Student's Assessment Number. . . . . . . . . . . . . . . . . . . . . . . . . .

THE UNITED REPUBLIC OF TANZANIA, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

MADABA DISTRICT COUNCIL

MOCK EXAMINATIONS – 2025

FORM II

BOOK KEEPING

TIME : 2:30 Hours July 18th 2025 p.m

INSTRUCTIONS

- This paper consists of sections A, B and C with a total of ten (10) questions.

- Answer all questions in all sections.

- ll answers should be in blue or black ink.

- Write your examination number on every page of the sheet.

- All communication devices and any unauthorized materials are not allowed in the examination room

| FOR ASSESSOR’S USE ONLY | ||

| QN. NUMBER | SCORE | ASSESSOR'S INITIAL |

| 1. | ||

| 2. | ||

| 3. | ||

| 4. | ||

| 5. | ||

| 6. | ||

| 7. | ||

| 8. | ||

| 9. | ||

| TOTAL | ||

| CHECKER’S INITIALS | ||

SECTION A (15 MARKS)

Answer all questions in this section.

1.For each of the items (i-x) choose the correct answer and write its letter besides the item number.

(i) Properties held in business for a long time are known as:-

- Assets.

- Current assets.

- Liabilities.

- Non-current assets.

(ii) Proper document used to deposit money in the bank account are called:-

- Bank statement.

- Invoice.

- Pay-in-slip.

- Payment voucher.

(iii) Which of the following are sources of government revenue.

- Taxation, central bank, ambit of vote.

- Taxation, dividends, ambit of vote.

- Taxation, grants, aids, interest from investments.

- Taxation, licenses fees, receiver of revenue.

(iv) The financial year of the government of the United Republic of Tanzania starts from?

- 1st January to 31st December each year.

- 1st January to 31st December the following year.

- 1st July to 31st December the following year.

- 1st July to 30th June of the following year.

(v) The value of closing stock is found by?

- Doing stock taking.

- Adding opening stock to purchases.

- Deducting purchases from sales.

- Looking in stock.

(vi) Customers personal accounts are found in the?

- Sales ledger.

- General ledger.

- Purchases ledger.

- Private ledger.

(vii) Which of the following is not the objective of book-keeping?

- Obtain job.

- Business control.

- Fair tax assessment.

- Reliable financial position.

(viii) The descending order in which current assets should be shown in the statement of financial position is:

- Stock, debtors, bank, cash.

- Cash, debtors, bank, stock.

- Debtors, stock, cash, bank.

- Debtors, cash, stock, bank.

(ix) The excess of sales over the cost of goods sold is called?

- Gross loss.

- Gross profit.

- Net loss.

- Net profit.

(x) A credit balance in the cash column of the cash book means?

- Posting error.

- Totaling error.

- More is spent than what has been received.

- Principal error.

ANSWERS.

| (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) | (viii) | (ix) | (x) |

| . |

2. Match the items in list A with the correct responses in list B by writing the letter of the correct response beside the item number.

| LIST A | LIST B |

| (i) Any legal activity undertaken for the purpose of making profit. (ii) The amount of money with the petty cashier starts with each period. (iii) The process of recording transactions in a journal. (iv) The value of goods remaining unsold at the end of the trading period. (v) A statement showing the list of balances extracted from the ledger at a given date. |

|

SECTION B (40 MARKS)

Answer all questions in this section.

3. At the end of the month of May 31st 2024, Masawe balanced his cash book(bank column) which showed that, there was Tzs. 5,000,000 in his bank account but when he took the bank statement from NMB, it showed a credit balance of shs. 9,000,000. Explain five reasons for the balances to differ.

4. How do you understand by the following terms as used in government accounting?

- Controller and Auditor General (C&AG)

- Exchequer Account.

- Vote.

- Accounting officer.

- Public money.

5. The government of the United Republic of Tanzania needs money in order to provide services to the people. Explain (5) five sources of government revenue.

6. Complete the following table.

| S/NO | NAME OF ACCOUNT | TYPE OF ACCOUNT |

| (i) | Drawing account | |

| (ii) | Real account | |

| (iii) | Insurance account | |

| (iv) | Personal account | |

| (v) | Nominal account | |

| (vi) | NHC Ltd account | |

| (vii) | Plant and machinery account | |

| (viii) | Capital account | |

| (ix) | Interest received account | |

| (x) | Stock account |

SECTION C (45 MARKS)

Answer all questions in this section.

7. The following trial balance was extracted from the books of Kakwaya General Merchandise as at 31st December 2021.

| NAME OF ACCOUNT | DR(TZS) | CR(TZS) |

| Purchases and sales | 1,600,000 | 2,000,000 |

| Returns | 50,000 | 30,000 |

| Carriage on purchases | 15,000 | |

| Carriage on sales | 5,000 | |

| Discounts | 40,000 | 35,000 |

| Salaries | 250,000 | |

| Advertising | 80,000 | |

| Insurance | 15,000 | |

| Stock 1st Jan, 2021 | 300,000 | |

| Motor van | 500,000 | |

| Premises | 200,000 | |

| Drawings | 90,000 | |

| Rent and rates | 10,000 | |

| Capital | 1,090,000 | |

| 3,155,000/= | 3,155,000/= |

Stock as at 31st December 2021 was valued at shs. 800,000

Required:

Prepare income statement and statement of financial position for the year ended as at 31st December 2021.

8. On 31st December 2020, Naomi trader’s cash book showed a debit balance of shs. 420,000/= and the bank statement showed a credit balance of shs. 396,000/=

The following transactions did not appear in the bank statement:-

- A cheque to John Tsh. 100,000

- A cheque to Maua Tzs 4000

- Cheque received from Nangasa Tzs 60,000

- Cheque received from Moshi Tzs. 40,000

The items which did not appear in the cash book were:-

- Bank charges Tzs. 18,000

- Bank interest received Tzs. 15,000

- Cash paid direct into the bank account Tshs. 120,000

- Standing order tzs. 145,000

Required:

(a) Adjust the cash book to show the correct balance.

(b) Prepare bank reconciliation statement starting with the balance as per bank statement.

9. Mjomba Co. Ltd made the following transactions for the month of January 2008.

- Jan 1 Cash balance Tsh. 140,000

- 1 Bank overdraft Tzs. 15,000

- 3 Cash purchases Tzs. 10,000

- 4 Paid cash into bank Tzs. 15,000

- 5 Cash sales to date Tzs. 10,000

- 6 Withdrew cash for office use Tzs. 12,000

- 7 Withdrew cash for personal use Tzs. 4000

- 8 Paid cash into the bank Tzs. 30,000

- 9 Cash drawings Tzs. 45,000

- 10 Paid cheque to James Tzs. 10,000

- 11 Received cheque from bank Tzs. 15,000

You are required to prepare two column cash book and bring down the balances as at 1st February 2008.

FORM TWO BKEEPING EXAM SERIES 110

FORM TWO BKEEPING EXAM SERIES 110

THE UNITED REPUBLIC OF TANZANIA PRESIDENT’S OFFICE, REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

FORM TWO MOCK II EXAMINATION CODE 062 BOOK-KEEPING

TIME: 2:30 Hours May, 2024

INSTRUCTION

- This paper consists with sections A, B and C with total of nine questions

- Answer ALL questions

- All writings should be in blue or black pen and all drawings should be in pencil

- Write your Examination number on your every page of your answer booklet(s)

SECTION A (15 MARKS)

Answer all questions in this

1. Choose the most correct answer from among the given alternative and write its letter in the space provided.

i. Mr. Mlay the supplier sent a document to his customer to show allowance in respect of unsatisfactory goods, what is the name of the document been sent by Mr. Mlay?

- Credit note

- Debit note

- Sales invoice

- Purchases invoice

ii. The principle that calls for every debit entry to have equal credit entry in the books of account.

- Single entry system

- Double entry system

- Three entry system

- Contra entry system

iii. Mr. Kimwana always complains about his business getting loss while he doesn’t respect his business operations as he normally takes money from the business. Advise him on which concept that can help him to avoid loss

- He should apply business entity

- He should apply money measurement

- He should use dual aspect concept

- D. He should use the going concern concept

iv. Your friend doesn’t know anything about where creditor’s personal accounts are kept. As a friend assist him by telling where does creditor’s accounts are kept from the following

- Purchases journal

- Purchases ledger

- Sales ledger

- Sales journal

v. Mwajuma bought goods on credit from Mwanaidi stores for Tzs. 1,900,0000/=. The supplier offered her a trade discount of 2%. How would be the amount to be paid by Mwajuma?

- 1,938,000

- 1,862,000

- 1,900,000

- 38,000

vi. After posting all transactions in their respective ledgers and balancing them. What will be next step in accounting process?

- Preparation of bank statement

- Preparation of income statement

- Preparation of Trial balance

- Closing the books

vii. Suppose your teacher wants to arrange the current assets in their descending order. How will you arrange

- Inventory, trade receivables, bank, cash

- Cash, bank, trade receivable, inventory

- Trade receivables, inventory, cash, bank

- Bank, trade receivable, inventory, cash

viii. Theodory is confused with the issue of when her accounting period will end as her accounting period starts on 1/11/2020. When will it end?

- 31th December 2021

- 1th November 2021

- 30th September 2021

- 31th October 2021

ix. Mwanadamizi, the owner of clothing retail store, took Tzs. 800,000 from his business account and used the money to pay school fees for his son. What is the best term to describe the scenario?

- Purchases

- Sales

- Drawings

- Capital

x. The system whereby at the beginning of accounting period the petty cashier is supplied with a fixed amount of money is called

- Petty cash programme

- Double entry system

- Principle of book keeping

- Imprest system

2. Match the item in COLUMN A with response in COLUMN B by writing the letter of the correct responses below the corresponding item number in a table provide.

| COLUMN A | COLUMN B |

|

|

SECTION B (40 MARKS)

Answer ALL questions in this section

3. Describe the following terms

- Purchases day book

- Capital

- Invoice

- Book – keeping

- Trial balance

4. Complete the following table by identifying the account to be credited and debited as well:

| S/N | Transactions | Account to be debited | Account to be credited |

| i | Cheque paid to Rahima | ||

| ii | A payment of rent by cash | ||

| iii | Sales of goods to Maimuna | ||

| iv | Cheque received from Julius | ||

| v | Purchased furniture for cash |

5. Use the knowledge of accounting equation to fill in the gap in the following table (show your workings)

| S/N | ASSETS | CAPITAL | LIABILITIES |

| i | 3,500,000 | 1,700,000 | |

| ii | 8,000,000 | 4,100,000 | |

| iii | 4,900,000 | 2,100,500 | |

| iv | 25,600,000 | 17,900,000 | |

| v | 15,500,000 | 3,400,000 |

6. MICHAEL made the following credit purchases during the month of August 2020.

- Aug 11: Bought from Prince Shop:

- 4 cartons of mango juice sh. 5,000/= each

- 6 cartons of apple juice sh. 4,000/= each

- 5 cartons of guava juice sh. 6,000/= each

- Aug 22: Bought from Mathias traders:

- 10 dozen of socks sh. 3,000/= each pair

- Aug 27: Bought from Valentina Shop:

- 6 bags of wheat flour sh. 10,000/= each.

- 4 buckets of cooking oil sh. 40,000/= each

Required: Prepare the Purchases journal.

SECTION C (45 MARKS)

Answer ALL questions in these questions

7. The given Trial Balance was extracted from the accounting records of Mr. Okello for the year ending 31st December• 2021.

| Details | Dr TZS | Cr TZS |

| Inventory l. 1.2021 Purchases Sales Returns inward Salaries Advertising Discount allowed Discount received Drawings Carriage inward Carriage outward Motor van Buildings | 240,000 1,280,000 160,000 140,000 110,000 120,000 360,000 80,000 170,000 800,000 1,200,000 | 1,600,000 180,000 |

| Bank overdraft Cash Debtors Creditors Capital | 310,000 600,000 | 260,000 1,200,000 2,330,000 |

| Total | 5,570,000 | 5,570,000 |

Additional information:

Inventory at 31st December 2021 was TZS 440,000.

Prepare an Income statement for the year ending 31st December 2021 and the Statement of Financial

Position as at 3 1 st December, 2021.

8. On 31st December 2023, Hussein's Bank balance as shown by the cash book was Tsh 75,000/=. On receipt of Bank statement, it was found that:-

- The bank statement balance was Tsh 80470

- A cheque of Tsh 8,500/= drawn in favour of a supplier on 28th December2023 had not been presented to the bank for payment

- The bank had credited Tsh 8000/= on 30th December 2023, in respect of dividend collected, the information not having yet received.

- A chequeofTsh11,000/= deposited into bank on 30th December 2023 had been credited to the bank statement on 4th January 2024

- The bank had debited Tsh 30/= bank charges om 30th December 2023 but not entered in the cash book Required: Show the reconciliation of the bank balance as per cash book with the bank statement as per bank statement as onb31st

9. Jumbe keeps petty cash book with imprest being TZS 250000. For the month of April 2019 his petty cash transaction were as follows:

- 1st April Petty cash balance TZS 11300

- 2nd April Petty cashier presented vouchers to the cashier and obtained cash to restore the imprest TZS 238700

- 4th April Bought postage stamps TZS 85000.

- 7th April Bought stationaries TZS 12,300

- 9th April Paid to Asim, a creditor TZS 23500.

- 11th April Paid bus fares TZS 17200

- 17th April Bought office files TZS 7000

- 23rd April Paid for transportation TZS 68000

- 26th April Bought petrol TZS 10000

Enter the above transactions in the petty cash book using columns for Postage, Stationary, Ledger and Travelling. Balance the petty cash book on 30th April, bringing down the balance on 1st May and restore the imprest amount.

FORM TWO BKEEPING EXAM SERIES 98

FORM TWO BKEEPING EXAM SERIES 98

CHRISTIAN SOCIAL SERVICES COMMISSION – (CSSC)

WESTERN ZONE

FORM TWO JOINT EXAMINATION

062 BOOK KEEPING

Time 2:30 Hours 31st ,August, 2023

![]()

Instructions

1. This paper consists of sections A, B and C with a total of nine (9) questions.

2. Answer all questions.

3. Sections A carries fifteen (15) marks and B carries forty (40) marks and Section C carries forty-five (45) marks.

4. All writings must be in blue or black ink.

5. All answers must be written in the spaces provided.

6. Cellular phones and any unauthorized materials are not allowed in examination room.

| FOR EXAMINERS USE ONLY | ||

| QUESTION NUMBER | SCORE | EXAMINER’S INITIAL |

| 1 |

|

|

| 2 |

|

|

| 3 |

|

|

| 4 |

|

|

| 5 |

|

|

| 6 |

|

|

| 7 |

|

|

| 8 |

|

|

| 9 |

|

|

|

TOTAL |

|

|

SECTION A (15 Marks)

Answer all questions in this section.

1. For each of the items (i) – (x), choose the correct answer from among the given alternatives and write its letter in the box provided:

(i) Mtumzima, the owner of clothing retail store, took TZS 8,000,000 from his business account. He used the money to buy a motor vehicle for his wife. The act by Mtumzima best described as:

A. Purchases C. Drawings

B. Sales D. Capital

(ii) Gladness and Erick were arguing on the primary and basic reason of preparing a trial balance. Which one of the following is the basic reason for writing up a trial balance to a business?

A. A trial balance issued for internal control as back up document.

B. A trial balance is used as a tool for preparing financial statement.

C. A trial balance is used to present a list of balances at one place.

D. A trial balance is used to check arithmetical accuracy of double entry.

(iii) Daniella, a petty cashier received TZS 100,000 cash float on 1st March, 2022; she spent TZS 65,000 for Transport expenses and TZS 8,000 for telephone charges during the month. How much would be reimbursed during the month?

A. TZS 65,000

C. TZS 73,000

B. TZS 25,000

D. TZS 100,000

(iv). Khadija bought on credit from Diana stores for TZS 3,800,000. The supplier offered her a trade discount of 2%. How much would be the amount due to the supplier?

A. TZS 3,876,000 C. TZS 3,724,000

B. TZS 3,800,000 D. TZS 76,000

(v) Gibbon wants to start up a business dealing with Sportswear retailing store, but his does not have enough capital to commence his business. The following can be used as sources of capital for a business, except.

A. Accounts payable

B. Revenue from business operation

C. Money borrowed from external source

D. Loan from bank

(vi) What would be the double entry for cash withdrawn from bank for business use TZS 500,000?

A. Debit cash column TZS 500,000: Credit bank column TZS 500,000

B. Debit Drawings TZS 500,000: Credit cash column TZS 500,000

C. Debit bank column TZS 500,000: Credit cash column TZS 500,000

D. Debit cash column TZS 500,000: Credit cash column TZS 500,000

(vii) Lewis bought a machine by cheque TZS 18,000,000. What would be the effect of this transaction in the accounting records?

A. Asset of Bank will increase, Asset of machine will decrease

B. Asset of Bank will decrease, Asset of machine will increase

C. Asset of Cash will increase, Asset of machine will decrease

D. Asset of Cash will decrease, Asset of machine will increase

(viii) The following are internal users of financial statements except.

A. Managers C. Investors

B. Owners D. Wholesalers

(ix) During the Book keeping lesson, students were taught about expenses that can be paid out of petty cash. The following are among those expenses, except.

A. Van replacement cost C. Wages cost

B. Staff traveling cost D. Postage cost

(x) Rachel and Albert were arguing on the primary and basic objectives of recording and keeping accurate financial information of daily business transactions of a business. Which one of the following is the objective of book-keeping in a business?

A. Bridge the gap between buyer and seller

B. Fair tax assessment.

C. Paying tax to the government

D. Creation of employment

Answers:

| (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) | (viii) | (ix) | (x) |

|

|

|

|

|

|

|

|

|

|

|

2. Match the items in Column A with the responses in Column B by writing the letter of the correct responses below the corresponding item number in the table provided

|

| Column A | Column B |

| (i)

(ii) (iii)

(iv)

(v) | A monthly or quarterly summary which the bank sends to its customers. A statement prepared to reconcile cash book balance and bank statement balance. The actions by which petty cashier is refunded the amount spent in the given period The amount of money which the bank customer can draw out of the bank in excess of his/her bank balance Accounting mistakes in recording and posting some transactions and entries in the books of accounts | A. Bank overdraft B. Bank charges C. Errors D. Cheque E. Bank statement F. Standing order G. Bank reconciliation statement H. Imprest system I. Dishonoured cheque J. Reimbursement K. Income statement |

Answers

| Column A | i | ii | iii | iv | v |

| Column B |

|

|

|

|

|

SECTION B (40 Marks)

Answer all questions in this section.

3. Accounting records provide information to various interested parties (users) and serve very useful purposes in the business. Identify and explain five (5) users of accounting information.

(i) …………………………………………………………………………… …………………………………………………………………………..

(ii) ……………………………………………………………………………

……………………………………………………………………………

(iii) …………………………………………………………………………… …………………………………………………………………………..

(iv) …………………………………………………………………………… …………………………………………………………………………..

(v) …………………………………………………………………………… …………………………………………………………………………..

4. Complete the following table.

| Transactions |

| Effect upon | |

|

| Assets | liabilities | capital |

| (i) We paid a creditor (MANDELA) by cheque |

|

|

|

| (ii) Bought motor van paid by cheque |

|

|

|

| (iii) Bought goods on credit |

|

|

|

| (iv) The proprietor paid payable using cash |

|

|

|

| from BICO Rotary |

|

|

|

| (v) SHANGAZI lends the firm by cheque |

|

|

|

5. Hezekiah wants to do task of recording and reporting financial information of the business. As you an expert of recording and reporting financial information tell him five accounting rules which he must follow in order to prepare financial information of the business.

(i) …………………………………………………………………………………… …………………………………………………………………………………….

(ii) ……………………………………………………………………………

……………………………………………………………………………………

(iii) …………………………………………………………………………………… ……………………………………………………………………………………..

(iv) …………………………………………………………………………………… ……………………………………………………………………………………..

(v) …………………………………………………………………………………… …………………………………………………………………………………..

6. Trial balance at 31st December 2020 showed a difference of TZS 11,600 being a shortage on the debit side. On 28th February 2021 all the errors from the previous year were found.

a. A cheque of TZS 15,000 paid to L. BATRIDA had been currently entered in the cash book but had not been entered in L. BATRIDA's account

b. The purchases account had been under casted by TZS 2000

c. A Cheque of TZS 9,300 received from K. SENGA had been correctly entered in the cash book, but had not been entered in K. SENGA's account as TZS 3,900

Required:

i. Prepare Journal entry to correct the above errors ii. Record double entry for those items in the suspense account.

SECTION C (45 Marks)

Answer all questions in this section.

7. Mr. NJOROGE had a cash book a debit balance of TZS 786/= at the Cash book on 30th June 2020, while the bank statement on 30th June 2020 showed a credit balance of TZS 1,375/=

On comparing the cash book with the statement the following differences had been observed

a) Cheques not yet credited TZS 152/=

b) Cheques not yet presented TZS 565/=

c) Bank charges TZS10/= appeared on the bank statement but not in the cash book

d) A standing order TZS 10/= payable on 28th June had been paid by bank but no entry had been made in the cash book

e) Dividends of TZS 196/= were collected by the bank, no entry had been made in the cash book.

Using the information provided

(a) Write the cash book up to date

(b) Prepare bank reconciliation statement as at 30 June using balance as per cash book updated.

8. The following is the summary of Babayoyo’s Petty cash transaction for the period of 1st December 2009. Assume that Babayoyo uses the imprest system to manage the petty cash fund

December 1st Received from main cashier TZS 40,000

2nd Paid sweeping charges TZS 5000

4th Bought coffee tea and sugar TZS 6200

7th bought envelopes charges TZS 11,200

10th Paid carriage TZS 7500

18th Bought postage stamps TZS 2500

25rd Bought stationary TZS 4300

27th Paid for stamp duty TZS 700

28th Paid telegram charges TZS 1700

Required: Enter the above transactions into a petty cash book with analysis columns for stationary, postage and the sundry expenses and show the amount to be restored on 29th Dec 2009.

9. From the following trial balance of MAHELA traders extracted after one year of operations. Prepare an Income statement for year ended 30 June 2020

| S/N | DETAILS | DR | CR |

| TSHS | TSHS | ||

|

| Sales | --- | 67,000 |

|

| Purchases | 42,600 |

|

|

| Buildings | 20,000 |

|

|

| Fixture and fitting | 7,500 |

|

|

| Debtors | 12,000 |

|

|

| Bank | 1,200 |

|

|

| Cash | 400 |

|

|

| Creditors |

| 9,000 |

|

| Drawings | 9,000 |

|

|

| Stock as at 1.7.2018 | 3,000 |

|

|

| Wages | 5,200 |

|

|

| Lighting and heat expenses | 1,900 |

|

|

| Rent | 2,400 |

|

|

| General expenses | 700 |

|

|

| Carriage charges | 1,100 |

|

|

| Capital |

| 31,000 |

|

|

| 107,000 | 107,000 |

NB; Closing stock as at 30th June 2020 was TSHS 5,500

FORM TWO BKEEPING EXAM SERIES 76

FORM TWO BKEEPING EXAM SERIES 76

THE UNITED REPUBLIC OF TANZANIA PRESIDENT'S OFFICE

REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

MOROGORO FORM TWO REGIONAL ASSESSMENT

BOOK KEEPING

CODE: 032

TIME: 2.30 HOURS YEAR: 2023

INSTRUCTIONS

1. This paper consists of sections Ä, B and C With a total of nine (9) questions

2. Answer all questions

3. All writing must be in blue or black ink

4. All answers must be written in the space provided

SECTION A (15 Marks)

Answer all questions in this section

1. For each of the items (I - (x) choose the correct answer from among the given alternative and write its letters in the box provided

i) What is the alternative name for the sales journal?

A. Sales invoice C. Daily sales

B. Sales ledger D. Sales day book

ii) A system where by a petty cashier is reimbursed to maintained his or her original financial position is known as

A. Double entry system

C. Petty cash book

B. Column petty cash

D. Imprest system book

iii) Which of the following is a source of government revenue?

A. Taxation, license fees) government employee's salaries

B. Taxation, grants, public roads maintenance

C. Taxation, interest from investments, grants, aids

D. Taxation, dividends from investments consolidated fund

iv) Which of the following is an asset to a business?

A. Debtors C. Bank overdraft

B. Creditors D. Loan from bank

v) At what side does the total of discount received in the cash book is posted

A. Credit side of discount received account

B. Debit side of purchases account

C. Credit side of creditors account

D. Debit side of discount received account

vi) What would be the double e try for cash withdrawn from bank for business use

A. Debit cash account, credit business account

B. Debit business account, credit bank account

C. Debit bank account, credit, cash account

D. Debit cash account, credit bank account

vii) A transaction where payment for goods is made later is called: -

A. Credit transaction C. Cash transaction

B. Trade transaction D. Gross transaction

viii) The goods bought for resales but remain unsold to the end of the financial year are called

A. Opening stock or C. Closing stock or opening inventory closing inventory

B. Returns outwards D. Returns inwards day book

ix) During the book - keeping lesson, students were taught about expenses that can be paid out of petty cash. The following are among those expenses except

A. Replacement cost C. Postage cost

D. Staff travelling cost D. Wages cost

x) The accounting equation is concerned with: -

A. Assets only C. Liabilities only

B. Assets, liabilities and D. Assets and liabilities capital only

2. Match the items in column A against with the responses in column B and write the correct answer below the corresponding item number in the table provided.

| COLUMN A | COLUMN B |

|

|

SECTION B (40 MARKS)

Answer all questions in thus sections

3. The agreement of trial balances us not conclusive evidence that transactions are correct. Briefly explain only five (5) errors which do not affect the trial balance

4. For each of the transaction (i-x) stare the name of the account to be debited and the account to be credited

|

| TRANSACTON | ACCOUNT TO BE DEBITED | ACCOUNT TO BE CREDITED |

| i) | Started business with cash in hand |

|

|

| ii) | Cash purchases of gods for resale |

|

|

| iii | Paid rent b cash |

|

|

| iv | Deposited cash into bank |

|

|

| v) | Paid electricity through the bank |

|

|

| vi) | Sold goods on credit to Rahim |

|

|

| vii | Sold goods on cash |

|

|

| viii) | Bought stationaries for cash |

|

|

| ix) | Cash withdrawn from bank for personal use |

|

|

| x) | Received cheque from Zawadi |

|

|

5. a) Classify the following into personal real and nominal account

|

| NAME OF ACCOUNT | CLASSIFICATION |

| i | Sala |

|

| ii | Machine |

|

| iii | Mwashamba |

|

| iv | Building |

|

| v | Wages |

|

b) Complete the gaps in the following table

|

| ASSETS | CAPITAL | LIABILITIES |

| i | 15 799 | 8 650 |

|

| ji |

| 24 700 | 8 850 |

| iii | 27 310 |

| 6 350 |

| iv |

| 38 150 | 13 450 |

|

| 20 500 | 17 620 |

|

6. Briefly explain five users of financial statement

SECTION C (45 MARKS)

Answer all questions in this section

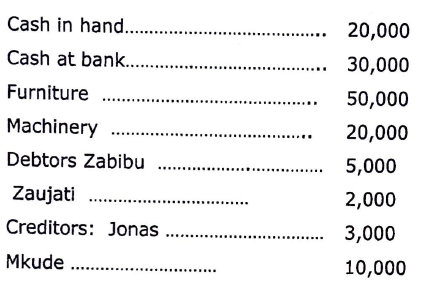

7. On 1st January 2022 Zambia started business as a furniture dealer with the following assets and liabilities

Required: Enter the above balances in the journal proper

8. Record the following transactions in the petty cash book with analysis columns for postage, office expenses, wages and ledged accounts

| January | 1. Balance in hand of petty cashier was 14,500 | |

|

| 1. Cheque received from chief casher 4. Postage stamp .......................... 5. Typewriter ribbons purchased 6. Paid to Jonijo accreditor 8. Cleaner's wages paid 10. Purchased stationary 11. Bought stamps 12. Paid W. Mpole accreditor 13. Cleaner's wa es | 40,000 6550 3450 3900 4,950 2,850 9,750 2,000 5 300 |

Balance the books on 31 st January total the analysis column and restore the impress

9. The following information were extracted from Jamaica traders as at 31 st December 2021

JAMAICA TRADERS

TRIAL BALANCE AS AT 31 ST12/2021

|

| |||

|

| NAME OF ACCOUNT | DR | CR |

| 1 | Stock at 1,Janua 2021 | 3249 |

|

| 2 | Purchases | 11380 |

|

| 3 | Sales |

| 18 462 |

| 4 | Motor ex enses | 520 |

|

| 5 | Salaries | 150 |

|

| 6 | Rent and rates | 670 |

|

| 7 | Insurance | 111 |

|

| 8 | General expenses | 105 |

|

| 9 | Premises | 1500 |

|

| 10 | Motor vehicle | 1200 |

|

| 11 | Debtors | 1950 |

|

| 12 | Creditors |

| 1538 |

| 13 | Cash it bank | 1654 |

|

| 14 | Cash in hands | 2040 |

|

| 15 | Drawin s | 895 |

|

| 16 | Ca ital |

| 5424 |

|

|

| 25 424 | 25 424 |

Stock 31/12/2021 was valued at Tshs. 2548 Required: Prepare

i) Income statement for the year ended 31/12/2021

ii) Statement of financial position for the year ended 31/12/2023

FORM TWO BKEEPING EXAM SERIES 59

FORM TWO BKEEPING EXAM SERIES 59

| PRESIDENT’S OFFICE REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT MVOMERO DISTRICT COUNCIL |  |

FORM FOUR MOCK EXAMINATION

CODE: 062 BOOK KEEPING

Time: 3 Hours May, 2023

Instructions

- This paper consists of sections A, B and C with a total of eight (8) questions.

- Answer ALL questions.

- All writing must be in blue or black ink.

- All answers must be written in the spaces provided.

- Calculators, cellular phones and any unauthorized materials are not allowed in the examination room

| FOR EXAMINER’S USE ONLY | ||

| QUESTION NUMBER | SCORE | EXAMINER’S INITIALS |

| 1 | ||

| 2 | ||

| 3 | ||

| 4 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 8 | ||

| 9 | ||

| TOTAL | ||

| CHECKER’S INITIALS | ||

SECTION A (15 Marks)

Answer all questions in this section.

- For each of the items (i)-(x), choose the correct answer from among the given alternatives and write its letter in the box provided.

i. Which of the following is best describes as fixed assets?

- Expensive items bought for the business

- Items having long life and not bought for resale

- Items which will not wear out quickly

- Items bought to be used by the business

ii. What is a cash receipt?

- Is a documentary evidence for cash paid

- Is a documentary evidence for sale of goods

- Is a documentary evidence for cash received

- Is a documentary evidence for purchase of goods

iii. How does the contra entry occur?

- When double entry is completed within the cash account

- When double entry is completed with the bank account

- When the double entry is not completed within the same book

- When double entry is completed within the same cash account

iv. Which of the following should not be called sales?

- Sales of unwanted furniture

- Sales of goods on credit

- Cash sales

- Sales of goods

v. The following are sources of documents:

- Sales, Credit note, Cheques

- Cheques, Invoice, Cheques paid

- Credit note, Debit note,Cash

- Invoices, Cash receipt, Debit note

vi. The subsidiary book where we record small cash payments is the..

- Petty cash book

- Cash book

- Bank account

- Payments

vii. Which of the following is given to traders only?

- Cash discount

- Trade discount

- Quantity discount

- Settlement discount

viii. Working capital means

- Total of fixed assets plus current assets

- Excess of the current assets over current liabilities

- Amount of capital invested by the proprietor

- Capital less drawings

ix. The descending order in which current assets should be shown in the balance sheet are:

- Cash, bank, debtors and stock

- Stock debtors, cash and bank

- Stock, debtors, bank, and cash

- Cash, debtors, bank, stock

x. Which of the following statement is incorrect?

- Assets – capital = liabilities

- Liabilities + capital = assets

- Liabilities + assets = capital

- Assets – liabilities =capital

Answers;

| i | ii | iii | iv | v | vi | vii | viii | ix | X |

2. Match the explanation of accounting concept in Column A with the corresponding names in Column B by writing the letter of the correct response beside the item number in box provided,

| COLUMN A | COLUMN B |

|

|

Answers;

| | | | | |

SECTION B (40 Marks)

Attempt all questions from this section

3. Juma is a form one student at Mtakuja secondary school whoever she is in dilemma to go science or studying book keeping. Briefly elaborate to her on how book keeping would contribute in her life with relevant examples

- ...........................................................................................................................................................

- ...........................................................................................................................................................

- ...........................................................................................................................................................

- ...........................................................................................................................................................

- ...........................................................................................................................................................

4. Briefly explain any five reasons why some people returns goods to their suppliers

- ......................................................................................................................................................................................................................................................................................................

- ......................................................................................................................................................................................................................................................................................................

- ......................................................................................................................................................................................................................................................................................................

- ......................................................................................................................................................................................................................................................................................................

- ......................................................................................................................................................................................................................................................................................................................

5. Indicate the following whether nominal, Real or personal.

S/No. Name of account Classification of Account

- Cash account _______________________

- Boneli account ________________________

- Capital account ________________________

- Computer account _______________________

- Sales account ________________________

- Carriage account ______________________

- Wages account ________________________

- Genesi’s account ________________________

- Machine account ________________________

- Shuayb account ________________________

6. There are good reasons that could bring about the difference between the cash book balance and bank statement balance. Apply the knowledge you have developed in your studies to identify and explain at least five reasons for disagreement between the Bank statement balance and the Cash book balance.

- ...........................................................................................................................................................

- ...........................................................................................................................................................

- ...........................................................................................................................................................

- ...........................................................................................................................................................

- ...........................................................................................................................................................

SECTION C (45 Marks)

Answer all questions on this section

- From the following information of Jitahidi Unaweza shopping Centre, Prepare the Bank and Cash Accounts and balance off the accounts at 30th April 2023.

| DATE | TZS | |

| 1st April | Started business with capital in cash | 200,000 |

| 2nd April | Paid rent by cash | 46,000 |

| 3rd April | Adolf lent Jitahidi unaweza and paid directly into her bank account | 400,000 |

| 4th April | Jitahidi unaweza paid Nyanza by cheque | 172,000 |

| 5th April | Cash sales | 38,000 |

| 7th April | Pendo paid Jitahidi Unaweza | 68,000 |

| 9th April | Jitahidi Unaweza paid Kitambi in cash | 184,000 |

| 11th April | Cash sales paid direct into bank | 302,000 |

| 15th April | P. Mkota paid Jitahidi Unaweza in cash | 192,000 |

| 16th April | Jitahidi Unaweza took out of cash till and paid it into the bank account | 20,000 |

| 19th April | Jitahidi Unaweza repaid Kapiga by cheque | 100,000 |

| 22th April | Cash sales paid direct into the bank | 24,400 |

| 26th April | Paid motor expenses by cheque | 15,000 |

| 30th April | Withdrew cash from the bank for business use | 40,000 |

| 30thAPril | Paid wages in cash | 64,000 |

8. Luanda provision store had the following balances on 1st May 2017

- Cash Tshs. 29,000

- Bank Tshs. 654,000

Debtors: Creditors

- K. Ocholatsh. 120,000 T. Olootsh. 60,000

- S. Ayako Tsh.280, 000 Kairo Distributors TSH. 440,000

- J. Mango tsh. 40,000 Makori investment Tshs. 100,000

- During the month, the following transactions took place:

- May 2: K .ochola paid his account by cheque less 2.5% cash discount.

- May 3: paid Makori investments their account by cheque less 5% discount.

- May 8: Withdrew Tsh. 100,000 cash from the bank for business use.

- May 11: S. Ayako settled her account by cheque less 2.5% Cash discount

- May 15: paid wages in cash Tsh. 90,000

- May 20: J. Mango paid his account in cash deducting 2.5% cash discount

- May 25: Bought furniture and fittings and paid by chequetsh. 250,000

- May 28 Cash sales Tshs. 250,000

- May 29: Deposited Tsh. 250,000 from the cash till into the business bank account

- May 29: paid T. Oloo in cash , less a cash discount 5%.

- May 30: Paid Kairo distributors by cheque less 5% cash discount

Required.

Open cash book to record the above information.

9. The trial balance below belongs to Kamwezi traders of mbeya for the year ended 31st December, 2013

| DETAILS | DR | CR |

| Inventory 1st January,2013 | 9,500 | |

| Purchases | 11,500 | |

| Sales | 28,500 | |

| Capital | 44,800 | |

| Land and Building | 19,000 | |

| Machinery | 22,000 | |

| Carriage inwards | 1,200 | |

| Carriage outwards | 1,700 | |

| Returns | 1,000 | 800 |

| Motor vans | 16,000 | |

| Debtors | 9,000 | |

| Creditors | 17,000 | |

| Salaries and wages | 3,000 | |

| Rent and rates | 1,500 | |

| Discounts | 1,000 | 3,500 |

| Insurance | 1,000 | |

| Loan from CRDB | 10,000 | |

| Drawings | 2,200 | |

| Cash at bank | 2,000 | |

| Cash in hand | 3,000 | |

| 104,600/= | 104,600/= |

Additional information; inventory 1st December, 2013 was 2,000

Required;

- Income statement for the year ended 31st December, 2013

- Statement for financial position as at 31st December,2013

FORM TWO BKEEPING EXAM SERIES 56

FORM TWO BKEEPING EXAM SERIES 56

TANZANIA HEADS OF ISLAMIC SCHOOLS COUNCIL

FORM TWO INTER ISLAMIC MOCK EXAMINATION

062 BOOK KEEPING

TIME: 2:30 Hours Tuesday 1st August, 2023 a.m.

![]()

Instructions

1. This paper consists of sections A, B and C with a total of nine (9) questions.

2. Answer all questions.

3. Section A carries fifteen (15) marks, section B carries forty (40) marks and section C carries forty five (45) marks.

4. All answers must be written in the spaces provided.

5. All writings must be in blue or black ink except drawings which must be in pencil.

6. Cellular phones, calculators and any unauthorized materials are not allowed in the examination room.

7. Write your Examination Number on the top right on every page.

| FOR EXAMINERS’ USE ONLY | ||

| QUESTION NUMBER | SCORE | EXAMINER’S INITIALS |

| 1 |

|

|

| 2 |

|

|

| 3 |

|

|

| 4 |

|

|

| 5 |

|

|

| 6 |

|

|

| 7 |

|

|

| 8 |

|

|

| 9 |

|

|

| 10 |

|

|

| TOTAL |

|

|

| CHECKER’S INITIALS |

| |

SECTION A (15 Marks)

Answer all questions in this section

1. For each of the items (i) – (x), choose the correct answer from among the given alternatives and write its letter in the box provided.

(i) Mr. Juma bought three pairs of shoes from Kilimanjaro shoes production. Two days later he returned one part of shoes. Which among the following might not be a reason for his decision? A. Wrong size

B. Wrong type delivered

C. Reach later than expected

D. Higher price charged

(ii) Salmin’s cash account shows a debit balance of TZS 10,000. What does this mean?

A. Cash has been overspent by TZS 10,000

B. TZS 10,000 was the total of cash paid out

C. There was TZS 10,000 cash in hand

D. The total of cash received was less than TZS 10,000

(iii) Mr. Muhtaji unexperienced accountant has been given a task to prepare a trial balance. He approaches you to help him to identify item(s) that does not appear in that trial balance. What will be your response?

A. Capital at the beginning

B. Closing inventory

C. Opening inventory

D. Drawings

(iv) Miss Farheen is an employee at Fikosh Safaris Ltd who deals with recording all financial transactions related to the company in accounting books. Who is miss Farheen?

A. A book keeper

B. A trader

C. An auditor

D. A banker

(v) If the business of Mr. Kupata has TZS 500/= as purchases instead of being noncurrent asset. What effect will be in his income statement?

A. Net profit only would be understated

B. Net profit only would be overstated

C. Both gross profit and net profit would be understated

D. It would not affect net profit

(vi) Mwanamvua drew a cheque of TZS 2,000,000 on 20/07/2022 to Mwela who presented it at the bank on 23/01/2023, unfortunately the bank refused to cash that cheque. Why was that cheque refused by the bank?

A. It was a stale cheque

B. It has a wrong figure

C. The drawer has died

D. It has wrong amount

(vii) A petty cashier received TZS 300,000 from chief cashier, if TZS 267,000 has been spent in the period, how much will be reimbursed at the end of that period?

A. TZS 267,000

B. TZS 300,000

C. TZS 33,000

D. TZS 567,000

(viii) ABC loan officer before advancing loan to Msukuma he asked him to bring a statement which shows the list of his assets and liabilities. Which among of the following statements Msukuma will take to the bank?

A. Income statement

B. Bank statement

C. Cash flow statement

D. Statement of financial position

(ix) Cash and goods are things that can be taken from the business by the proprietor. Which account should be debited once the proprietor has taken cash for personal use?

A. Drawings account

B. Bank account

C. Cash account

D. Goods account

(x) The trial balance of one of your friends did not agree, he decided to ask you for the help on where to post the difference. What will be your suggestion?

A. Post to statement of profit or loss

B. Post to suspense account

C. Post to nominal account

D. Post to capital account

ANSWERS:

| Item | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) | (viii) | (ix) | (x) |

| Answer |

|

|

|

|

|

|

|

|

|

|

2. Match the explanations of the types of errors in column A with the corresponding terms in column B by writing the letter of the correct response beside the item number in the box provided.

|

| COLUMN A | COLUMN B |

| (i) (ii) (iii) (iv) (v) | Occurs when correct amount is recorded on the wrong sides of the accounts. Occurs when correct amount is entered in the wrong personal account. Occurs when transaction is completely omitted from the books. Occurs when transaction is posted in the wrong class of account. Occurs when incorrect figure is entered in the books of account.

| A. Error of principle B. Error of omission C. Compensating error D. Error of original entry E. Complete reversal of entries F. Error of commission G. Overcasting error H. Undercasting error

|

ANSWERS:

| COLUMN A | (i) | (ii) | (iii) | (iv) | (v) |

| COLUMN B |

|

|

|

|

|

SECTION B (40 Marks)

Answer all questions in this section

3. Taxation is one among the sources of government revenue in Tanzania, the money is used for short, medium and long term plans and expenses for the government. As a form two student outline five (5) other sources

(i) _____________________________________________________________________

(ii) _____________________________________________________________________

(iii) ____________________________________________________________________

(iv) ____________________________________________________________________

(v) ____________________________________________________________________

4. Mr. Musa was shocked after receiving a monthly bank statement showing the closing balance of TZS 3,000,000 while in his prepared cash book the balance was TZS

4,500,000. Help Mr. Musa to identify five (5) reasons for this situation to occur

(i) _____________________________________________________________________

(ii) _____________________________________________________________________

(iii) ____________________________________________________________________

(iv) ____________________________________________________________________

(v) _____________________________________________________________________

5. Complete the following table related to Mwasiti a Jewelry dealer at Kariakoo market by indicating the account to be debited and the account to be credited from each transaction.

|

| Transaction | Account debited | to | be | Account to be credited |

| (a) | Mwasiti started a business with cash

|

|

|

|

|

| (b) | Sold goods to Bakari on credit

|

|

|

|

|

| (c) | Received a cheque from Amina

|

|

|

|

|

| (d) | Jamal returned goods after purchases

|

|

|

|

|

| (e) | Mwasiti took goods for her own use

|

|

|

|

|

6. From the following list of balances from Zuberi business construct a trial balance as at 31 December 2022.

TZS

Sales ……………………………………………… 38,500,000

Purchases ……………………………………………… 29,000,000

Rent ……………………………………………… 2,400,000

Wages ……………………………………………… 1,500,000

Advertising ………………………………………………. 600,000

Fixtures and fittings ……………………………………………… 5,000,000

Accounts receivable ……………………………………………… 6,800,000

Accounts payable ……………………………………………… 9,100,000

Cash at bank ……………………………………………… 8,100,000

Cash in hand ……………………………………………… 200,000

Drawings ……………………………………………… 7,000,000

Capital ……………………………………………... 20,000,000

Premises ……………………………………………... 7,000,000

SECTION C (45 Marks)

Answer all questions in this section

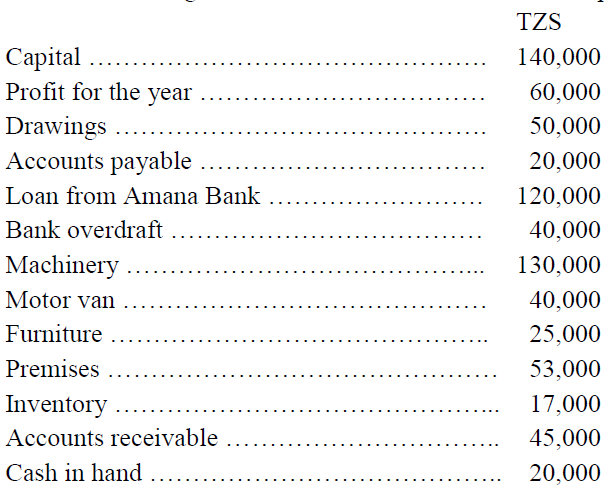

7. Post the following details into the statement of financial position as at 31st Dec 2021.

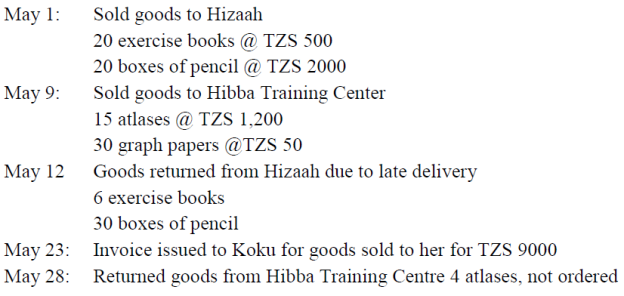

8. From the following information related to Makame a trader, record the following transactions in the sales journal and sales returns journal for the year 2023.

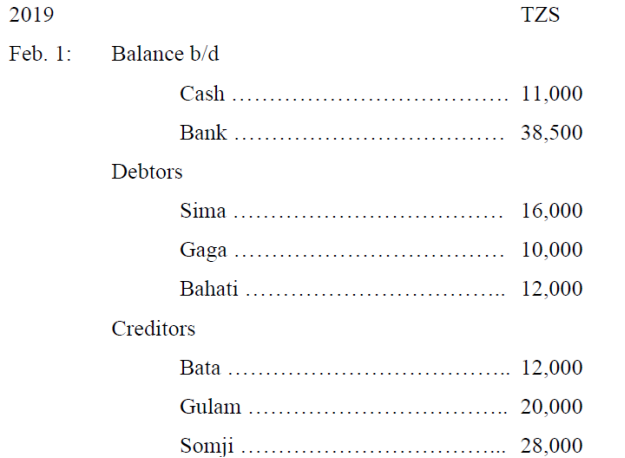

9. Enter the following transactions in cash book of Mr. Mtakuja, balance the cash book and open discount allowed and discount received accounts.

FORM TWO BKEEPING EXAM SERIES 43

FORM TWO BKEEPING EXAM SERIES 43

PRESIDENT'S OFFICE REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

KILIMANJARO REGION MOCK FORM TWO EXAMINATION

CODE: 062 BOOK KEEPING

TIME: 2:30 HOURS MAY 2023

INSTRUCTIONS

- This paper consists of sections A, B and C with a total of nine (9) questions.

- Answer all questions.

- Sections A carries fifteen (15) marks and B carries forty (40) marks and Section C carries forty-five (45) marks.

- All writings must be in blue or black ink.

- All answers must be written in the spaces provided.

- Cellular phones and any unauthorized materials are not allowed in examination room.

| FOR EXAMINER'S USE ONLY | ||

| QUESTION NUMBER | SCORE | INITIALS OF EXAMINER |

| 1. | ||

| 2. | ||

| 3. | ||

| 4. | ||

| 5. | ||

| 6. | ||

| 7. | ||

| 8. | ||

| 9. | ||

| 10. | ||

| TOTAL | ||

SECTION A 15 MARKS

Answer all questions in this section.

1. For each of the items (i) — (x), choose the correct answer from among the given

alternatives and write its letter in the box provided:

i. Mangoto, the owner of clothing retail store, took TZS 8,000.000 from his

business account. He used the money to buy a motor vehicle for his wife. 1 he act by Mangoto is best described as:

- Purchases

- Sales

- Drawings

- Capital

ii. Grace and Erick were arguing on the primary and basic reason of preparing a trial balance. Which one of the following is the basic reason for writing up a trial balance to a business?

- A trial balance issued for internal control as back up document.

- A trial balance is used as a tool for preparing financial statement.

- A trial balance is used to present a list of balances at one place.

- A trial balance is used to check arithmetical accuracy of double entry.

iii. Aisha , a petty cashier received TZS 100,000 cash float on Pt March, 2022: she spent TZS 65,000 for Transport expenses and TZS 8,000 for telephone charges during the month. How much would be reimbursed during the month?

- TZS 65,000

- TZS 25,000

- TZS 73,000

- TZS 100,000

iv. Khadija bought goods on credit from Diana stores for TZS 3,800,000. The supplier offered her a trade discount of 2%. How much would be the amount due to the supplier?

- TZS 3,816;000

- TZS 3,800,000

- TZS 3,724,000

- Tzs 76,00()

v. Briella wants to start up a business dealing with Spoi-tswear retailing store, but she does not have enough capital to commence his business. The following can be used as sources of capital tbr a business, except.

- Accounts payable

- Revenue from business operation

- Money borrowed from external source

- Loan from bank

vi. What would be the double entry for cash withdrawn from bank for business use TZS 500,000?

- Debit cash column TZS 500,000: Credit bank column TZS 500,000

- Debit Drawings TZS 500,000: Credit cash column TZS 500.000

- Debit bank column TZS 500,000: Credit cash column TZS 500.000

- Debit cash column TZS 500,000: Credit cash column TZS 500,000

vii. Lema bought a machine by cheque TZS 18,000,000. What would be the effect

of this transaction in the accounting records?

- Asset of Bank will increase, Asset of machine will decrease

- Asset of Bank will decrease, Asset of machine will increase

- Asset of Cash will increase, Asset of machine will decrease

- Asset of Cash will decrease, Asset of machine will increase

viii. The following are internal users of financial statements except.

- Managers

- Owners

- Investors

- Wholesalers

ix. During the Book keeping lesson, students were taught about expenses that can be paid out of petty cash. The following are among those expenses, except.

- Van replacement cost

- Staff traveling cost

- Wages cost

- Postage cost .

x. Radhia and Ally were arguing on the primary and basic objectives of recording and keeping accurate financial information of daily business transactions of a business. Which one of the Following is the objective of hook-keeping in a business?

- Bridge the gap between buyer and seller

- Fair tax assessment.

- Paying tax to the government

- Creation of employment

| Question | i. | ii. | iii. | iv. | v. | vi. | vii. | viii. | ix. | x. |

| Answers | | | | | | | | | | |

2. Match the items in Column A with the responses in Column B by writing the letter of the correct responses below the corresponding item number in the table provided.

| COLUMN A | COLUMN B |

| i. A book of prime entry which used for recording goods returned to suppliers ii. A book of prime entry used for recording all goods bought on credit. iii. A book of prime entry, which used to record the details of all transactions that cannot be recorded in any other book of original entry. iv. A book of prime entry used to record all goods sold on credit v. Book of original entry used to record prompt receipts and payments |

|

| Question | i. | ii. | iii. | iv. | v. |

| Answers | | | | | |

SECTION 13 (40 Marks)

Answer all questions in this section.

3. Any account is divided into columns.Mention and explain those columns.

4. Kadogoo is a student of JK secondary school expert in accounting who assists a school bursary office to perform bank reconciliation. On 3 lst January 2023, she was issued with a cash book showing a debit balance of TZS 543,000 and a bank statement with a credit balance of TZS 320,500.

With five (05) points explain the reasons for this difference.

5. Utopolo Traders bought goods worth Tshs 5,000,000 from Kamongo Stores. Kamongo is offered a trade discount of 10% and Cash discount of 5% if the customer pays the bill within 30 days. Use the information provided to calculate the following:

- Trade discounts

- Amount due to Utopolo stores.

- Discount received if he paid within 30 days

- Net amount to be paid to Kamongo stores.

6. Enter the following in the petty cash book, using separate columns for postage, carriage, stationery and sundry expenses, Balance the book as at 10th January.

- Jan 4 Received cash from main cashier . . . . . . . shs 25000

- 4 paid for postage . . . . . . . shs 1500

- 5 paid for stationery . . . . . . . shs 3500

- 5 paid for carriage. . . . . . . shs 550

- 6 paid for postage stamps. . . . . . . shs 4300

- 7 paid for carriage. . . . . . . shs 800

- 7 paid for telegram. . . . . . . shs 3000

- 8 paid for stationery. . . . . . . shs 250

- 8 paid transport charge. . . . . . . shs 1600

- 9 Paid for wages . . . . . . . shs 4000

9 Received cash in order to restore imprest

SECTION C (45 Marks)

Answer all questions in this section.

7.From the following cash book prepare Trial Balance as at 30th April 2022

DR. CASH BOOK CR.

| Date | Particulars | Cash | Bank | Date | Particulars | Cash | Bank |

| Apr. 1 | Capital | 500,000 | 300,000 | Apr10 13 | Bank Purchases | 250,000 100,000 | |

| 10 | Cash | | | ||||

| 25 | Sales | 450,000 | | 15 | Drawings | | 15.000 |

| | | | 22 | Motor van | 150,000 | | |

| | | | 28 | Rent | _ | | |

| | 30 | Balance c/d | 450,000 | 527,000 | |||

| | 950,000 | 550,000 | | | 950,000 | 550.000 | |

| May 1 | | 450,000 | 527,000 | | | |

8. 0n 31st March 2022 the bank column on cash book showed a debit balance of 60,000/=. A bank statement showed a balance of 512,000/= written tip to 31 March 2022 disclosed that the following items had not been entered in the cashbook:

- The sum of TZS 150,000/= received from Mtwiki by credit transfer

- The payment of TZS 100, 000/= for Standing orders as instructed by Account holder had been made by the bank.

- Bank charges TZS 18, 000/=.

On receiving the bank statement, the following items were discovered:

- Cheques drawn in favour of creditors amounting to TZS 830,000/= had not yet been presented

- Cash and cheques TZS 410. 000/= had been entered in the cashbook but not yet credited by the bank.

You are required to prepare as at 31st March 2022:

- Adjusted cash book balance

- A Bank Reconciliation statement as on 31' March 2022, showing the balance as per adjusted cash book

9. The financial year of Chakechake enterprise ends on 31st December annually. The following information has been extracted from the stores' accounting records for the year ending 31st December, 2022.

| Details | TZS |

| Sales | 9,780,000 |

| Inventory on 151 January 2022 | 1,037,000 |

| Rent | 450,000 |

| Purchases | 8,500,000 |

| Insurance , | 187,000 |

| Heating expenses | 160,000 |

| Motor van expenses | 584,000 |

| Capital | 10,079,000 |

| Cash at bank | 848,000 |

| Motor van | 1,050,000 |

| Loan from NBC | 5,300,000 |

| Drawings | 1,416,600 |

| Accounts payable | 1,975,000 |

| Buildings | 8.200,000 |

| Sundry expenses | 252,000 |

| Fixtures & Fittings | 1,011,200 |

| Salaries | 922,000 |

| Accounts receivable | 2,016,000 |

| Cash in hand | 500,000 |

| Inventory on 31st December, 2022 | 1,535,000 |

Use the information provided to prepare the store's income statement for the year ending 31st December, 2022 and a statement of financial position as at 31st December, 2022.

FORM TWO BKEEPING EXAM SERIES 37

FORM TWO BKEEPING EXAM SERIES 37

THE PRESIDENT’S OFFICE REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

MOSHI MUNICIPAL COUNCIL

SECONDARY EDUCATION EXAMINATIONS SYNDICATE

062 BOOK KEEPING

FORM TWO MOCK EXAMINATION

Friday 01th July 2022pm Time: 2:30Hours

INSTRUCTIONS

- This paper consists of three sections A, B and C

- Answer ALL questions from all sections

- Use pencil for drawing only

SECTION A:(20 MARKS)

1. For each of the following questions write the letter which represents the correct answer.

(i) The transfer of goods or services from one person to another is known as:

- Ledger balance

- Purchases

- Transactions

- Transfer of wealth

(ii) The art of recording a financial transaction in a set of books in monetary terms is known as;

- Business

- Commerce

- Book-keeping

- Stock taking

(iii) The cash or goods taken out from the business for private uses are known as:

A. Profit B. Loss C. Assets D. Drawings

(iv) The main aim of preparing trading account is to find:

- Net income

- Gross profit or gross loss

- Net profit or net loss

- Capital of the business

(v) The following not a source of government revenue:

- Net salaries

- Licenses

- Taxes

- Loans

![]() (vi) The statement used to check the correctness of the cashbook balance and bank statement balance is known as:

(vi) The statement used to check the correctness of the cashbook balance and bank statement balance is known as:

- Bank reconciliation statement

- Balance sheet statement

- Assets and capital statement

- Bank statement

(vii) Properties which are held in the business for a long time are called:

- Fixed capital

- Current assets

- Fixed asset

- Assets

(viii) The sale of goods on credit to Kahaya amounting to Tsh 200,000/= should be recorded as:

- Debit cash account , credit sales account

- Debit Kahaya’s account, credit sales account

- Debit Kahaya’s, credit cash account

- Debit sales account , credit Kahaya’s account.

(ix) Proper document used when depositing money in the bank is known as:

- Bank statement

- Pay –in-slip

- Invoice

- Payment voucher

(x) Which of the following is not a book of original entry?

- Cash book

- Purchases outwards journal

- Returns outwards journal

- Sales ledger

(xi) A cheque drawing or issued and entered in the cash book but not passed through the bank for payment until after the relevant date is known as:

- Unpresented cheque

- A standing order

- Credit transfer

- Dishonored cheque

(xii) The three column cash book records:

- Cash transactions, and cheque transactions

- Cash transactions, bank transactions and cash discounts

- Cash transactions and credit transactions

- Credit transactions and cash discounts

(xiii) One of the following reasons allows the goods to be returned to the supplier:

A. Durable goods

B. Consumable goods

C. Expired goods

D. Perishable goods

(xiv) Capital and drawing accounts are classified as:

- Personal accounts

- Nominal accounts

- Real accounts

- Properties accounts

(xv) Which of the following statements is not correct?

- Assets – capital = Liabilities

- Liabilities + capital = Assets

- Liabilities + Assets = Capital

- Assets – Liabilities = Capital

2. Match the items in LIST A with the responses in LIST B by writing the letter.

| LIST A | LIST B |

| (i) A book of prime entry used to record returns outwards from goods bought on credit (ii) A book of prime entry used to record all goods sold on credit (iii) A book of prime entry used to record returns inwards for goods sold on credit (iv) A book of prime entry used to records all goods bought on credit (v) A book of prime entry used to record all transactions which cannot be recorded in any other books of prime entry |

|

SECTION B: (20MARKS)

Answer all questions in this section

3(a) Classify the following into personal, real and nominal accounts

| NAME OF ACCOUNT | CLASSIFICATION |

|

|

.3(b) Complete the gaps in the following table

| ASSETS | LIABILITIES | CAPITAL | |

| i | 55,000 | 16,900 | . . . . . . . |

| ii | . . . . . . .. | 17,200 | 34,400 |

| iii | 36,100 | . . . . . . .. | 28,500 |

| iv | 119,500 | 15,400 | . . . . . . . |

| v | 88,000 | . . . . . . .. | 62,000 |

4. John Kibwetere is an account holder in National Microfinance Bank (NMB) who opened current account in that bank. At the beginning of March 2001 balance of cash book and balance of bank statement were the same amount Tsh 200,000, but at the end of that month 31-3-2001 two balances were disagree. Briefly explain five reasons which make two balances to disagree.

SECTION C (60 MARKS)

Answer all questions

5. The following is a summary of Mamayoyo’s petty cash transaction for the period of 1st December to 5th December 2000.

December 1st received from main cashier Tshs 40,000=

1st paid sweeping charges Tshs 5,000=

1st bought coffee, tea and sugar Tshs 6,200=

1st paid telegram charges Tshs 11,200=

2nd paid carriage Tshs 7,500=

2nd bought postage stamps Tshs 2,500=

3rd bought stationary Tshs 4,300=

4th paid carriage Tshs 700=

5th paid telegram charges Tshs 1,700=

Enter the above transactions into a petty cash book with analysis column of Stationary, Postage, Telegrams and Sundry expenses.

6. Post the following details into the Statement of Financial position of Moshi Traders as at 3112-2004.

Capital Tshs. . . . . . . . . 150,000

Net profit Tshs. . . . . . . . 50,000

Drawings Tshs. . . . . . . . .. 70,000

Creditors Tshs . . . . . . . . . 30,000

Loan from NMB Tshs . . . . . . . . . 130,000

Bank overdraft Tshs. . . . . . . . ... 40,000

Machinery Tshs. . . . . . . . ... 130,000

Motor van Tshs. . . . . . . . . 40,000

Furniture Tshs. . . . . . . . . 25,000

Premises Tshs. . . . . . . . . 53,000

Stock Tshs. . . . . . . . . 17,000

Debtors Tshs . . . . . . . . . 15,000

Cash at bank Tshs . . . . . . . . . 30,000

Cash in hand Tshs . . . . . . . . . 20,000

7. The following is the summary of Cash Book of Bora Brothers Ltd as appeared on 31st December 2010

| DR | CASH BOOK | CR | |||||

| DATE | DETAILS | F | AMOUNT | DATE | DETAILS | F | AMOUNT |

| 1.12.201 0 8.12.201 0 15.12.20 10 26.12.20 10 30.12.20 10 1.1.2011 | Balance Peter Salmini Cash Hamisi Balance | b/ d b / d | 495,000 76,000 54,000 88,000 116,000 829,000

634,000 | 9.12.201 0 26.12.20 10 28.12.20 10 31.12.20 10 | Musa Charles Samson a/ c Balance | c/ d | 47,000 106,000 42,000 634,000

|

NOTE: He receives the following Bank Statements from his manager

BANK STATEMENT

| DATE | DETAILS | DEBIT | CREDIT | BALANCE |

| 1,12,2010 8.12.2010 9.12.2010 15.12.2010 26.12.2010 29,12,2010 31.12.2010 | Balance b/d Cheques Musa a/c Cheque Cash Credit transferJuma Bank charges | 42,000 40,000 | 76,000 54,000 88,000 52,000 | 495,000 571,000 529,000 583,000 671,000 723,000 683,000 |

Require:

a)Prepare adjusted Cash Book

b). Prepare bank reconciliation statement starting with balance as per adjusted Cash Book

FORM TWO BKEEPING EXAM SERIES 21

FORM TWO BKEEPING EXAM SERIES 21

PRESIDENT'S OFFICE REGIONAL ADMINISTRATION AND LOCAL GOVERNMENT

TANZANIA HEADS OF ISLAMIC SCHOOLS COUNCIL

FORM TWO INTER ISLAMIC MOCK EXAMINATION

062 BOOK KEEPING

TIME: 2:30 HOURS Thursday, 30th September 2021 a.m.

Instructions

1. This paper consists of sections A, B and C with a total of seven (7) questions.

2. Answer all questions.

3. Section A and B carry twenty (20) marks each and section C carries sixty (60) marks.

4. All answers must be written in the spaces provided.

5. All writings must be in blue or black ink except for drawings which must be in pencil.

6. Calculators, cellular phones and any unauthorized materials are not allowed in the examination room.

7. Write Your Examination Number on the top right of every page.

| FOR EXAMINER’S USE ONLY | ||

| QUESTION NUMBER | SCORE | EXAMINER’S INITIALS |

| 1 | | |

| 2 | | |

| 3 | | |

| 4 | | |

| 5 | | |

| 6 | | |

| 7 | | |

| TOTAL | | |

| CHECKER’S INITIALS | | |

SECTION A: (20 Marks)

Answer all questions in this section

1. For each of the items (i) - (x), choose the correct answer from among the given alternatives and write its letter in the box provided.

(i) What is the purpose of book keeping?

- To interpret the double entry records

- To prepare financial statements at a regular intervals

- To record all the financial transactions of the business

- To summarize the financial position of the business.

(ii) Which statement describes the purpose of trial balance?

- It ensures the ledger accounts contain no errors

- It indicates errors where errors have arisen

- It checks the arithmetical accuracy of double entry

- It prevents errors from occurring.

(iii) General ledger accounts that record incomes and expenses such as purchases, sales, wages and salaries:

- Real accounts

- Personal accounts

- General accounts

- Nominal accounts.

(iv) Which statement describes development expenditure?

1. They are registered in the assets register of the government

2. They are the day-to-day running expenses of the government

3. They are assigned depreciation rate (if applicable)

- 1 and 2

- 2 only

- 3 only

- 1 and 3.

(v) The compulsory payments by individuals and firms to the government are of two categories:

- Fines and penalties

- Direct taxes and indirect taxes

- Open taxes and closed taxes

- Fees and dividends.

(vi) Why an income statement is prepared?

- To account for the revenues and expenses of a period

- To calculate the surplus or deficit of the organization

- To list the ledger balances on a particular date

- To summarize the business bank account.

(vii) Which account concept states that the business transactions must be separated from the personal transactions of the owner?

- Historical cost

- Going concern

- Money measurement

- Business entity.

(viii) The amount of cash or stock taken from the business by the owner for their personal use:

- Expenses

- Income

- Drawing

- Profit.

(ix) What is the going concern principle?

- Accounting records are prepared assuming that the business will continue to operate in the foreseeable future

- Income and expense should be accounted for in the same way they were accounted for in previous periods

- Profit should not be anticipated and losses should be written off as soon as they are taken

- Revenue and costs should be recognized as they are earned or incurred, not when the money is received or paid.

(x) Why would a Bank Manager look at trader’s financial statement?

- To calculate how fast trade creditors were being paid

- To check if the trader would be able to repay a loan

- To find out if customers will receive continuous supplies

- To know if inventory levels are too high.

2. Match the items in column A with the response in column B by writing the letter of the response besides the item number in the space provided:

| COLUMN A | COLUMN B |

| (i) A day book where all credit sales are first recorded (ii) A document issued by the business making a sale containing detailed information about the sale (iii) A day book where all credit purchases transactions are first recorded (iv) A book containing all the accounts of the credit customers of the business (v) A day book used to record all goods sold that are returned to business (vi) A sale invoice viewed from the perspective of the business making the purchase (vii) A place where transactions are first recorded before they are posted to the ledger account (viii) A book containing all the accounts of the credit suppliers of the business (ix) A document issued by the business when accepting returns inwards (x) A day book used to record all goods that are returned by the business to the original supplier |

|

Answers:

| Column A | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) | (viii) | (ix) | (x) |

| Column B | | | | | | | | | | |

SECTION B: (20 Marks)

Answer all questions in this section

3. Kibonde, an accountant for Bee& Cee Company is very happy as he has just finished preparing the trial balance as at 31st March 2021 in which the debit column seems to agree with the credit column. However he has been told by assistant that the agreement of trial balance totals is not a proof that the trial balance is free from errors. Outline the possible mistakes (five) that may have been committed in Kibonde’s accounts (ledger)

4. Show the account to be debited and credited in each of the following transactions:

| Items | Transactions | Account to be Debited | Account to be credited |

| i | Purchases of goods by cash | ||

| ii | Cash sales of goods | ||

| iii | Credit sales of goods to Kitetemo | ||

| iv | Purchases of goods from Mano | ||

| v | Banked cash |

SECTION C: (60 Marks)

Answer all questions in this section

5. The following trial balance was extracted from the books of Muha as at 30th September 2019.

Trial balance as at 30th September 2019

| Name of account | Dr-TZS | Cr-TZS |

| Capital ………………………………………… | ……………… | . 149,000 |

| Cash in hand …………………………………… | 12000 | |

| Cash at bank …………………………………… | 110,000 | |

| Stock (1.10.2018) ……………………………... | . 210,000 | |

| Trade creditors ……………………………… | ………………… | 100,000 |

| Trade debtors ………………………………….. | 80,000 | |

| Returns inwards ……………………………….. | 5,000 | |

| Sales ………………………………………… | ………………… | 560,000 |

| Purchases ……………………………………… | . 205,000 | |

| Salaries ………………………………………… | 40,000 | |

| Water and electricity ………………………….. | 6,000 | |

| Postage ………………………………………… | 2000 | |

| Drawings………………………………………. | 9000 | |

| Furniture and fittings …………………………. | 75,000 | |

| Motor van …………………………………….. | 320,000 | |

| Equipment ……………………………………. | 30,000 | |

| Loan ………………………………………… | ………………… | 300,000 |

| Rent received ………………………………… | ……………….. | 12,000 |

| Office rent ……………………………………. | 17,000 | 1,121,000 |

| 1,121,000 |

Closing stock was valued at TZS 135,000.

Required:

(a) Prepare his income statement for the year ended 30th September 2019.

(b) Prepare his statement of financial position as on that date and clearly show the total assets, net assets and owner’s equity.

6.The bank column in the cash book for November 2004 and the bank statement for that month for Kamgunda are:

Cash book

| 2004 | TZS | 2004 | TZS |

| Nov 5 Pengo | 8,000 | Nov 1 balance b/d | 21,000 |

| Nov 14 Flora | 11,500 | Nov 4 Hassan | 7,400 |

| Nov 18 Renatus | 8,600 | Nov 21 Nova | 9,500 |