decided to sell a machinery at a price lower than the original cost price.

- Prepaid rent at the beginning of the period was TZS 40,000/= and TZS 20,000/= was not paid last year. During the year payment of TZS 320,000/= was made with respect to rent. It was established that at the end of the period prepaid rent should be TZS 60,000/=. Compute the amount of Rent Expenses to be transferred to income statement.

- The following information relates with Star social club for the year ended 31st June 2020.

![]() 1.7.2019 31.6.2020

1.7.2019 31.6.2020

Subscription in arrears 4,500 3,200

Subscription received in advance 6,300 1,800

During the year, the subscriptions amounted to TZS. 120,000 were received from the club members.

Required:

Subscription account, showing the amount to be transferred to the statement of Income and expenditures for year ended 31st June, 2020.

SECTION C (40 Marks)

Answer two (2) questions from this section.

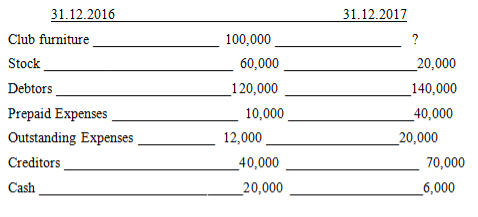

- SIJAFELI keeps his books on a single entries system. The following are the balances of Assets and Liabilities of his business for the year ended 31st December, 2017.

Receipts and Payments made for cash during the year were as follows:

Receipts from Debtors ______________________________________420,000

Payment to Creditors ______________________________________200,000

Carriage inwards ___________________________________________ 40,000

Drawings _________________________________________________120,000

Sundry Expenses __________________________________________140,000

Purchases of new furniture ___________________________________ 20,000

Other information:

There was a considerable amount of cash sales. Depreciate furniture at 10% on a closing balance.

From the information provided, prepare

- Accounts receivables and Accounts payables control Accounts

- Cash Account.

- Income statement for the year ended 31st December 2017

- Statement of financial position as at 31st December 2017

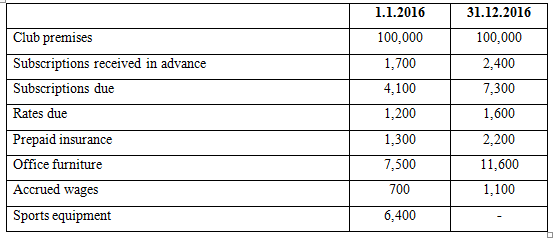

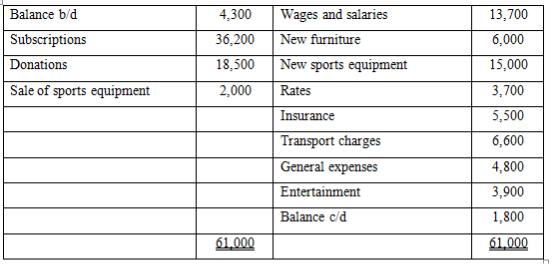

- MtumzimaSports Club, a non-profit making organization was looking for a form three student who is able to assist them in the preparations of various accounts and statements for payments. In their interview one of the questions was as follows: -

Assets and Liabilities:

Receipts and Payments Account

The following information were also available

- The sports equipment sold during the year had a book value of sh.3,500/=

- Depreciation on sports equipment was provided at 20% per year

Required:

- A statement of affairs as at 1.1.2016

- Subscription account

- A statement of Income and expenditure for the year ended at 31.12.2016

- A statement of financial position as at that date.

- The financial year of Collins Trading Company ended on 31.12.2017. You have been asked to prepare a Total Debtors Account and a Total Creditors Account in order to produce end-of-year figures for Debtors and Creditors for the draft financial statements.

You are able to obtain the following information for the financial year from the books oforiginal entry:

TZS

Sales made on Cash basis 782,500

Sales made on Credit 368,187

Purchases made on Cash basis 214,440

Purchases made on Credit 596,600

Total cash receipts from customers 300,570

Total cash payments to suppliers 503,970

Discounts allowed (all to credit customers) 5,520

Discounts received (all from credit suppliers) 3,510

Refunds given to cash customers 5,070

Balance in the sales ledger set off

against balance in the purchases ledger 700

Bad debts written off 780

Credit notes issued to credit customers 4,140

Credit notes received from credit suppliers 1,480

According to the audited financial statements for the previous year debtors and creditors as at 1.1.2017 were TZS 26,555 and TZS 43,450 respectively.

Required:

- Accounts receivables Control Account

- Accounts payables Control Account

Page 1 of 10

FORM THREE BKEEPING EXAM SERIES 98

FORM THREE BKEEPING EXAM SERIES 98

Hub App

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256

For Call,Sms&WhatsApp: 255769929722 / 255754805256